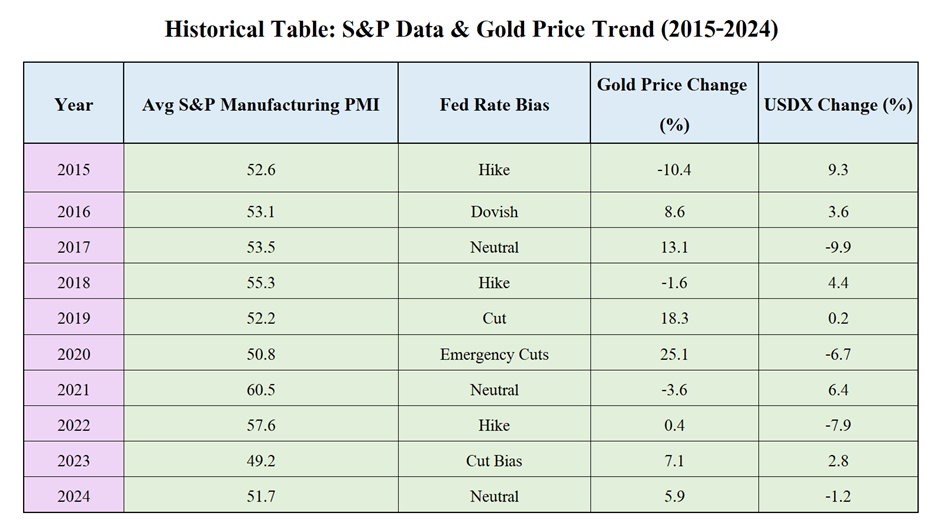

Certainly! Here’s a comprehensive, easy-to-understand answer, including explanations, a table of historical trends, and a summary table of scenarios for April 23, 2025.

Today’s given signal : https://t.me/calendarsignal/18098

Why Was Today’s US S&P Data Bad?

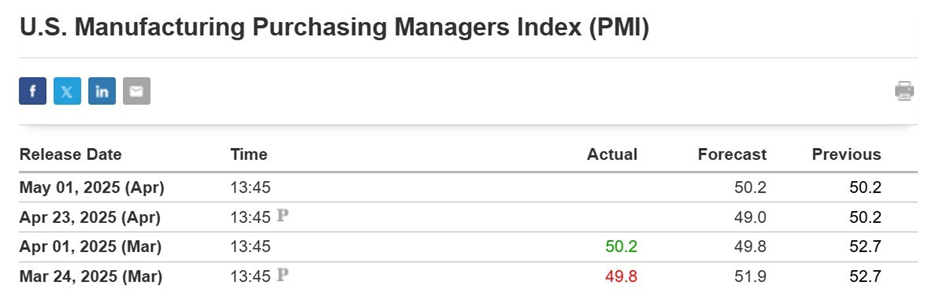

The S&P Global U.S. Manufacturing and Services PMI figures came in weaker than expected:

- Manufacturing PMI: Fell to 48.9 (below the 50 threshold, showing contraction)

- Services PMI: Dropped to 50.5 (barely in expansion)

- These readings reflect slowing business activity, weaker orders, and growing concerns over economic momentum.

Key Reasons:

- Rising interest rates over the past year have squeezed business investment and consumer spending.

- Global uncertainty and supply chain disruptions continue to pressure US companies.

- Companies are becoming cautious due to fears of recession and tightening credit conditions.

Trump’s Pressure on the Fed

Former President Trump publicly urged the Federal Reserve to cut rates to support the economy and markets, increasing political pressure on the central bank.

- This signals to the market that even policymakers are worried about economic slowdown.

- Markets may begin pricing in faster or deeper rate cuts.

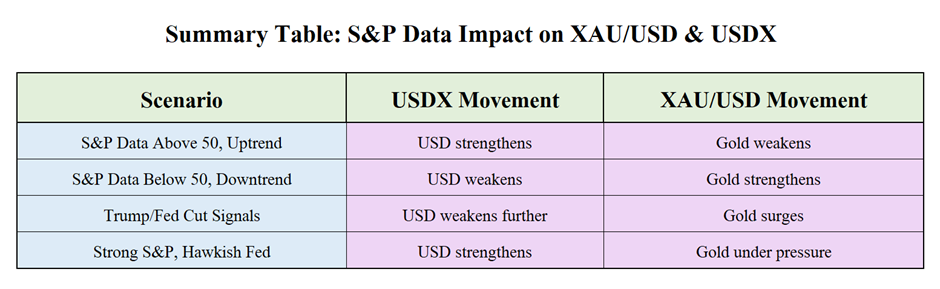

Bad S&P Data + Trump’s Fed pressure = Bullish gold scenario.

Gold benefits from economic worries and lower rate expectations, while the USD usually weakens.

New traders: Watch for PMI below 50 and Fed rate cut hints for bullish gold signals, but manage risk as gold is also technically overbought after recent rallies.

Previous released data results :

On last US S&P Data (1-4-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 49 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/gold-faces-volatility-as-us-sp-ism-data-hits-the-market-01-april-2025/

Check last given signal : https://t.me/calendarsignal/17708

Performance : https://t.me/calendarsignal/17727

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11