Here is a blog-style analysis of why “bad” U.S. weekly Initial Jobless Claims on 4 Dec 2025 could push Gold — and the pair XAU/USD — higher, what’s driving that reaction, and possible scenarios for gold going forward. I also include a mini “historical comparison” to show how gold has responded in similar situations in the past.

Today’s given signal : https://t.me/calendarsignal/22106

Why Weak US Initial Jobless Claims Data Matters (and Why It’s Viewed as “Bad”)

- What are Initial Jobless Claims?

Initial Jobless Claims tracks how many people filed for unemployment benefits for the first time in a given week — a leading, high-frequency indicator of labor-market health. A rise suggests more layoffs or a slowdown in hiring, signaling weakening economic momentum. - Why markets care:

Because the data arrives weekly, it often moves markets on release — especially when it diverges significantly from expectations. - Implications of “bad” (higher than expected) claims:

- It suggests a softening or slowing U.S. labor market, denting confidence in economic growth. That raises speculation that the Federal Reserve (the Fed) might respond by cutting interest rates or keeping them lower for longer. Lower interest rates reduce the attractiveness of yield-bearing assets (bonds), making non-yielding gold more appealing.

- A weaker labor market tends to weaken the U.S. dollar (USD) and may push down bond yields — both positives for gold priced in USD.

- Gold has traditionally been seen as a hedge or safe-haven during economic weakness or uncertainty.

That’s why, if on 4 Dec 2025 the jobless claims came in worse than forecast, many traders might interpret it as “bad data” — but “good for gold.”

Also, recent commentary suggests soft labor data could renew expectations of a rate cut from the Fed, which in turn supports gold.

Scenarios for Gold / XAUUSD: What Could Happen

Depending on follow-up developments (further data, inflation prints, Fed decisions, market sentiment), several scenarios could play out for XAU/USD.

🟩 Bullish Scenario — Gold Up

“Weak jobs → Rate-cut hopes → Gold rises.”

- If jobless claims stay high, markets may expect earlier Fed rate cuts.

- Lower expected rates = weaker USD + lower yields → good for gold.

- Safe-haven demand (geopolitics or uncertainty) could boost gold further.

- If price holds above support, gold may push toward higher resistance levels.

🟨 Neutral Scenario — Sideways / Range

“Mixed signals → Market waits.”

- Weak jobless claims but sticky inflation could make the Fed delay cuts.

- That creates uncertainty → gold moves sideways instead of trending.

- Price may stay stuck between support and resistance as traders wait for more data.

🟥 Bearish Scenario — Gold Down

“Weak jobs but Hawkish Fed → USD strong → Gold pressured.”

- If inflation stays high, the Fed may not cut rates even with weak job data.

- Strong USD or rising risk appetite (stocks rallying) could pull money out of gold.

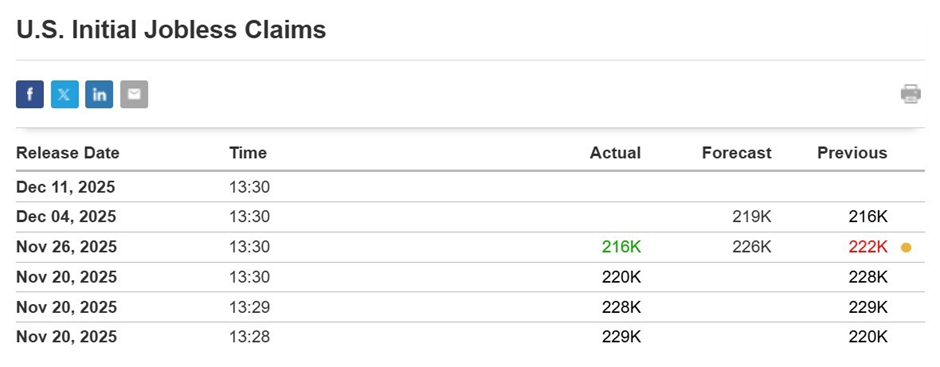

Previous released data results :

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11