The price of gold is a closely followed commodity in the market due to its historical significance and role as a store of value. Investors and traders often analyze the factors that influence the gold price to make informed investment decisions. In this document, we will examine the potential influence of two key indicators on the gold price: JOLTS Job Openings and Federal Reserve Chairman Jerome Powell’s speech.

Today’s given signal : https://t.me/calendarsignal/13449

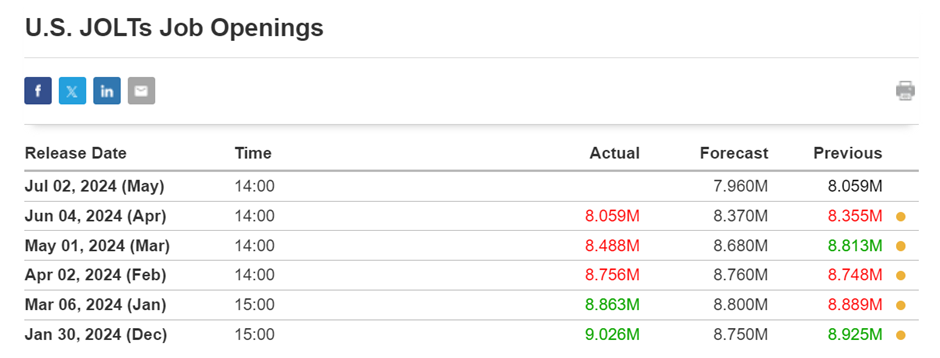

JOLTS Job Openings

The JOLTS (Job Openings and Labor Turnover Survey) report is a monthly release that provides data on job openings, hires, and separations in the United States. It is a valuable tool to assess the overall health of the job market and can provide insights into consumer spending patterns and overall economic activity.

A decline in JOLTS job openings, on the other hand, may indicate a weakening job market and slower economic growth. This can result in a decrease in gold demand as investors seek out other investment opportunities.

Federal Reserve Chairman Jerome Powell’s Speech

Federal Reserve Chairman Jerome Powell’s speeches are closely watched by investors, as they can provide insights into the central bank’s monetary policy and interest rate decisions. These speeches can influence the gold price through various channels.

If Chairman Powell signals a more hawkish stance on monetary policy, such as hinting at higher interest rates or a faster pace of tapering asset purchases, it can have a negative impact on gold prices. Higher interest rates can make holding non-yielding assets like gold less attractive, as investors can earn higher returns in interest-bearing assets.

On the other hand, a dovish speech, where Chairman Powell expresses concerns about the economic outlook or hints at maintaining current monetary policy, can be bullish for the gold price. Investors may perceive a dovish tone as indicative of lower interest rates or continued quantitative easing, which can support gold demand.

Previous released data results :

On last HAWKISH Speech (19-5-2024) we given SELL XAUUSD & price was fall after that speech.

Check last given signal : https://t.me/calendarsignal/12255

Performance :

On last JOLTs opening data (4-6-2024) we predict to SELL XAUUSD as for higher data, GOLD price was fall.

Check last given signal : https://t.me/calendarsignal/12721

Performance :

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11