In the fast-paced world of Forex trading, staying ahead of market movements is crucial for success. High impact economic indicators are key data points that can significantly influence currency prices. Understanding these indicators and their potential impact can help traders make more informed decisions. Here’s a look at some of the most influential Forex trading indicators:

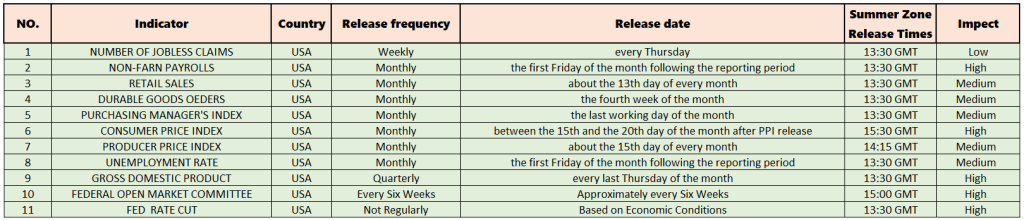

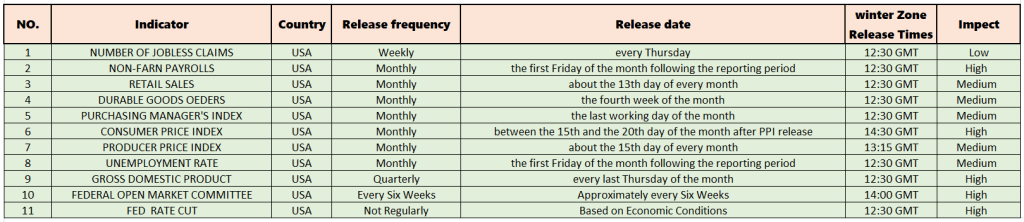

Key Economic Indicators: Frequency, Importance, and Most Significant Release

Understanding the release frequency and importance of key economic indicators is crucial for making informed trading and investment decisions. Here is a summary of these indicators:

Summer Zone : Typically from the second Sunday in March to the first Sunday in November.

Winter Zone : Typically from the first Sunday in November to the second Sunday in March.

These release times are critical for Forex trading as they often cause significant market movements.

1.Number of Jobless Claims

Definition: Tracks the number of individuals who have filed for unemployment benefits for the first time, providing a timely measure of labor market conditions.

- Frequency: Weekly

- Importance: Medium. Provides timely data on labor market conditions.

- Important Release: Released by the U.S. Department of Labor every Thursday.

2. Non-Farm Payrolls (NFP)

Definition: Measures the change in the number of employed people during the previous month, excluding the farming industry, reflecting labor market health.

- Frequency: Monthly

- Importance: Very High. Measures the change in the number of employed people during the previous month, excluding the farming industry.

- Important Release: Released by the U.S. Bureau of Labor Statistics (BLS) on the first Friday of each month.

3. Retail Sales

Definition: Measures the total receipts of retail stores, reflecting consumer spending patterns and economic activity.

- Frequency: Monthly

- Importance: High. Indicates consumer spending and economic activity.

- Important Release: Released by the U.S. Census Bureau around the middle of each month.

4. Durable Goods Orders

Definition: Tracks new orders placed with domestic manufacturers for delivery of factory hard goods, indicating manufacturing sector strength.

- Frequency: Monthly

- Importance: Medium. Reflects business investment and consumer spending on big-ticket items.

- Important Release: Released by the U.S. Census Bureau, typically around the end of each month.

5. Purchasing Managers’ Index (PMI)

Definition: An index of the prevailing direction of economic trends in the manufacturing and service sectors, based on surveys of purchasing managers.

- Frequency: Monthly

- Importance: High. Measures economic health of the manufacturing and service sectors.

- Important Release: Released by Markit Economics and the Institute for Supply Management (ISM) on the first business day of each month.

6. Consumer Price Index (CPI)

Definition: Measures the average change over time in the prices paid by consumers for a basket of goods and services, reflecting inflation.

- Frequency: Monthly

- Importance: High. Key measure of inflation and cost of living.

- Important Release: Released by the U.S. Bureau of Labor Statistics (BLS) around the middle of each month.

7. Producer Price Index (PPI)

Definition: Measures the average change over time in the selling prices received by domestic producers for their output, indicating inflation at the wholesale level.

- Frequency: Monthly

- Importance: Medium to High. Measures inflation at the wholesale level.

- Important Release: Released by the U.S. Bureau of Labor Statistics (BLS) typically in the second week of each month.

8. Unemployment Rate

Definition: The percentage of the total workforce that is unemployed and actively seeking employment, indicating labor market health.

- Frequency: Monthly

- Importance: High. Key indicator of labor market health.

- Important Release: Released by the U.S. Bureau of Labor Statistics (BLS) on the first Friday of each month.

9. Gross Domestic Product (GDP)

Definition: Measures the total value of all goods and services produced in a country over a specific period, reflecting economic health and growth.

- Frequency: Quarterly

- Importance: High. Indicates overall economic health and growth.

- Important Release: Quarterly release by the Bureau of Economic Analysis (BEA) in the U.S. Final estimates are the most accurate.

10. FOMC

- Definition: The FOMC is a branch of the Federal Reserve responsible for overseeing the nation’s open market operations and setting the federal funds rate, which influences overall economic activity and inflation.

- Frequency: Approximately every six weeks.

- Importance: Medium. The meetings where economic projections are released, often in March, June, September, and December, are particularly important. These meetings include press conferences by the Fed Chair.

- Important Release: Released by the U.S. Bureau of Economic Analysis (BEA) quarterly.

11. Fed Rate Cut

Definition: A Fed rate cut refers to the Federal Reserve’s decision to lower the federal funds rate, which is the interest rate at which banks lend to each other overnight. This action is typically taken to stimulate economic growth by making borrowing cheaper.

- Frequency: Rate cuts are not on a regular schedule and are made as needed based on economic conditions.

- Importance: Any FOMC meeting can be pivotal if a rate cut is expected or announced. The most impactful are those with accompanying economic projections and press conferences (March, June, September, December).

- Important Release: The FOMC statement announcing a rate cut, often followed by a press conference from the Fed Chair, is critical as it explains the rationale behind the decision and provides guidance on future monetary policy direction.

Powell’s Speech

- Role: Jerome Powell, the Chair of the Federal Reserve, often gives speeches following FOMC meetings. His statements provide insights into the Fed’s future policy direction.

- Timing: Typically, Powell’s press conference follows the FOMC statement.

- Summer Zone: 6:30 PM GMT

- Winter Zone: 7:30 PM GMT

- Effect on Forex: Powell’s tone and language during his speech can have a significant impact on market sentiment. A hawkish tone (indicating a focus on controlling inflation and potentially raising rates) can strengthen the USD, while a dovish tone (indicating a focus on stimulating economic growth and potentially cutting rates) can weaken the USD.

Summary of Most Important Releases

- GDP: Quarterly final estimates.

- PMI: Monthly, first business day of each month.

- CPI: Monthly, middle of each month.

- Unemployment Rate and NFP: Monthly, first Friday of each month.

These releases are closely monitored by traders, investors, and policymakers as they provide critical insights into economic performance, inflation, and labor market conditions.

WHERE TO CONTACT US

Website: https://forextrade1.co

Twitter: www.twitter.com/forextrade11

Telegram: telegram.me/ftrade1

Facebook: www.facebook.com/Forextrade01

Instagram: www.instagram.com/forextrade1

YouTube: www.youtube.com/ForexTrade1

Skype: forextrade01@outlook.com

Email ID: info@forextrade1.com