Here is a blog-style analysis of why “good” US data today (strong JOLTS Job Openings + strong US construction spending) could push Gold (XAUUSD) lower — and what scenarios may evolve from here.

Today’s given signal : https://t.me/calendarsignal/22034

Why today’s strong US JOLTS + Construction Spending data hurt gold

The release of a better-than-expected JOLTS report (job openings staying high or rising) — combined with strong construction spending — tends to be interpreted by markets as confirmation that the U.S. economy remains resilient and not on the verge of a sharp slowdown. That has several important implications for gold:

- Reduced expectations for rate cuts by the Federal Reserve (Fed): A strong labor market (as signalled by JOLTS) suggests that the Fed may not feel pressure to cut interest rates soon. Higher or stable rates make yield-bearing assets (like Treasury bonds) more attractive, reducing the appeal of non-yielding gold.

- Stronger US dollar & higher yields: Robust economic data tends to strengthen the dollar (as investors favor dollar denominated assets) and raises US Treasury yields. Since gold is priced in dollars, a stronger dollar makes gold more expensive for international buyers — weighing on demand.

- Less safe-haven demand: With improved economic outlook, investors may shift away from safe-haven assets like gold toward riskier, yield-bearing assets like equities, reducing gold buying.

- Monetary policy outlook shift: Strong data may delay rate cuts or even prompt rate-hike expectations, increasing the “opportunity cost” of holding gold (since gold yields nothing). That reduces bullion’s attractiveness compared to fixed-income instruments.

What Does This Mean for XAUUSD — Possible Scenarios

Given today’s data, here are a few plausible scenarios for gold (XAUUSD) in the near-term and medium-term:

🔻 Scenario 1: Gold Retreats Further (Base Case)

- With strong economic data, the dollar and US yields remain firm → downward pressure on gold.

- Risk-on sentiment prevails: investors rotate into equities / bonds, reducing safe-haven demand for gold.

- Result: XAUUSD could dip further — possibly targeting a support zone (depending on technical levels), before any meaningful bounce.

🔄 Scenario 2: Range-bound / Consolidation

- Some investors book profits and sell gold, but others (e.g., central banks, long-term holders) remain supportive.

- Gold may trade in a sideways range, oscillating between support and resistance as markets await next major catalyst (e.g. upcoming inflation data, Fed signals).

- XAUUSD could trade in a consolidation band, moving lower on strong data days and bouncing on signs of liquidity stress / risk.

📈 Scenario 3: Rebound on Unexpected Weakness or External Shocks

- If upcoming data disappoints (e.g. weak inflation, poor economic growth), or if geopolitical risk spikes — investors may rush back into gold.

- Renewed expectations for Fed rate cuts or safe-haven demand could push XAUUSD higher again.

- Gold could retest recent highs, especially if dollar weakens or yields fall.

Key factors to watch for in coming days: US inflation data (e.g. PCE), yield moves, dollar strength, Fed commentary — and any signs of economic slowdown or geopolitical tension.

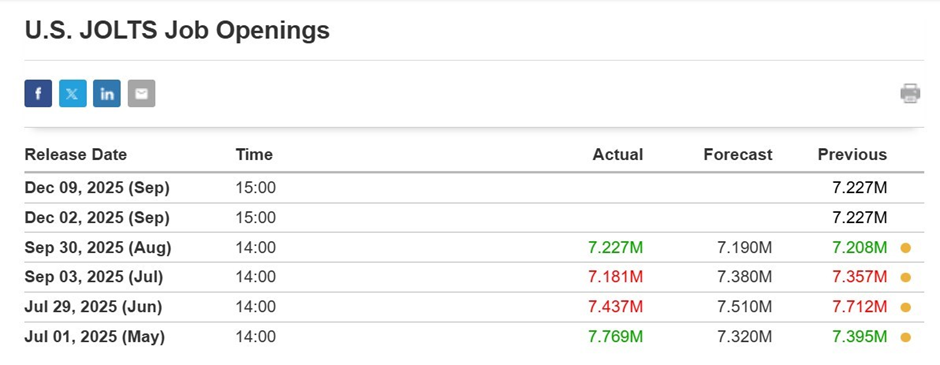

Previous released data results :

On last US JOLTS opening data (30-9-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 89 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/xau-usd-analysis-gold-faces-pressure-from-todays-us-economic-data-30-9-2025/

Check last given signal : https://t.me/calendarsignal/20660

Performance : https://t.me/calendarsignal/20676

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11