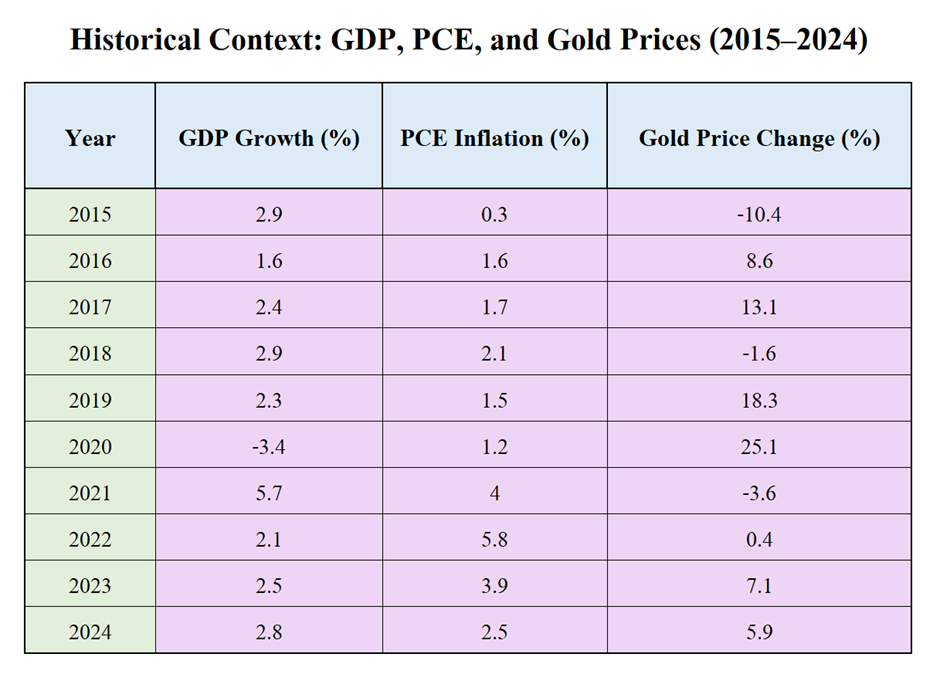

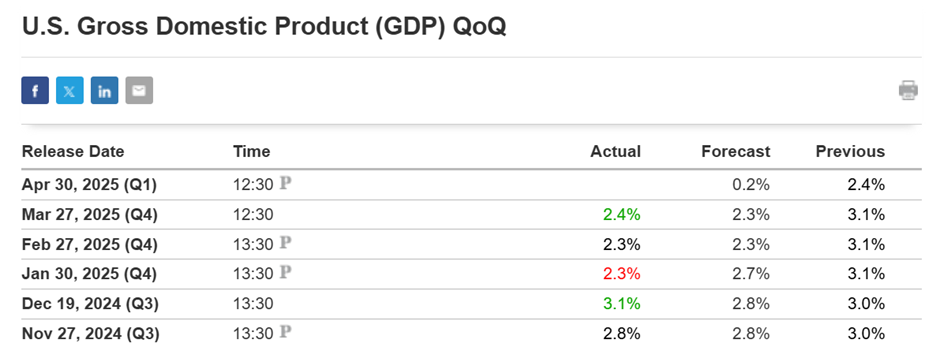

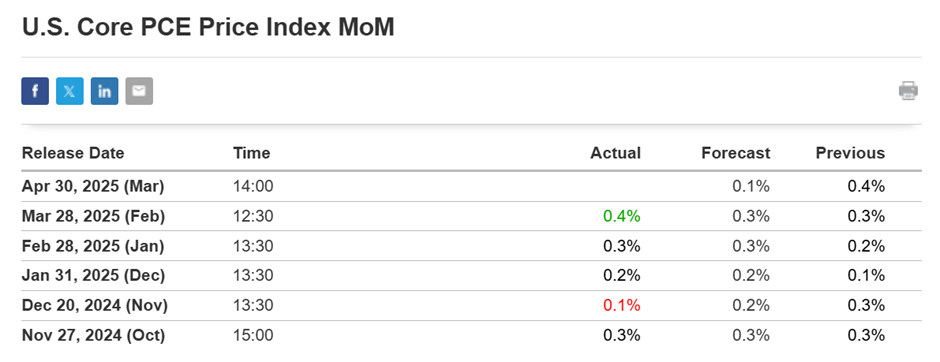

On April 30, 2025, the U.S. economy exhibited signs of strain, with Q1 GDP growth slowing to an annualized rate of 0.3%, marking the weakest pace since mid-2022. This deceleration was primarily attributed to a surge in imports as businesses stockpiled goods ahead of anticipated tariffs, leading to a record-high goods trade deficit in March. Simultaneously, the Personal Consumption Expenditures (PCE) price index, the Federal Reserve’s preferred inflation gauge, rose by 3.3%, up from 2.6% in the previous quarter, indicating persistent inflationary pressures.

Today’s given signal : https://t.me/calendarsignal/18231

Key Economic Indicators and Their Implications

1. Gross Domestic Product (GDP)

- Q1 2025 Growth: 0.3% annualized rate.

- Contributing Factors:

- Businesses accelerated imports to avoid impending tariffs, inflating the trade deficit.

- Consumer confidence declined, reaching a near five-year low, dampening domestic spending.

2. Personal Consumption Expenditures (PCE) Price Index

- Q1 2025 Increase: 3.3% annualized rate.

- Implications:

- Persistent inflation suggests that the Federal Reserve may face challenges in achieving its 2% inflation target.

- Elevated inflation could limit the Fed’s flexibility in adjusting interest rates.

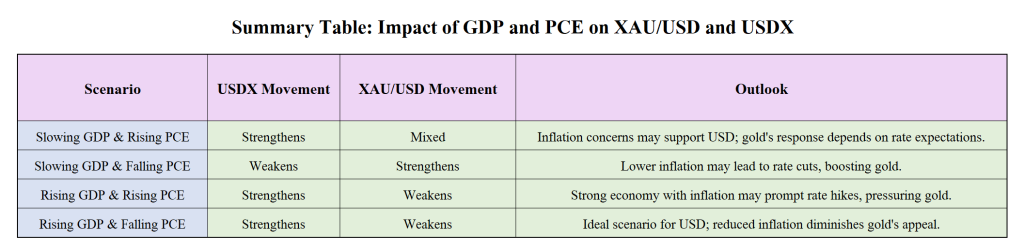

Impact on Gold (XAU/USD) and U.S. Dollar Index (USDX)

Gold (XAU/USD)

- Current Price: Approximately $3,300 per ounce.

- Influencing Factors:

- Economic Uncertainty: Slowing GDP growth and persistent inflation increase demand for safe-haven assets like gold.

- Interest Rate Expectations: If the Fed maintains or raises interest rates to combat inflation, gold may face downward pressure due to higher opportunity costs.

U.S. Dollar Index (USDX)

- Current Trend: Modest strengthening.

- Influencing Factors:

- Interest Rate Outlook: Expectations of sustained or higher interest rates to address inflation support the dollar.

- Global Trade Dynamics: Tariff-induced trade imbalances and economic uncertainty may lead to increased demand for the dollar as a reserve currency.

Previous released data results :

On last US GDP Data (27-3-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 33 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/17647

Performance : https://t.me/calendarsignal/17655

On last US PCE Data (28-3-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 56 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/xau-usd-volatility-sparks-as-us-pce-data-surprises-28-03-2025/

Check last given signal : https://t.me/calendarsignal/17660

Performance : https://t.me/calendarsignal/17671