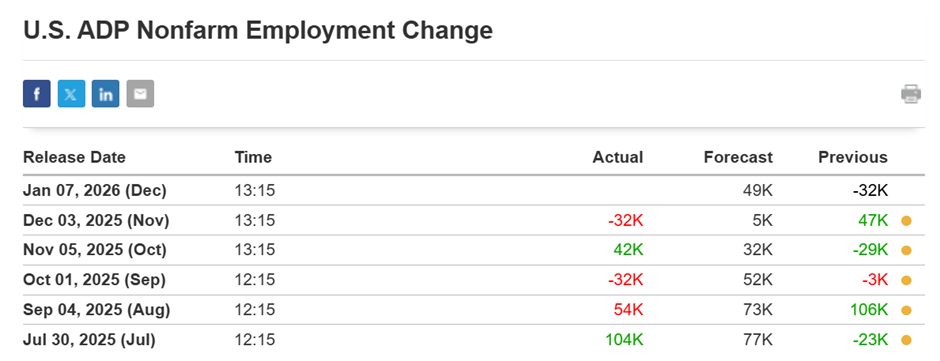

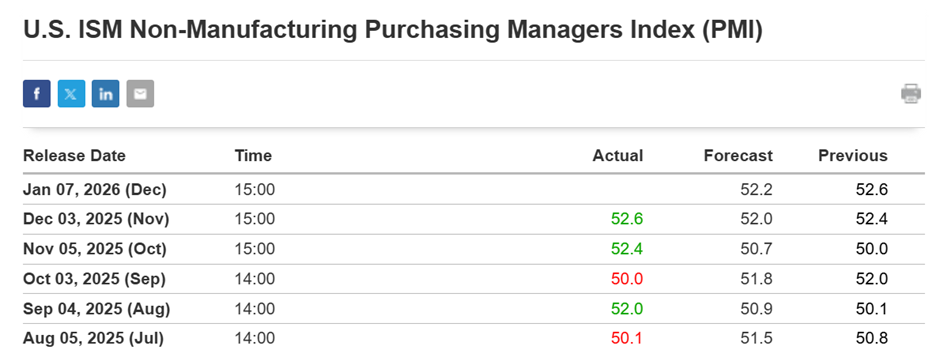

Today at 15:00 GMT, the U.S. will release two key economic indicators: ADP Non-Manufacturing Employment and the ISM Non-Manufacturing PMI. Markets expect strong (positive) data, and this expectation is why Forextrade1 anticipates a potential decline in XAU/USD (Gold).

Today’s given signal : https://t.me/calendarsignal/22721

Why Good ADP & ISM Data Matters

1. Strengthening U.S. Economic Outlook

• Higher ADP employment and faster services growth mean businesses are hiring and expanding — a sign of economic resilience.

• This increases confidence in consumer spending, which drives the U.S. economy (services account for the majority of GDP).

2. Fed Policy Expectations Shift

• Strong data reduces the likelihood of near-term rate cuts — or even raises expectations of future increases.

• Higher interest rates support the U.S. Dollar and boost government bond yields, making yield-bearing assets more attractive relative to gold, which pays no interest.

3. USD Strength & Gold Price Dynamics

• A stronger dollar typically makes gold more expensive for foreign buyers, reducing demand.

• Historically, when ADP & ISM readings surprise on the upside, gold often weakens as traders reprioritize positions toward USD-linked assets.

When both indicators perform well, markets assume:

✔ The U.S. economy is stable

✔ Inflation risks remain

✔ The Federal Reserve may keep interest rates higher for longer

This strengthens the US Dollar and raises bond yields, both of which are negative for gold, as gold does not pay interest.

Impact on Gold (XAU/USD)

Gold is priced in USD and is considered a safe-haven asset. Strong U.S. data usually reduces the need for safety and increases demand for yield-based assets.

Result:

➡ USD strengthens

➡ Investors sell gold

➡ XAU/USD price falls

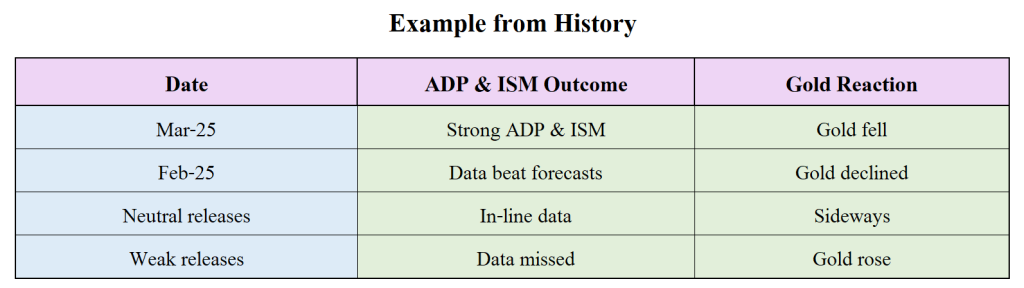

Possible Gold Price Scenarios

Scenario 1 – Strong Data (Most Likely)

ADP and ISM beat forecasts

• USD rises

• Treasury yields rise

• Gold drops (bearish XAU/USD)

Scenario 2 – Data In Line

Results meet expectations

• Short-term volatility

• Gold remains range-bound

Scenario 3 – Weak Data

Employment and services miss forecasts

• Fed rate-cut expectations increase

• USD weakens

• Gold rises (bullish XAU/USD)

Previous released data results :

Conclusion

Ahead of today’s 15:00 GMT release, expectations of strong U.S. ADP and ISM Non-Manufacturing data support a bearish outlook for XAU/USD. If the data confirms economic strength, gold is likely to face selling pressure due to USD strength and higher interest-rate expectations.

Traders should prepare for volatility and watch USD and bond yields closely.

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11