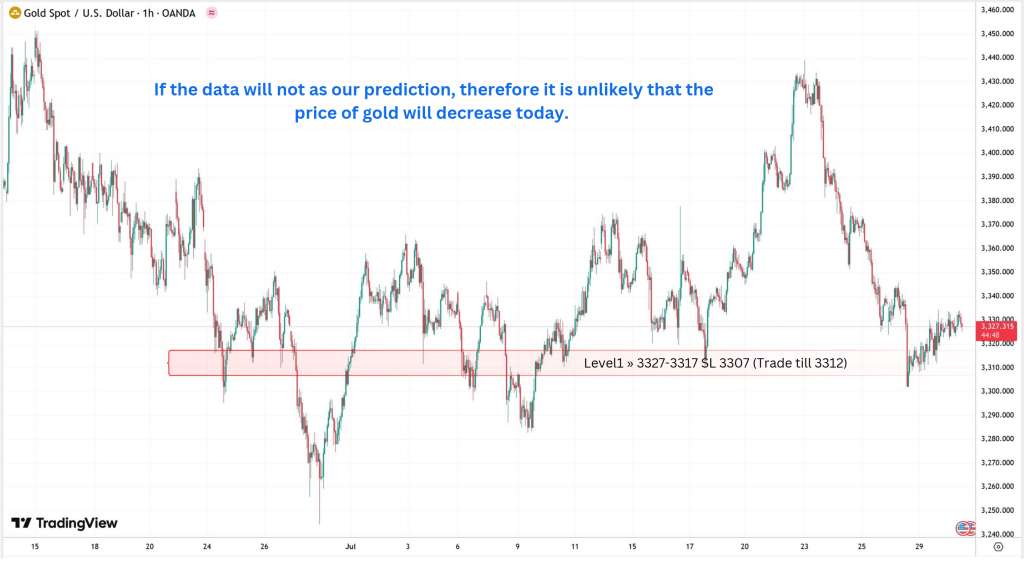

Today’s sharp rise in gold price is triggered by a combination of deteriorating US economic indicators, dovish monetary speculation, and political pressures weighing on the Federal Reserve’s independence. Let’s break down the scenario and its implications on XAU/USD.

Today’s given signal : https://t.me/calendarsignal/19713

Key Reasons Behind Today’s Gold Rally

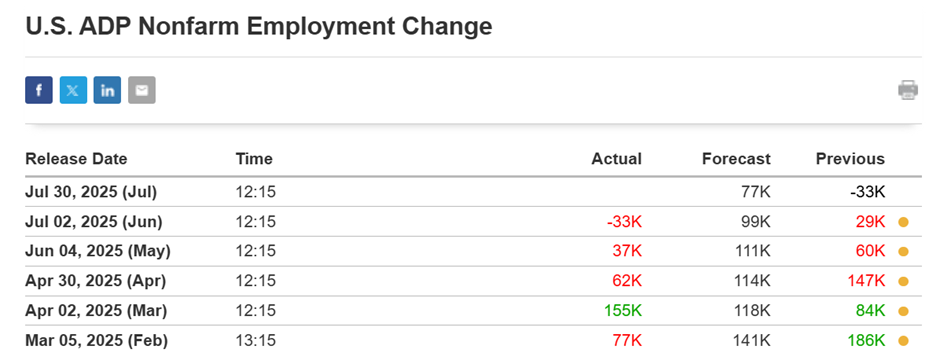

- Weak US ADP Employment Data

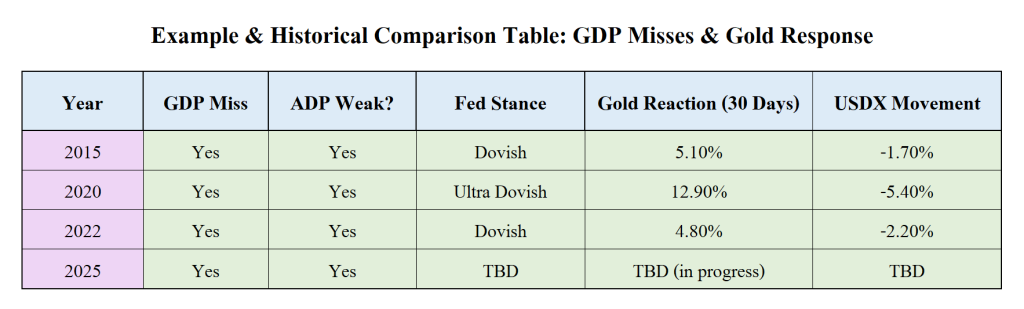

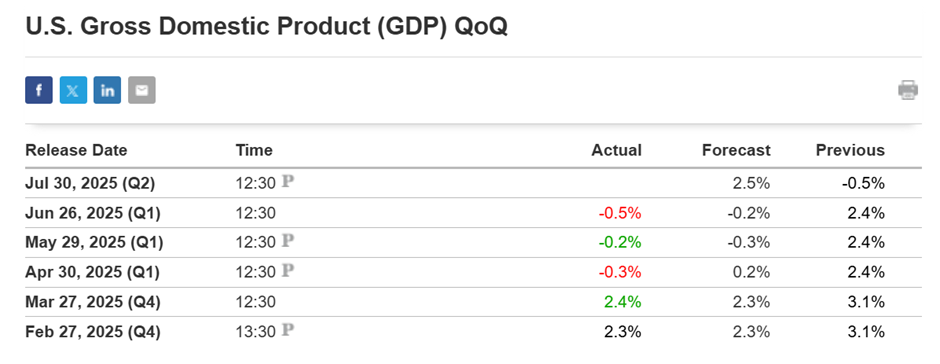

The ADP report revealed slower-than-expected job creation in the private sector, signaling potential softness in the broader labor market. Weak labor conditions typically lower the likelihood of interest rate hikes, favoring gold. - Disappointing US GDP Figures

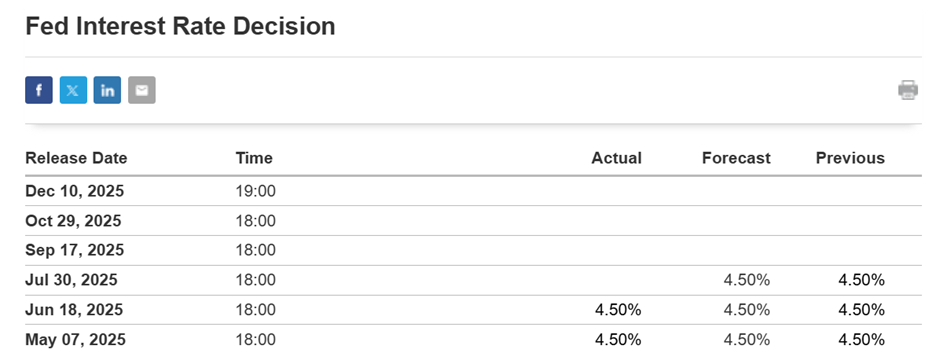

The Q2 GDP growth fell below market expectations, suggesting an economic slowdown. This increases the likelihood of a rate cut or dovish guidance from the Fed, boosting non-yielding assets like gold. - FOMC Policy Decision Uncertainty

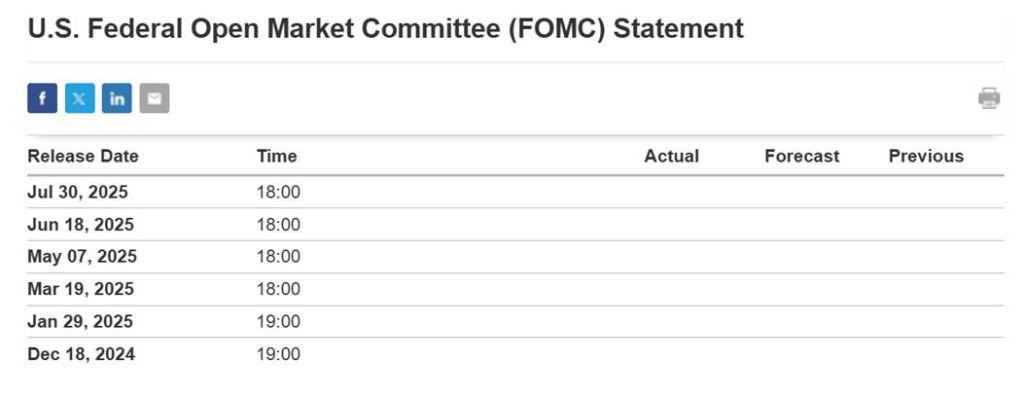

While the Fed held rates steady, market participants interpreted the language as cautious, especially after the data showed weakening fundamentals. This pivot leans dovish, further supporting gold prices. - Trump’s Renewed Pressure on Powell

Former President Trump’s public remarks criticizing the Fed’s hawkish stance and demanding more accommodative policies to avoid economic stagnation have added to the pressure on Powell. If political pressure intensifies, dovish stances may emerge from Fed members seeking stability. - Market Volatility and Safe-Haven Demand

With risk appetite diminishing due to policy uncertainty and soft macro numbers, investors are rotating toward traditional safe-haven assets. Gold benefits directly from this shift.

Previous released data results :

On last GDP data (26-6-2025) we predicted bad data, & as per that we suggest to BUY XAUUSD & as a result, we made a profit of 24 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/us-gdp-data-points-that-influence-gold-prices/

Check last given signal : https://t.me/calendarsignal/19227 Performance : https://t.me/calendarsignal/19241

On last ADP data (2-7-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 41 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/19319

Performance : https://t.me/calendarsignal/19329

===================================================================

On last Interest rate decision and FOMC statement (18-6-2025) we predicted dovish statement & no rate cut, & as per that we suggest to BUY XAUUSD & as a result, we made a profit of 65 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/19101

Performance : https://t.me/calendarsignal/19112

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11