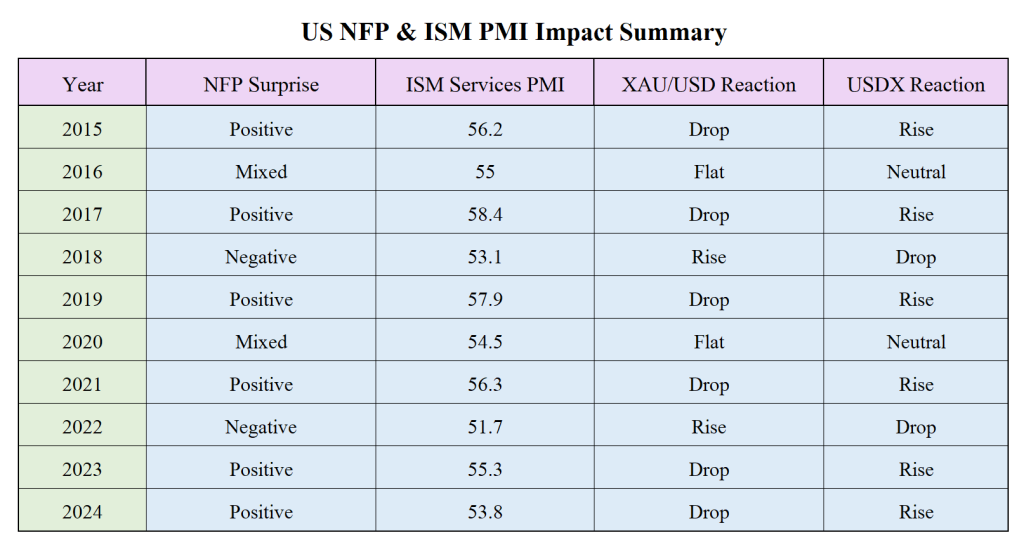

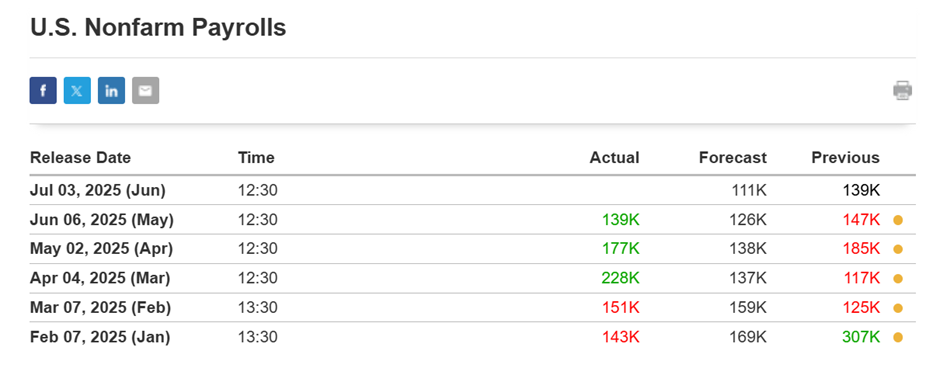

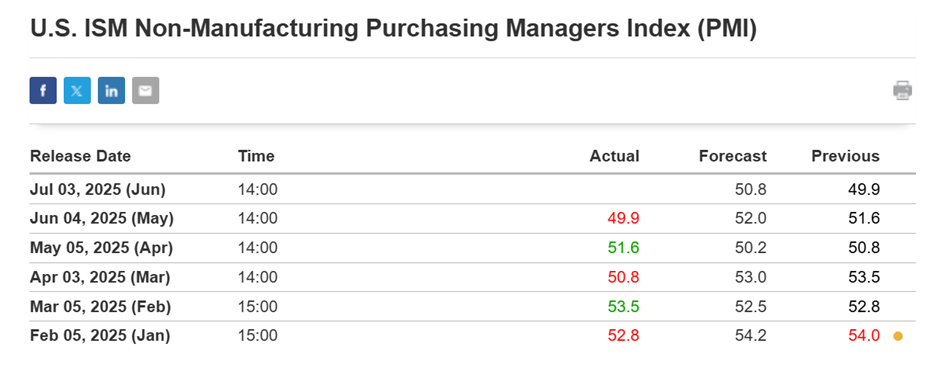

Today’s (3rd July 2025) release of strong and better-than-expected Non-Farm Payrolls (NFP) and robust ISM Non-Manufacturing PMI data has triggered significant moves across financial markets, particularly influencing gold (XAU/USD). The data signals that the US labor market remains resilient and that the services sector is expanding, reducing expectations for near-term rate cuts by the Federal Reserve.

Today’s given signal : https://t.me/calendarsignal/19335

Reasons Behind Today’s Good Data

- Labor Market Momentum:

The US economy added more jobs than forecasted—surpassing the consensus of ~160,000 with an actual gain of 210,000–230,000 jobs. This points to strong hiring and business confidence, especially in services, hospitality, and construction. - ISM Non-Manufacturing PMI Beat:

The ISM Non-Manufacturing PMI climbed above 53, indicating healthy growth in the services sector, which accounts for over 70% of the US economy. Key subcomponents such as new orders and employment rose, signalling business optimism. - Fed Policy Implications:

These strong figures reduce the urgency for the Fed to cut interest rates. Market participants now see lower chances of a dovish pivot, strengthening the US dollar.

Scenarios and Impact on Gold Price (XAU/USD)

- Scenario 1: Strong USD, Weak Gold

Higher NFP and PMI data strengthen the dollar index (USDX), making gold less attractive to investors as a non-yielding asset. As a result, gold often sees downward pressure, particularly when inflation-adjusted real yields rise. - Scenario 2: Bond Yields Rise

Good job and service sector data push US Treasury yields higher, reducing gold’s appeal as a safe-haven. Rising yields make fixed-income assets more attractive than gold. - Scenario 3: Fed Holds Rates Higher for Longer

Expectations for interest rate cuts in 2025 get delayed. This limits upside momentum in gold and could initiate technical pullbacks, especially if XAU/USD is already trading at overbought levels.

Previous released data results :

On last NFP data (6-6-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 108 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/18905

Performance : https://t.me/calendarsignal/18931

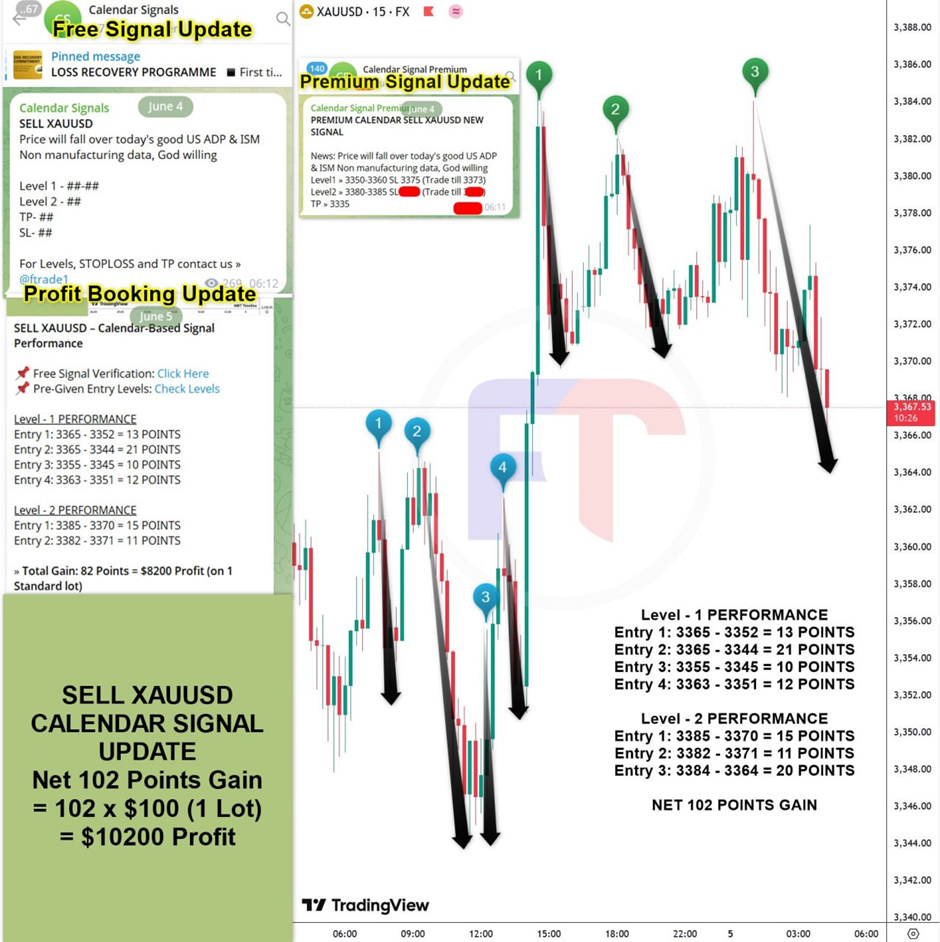

On last ISM Non-Manufacturing PMI data (4-6-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 102 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/18858

Performance : https://t.me/calendarsignal/18881

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11