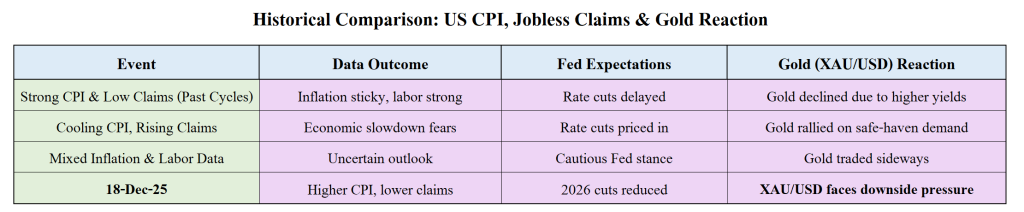

Gold prices (XAU/USD) are expected to face downside pressure today as higher-than-expected US CPI data combined with lower US Jobless Claims signal continued economic resilience in the United States. Together, these data points reduce expectations for Federal Reserve rate cuts in 2026, strengthening the US dollar and weighing on gold demand.

Gold, which does not offer interest income, is highly sensitive to inflation trends, labor-market strength, and future interest-rate expectations. Today’s data reinforces the idea that the US economy remains firm, making aggressive monetary easing less likely.

Today’s given signal : https://t.me/calendarsignal/22476

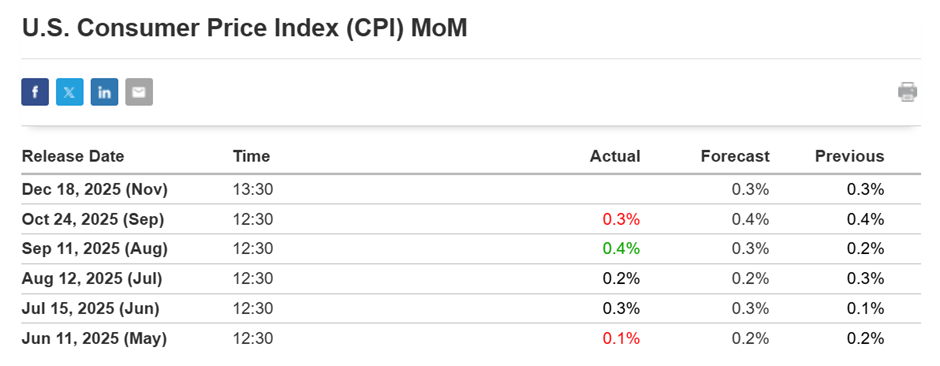

Why Today’s US CPI Data Came in Higher

Several key factors explain why inflation remains elevated:

1. Sticky Services Inflation

While goods inflation has moderated compared to previous years, services inflation remains stubborn, driven by housing costs, healthcare, and wages. These components are slower to cool and keep headline CPI elevated.

2. Strong Consumer Demand

Despite higher interest rates, US consumers continue to spend steadily. Solid demand allows businesses to pass on higher costs, preventing inflation from easing as quickly as markets expected.

3. Energy and Transportation Costs

Fluctuations in energy and transportation prices continue to add upside pressure to inflation, contributing to a higher CPI reading.

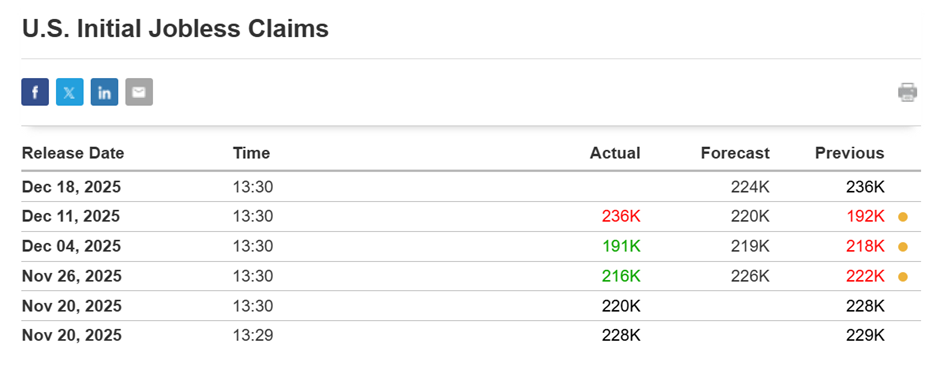

Why US Jobless Claims Remain Low

Lower-than-expected jobless claims reflect ongoing strength in the US labor market, supported by:

1. Tight Labor Conditions

Employers remain cautious about layoffs after years of hiring difficulties, keeping unemployment claims suppressed.

2. Stable Corporate Earnings

Many companies continue to post resilient earnings, allowing them to maintain payrolls even amid higher borrowing costs.

3. Limited Economic Slowdown

The absence of a sharp economic slowdown means fewer layoffs, reinforcing the perception of labor-market stability.

How This Data Impacts Gold (XAU/USD)

The combination of higher inflation and strong labor data directly affects gold through three main channels:

- Reduced Rate-Cut Expectations: Markets push back expectations for Fed easing in 2026.

- Higher Bond Yields: Rising yields increase the opportunity cost of holding non-yielding assets like gold.

- Stronger US Dollar: A firmer dollar makes gold more expensive for non-US buyers.

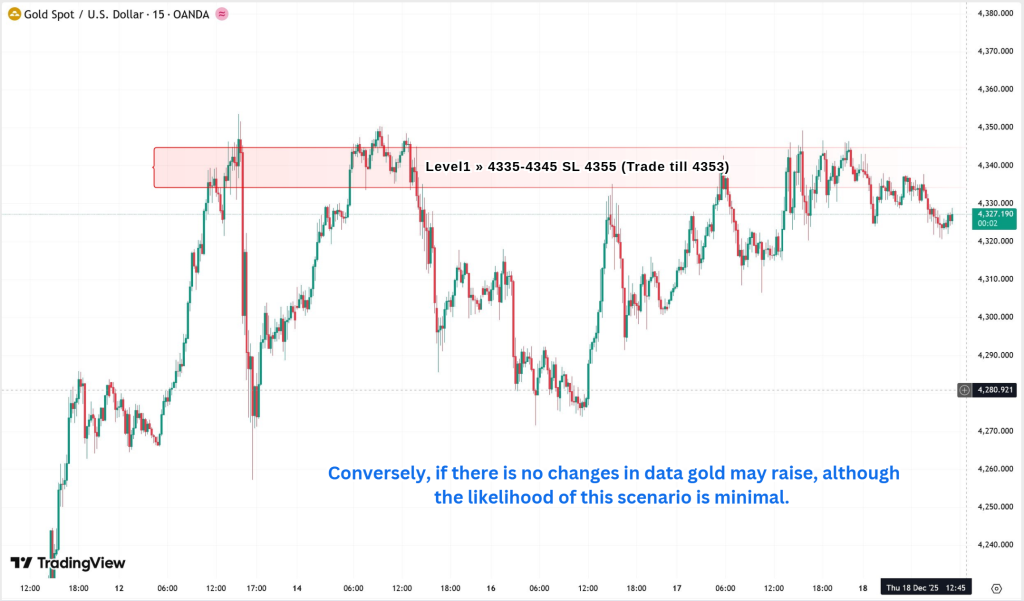

Possible Scenarios for XAU/USD

🔴 Scenario 1: Continued Downside Pressure (Bearish Gold)

If upcoming inflation and labor data remain firm, gold may extend losses as markets fully price out 2026 rate cuts.

🟡 Scenario 2: Range-Bound Consolidation

Gold could stabilize if investors balance strong US data with geopolitical risks or upcoming central-bank uncertainty.

🟢 Scenario 3: Short-Term Rebound

Any unexpected softening in future inflation or labor data could trigger short-covering rallies in XAU/USD.

Previous released data results :

On last US CPI data (24-10-2025) we predicted bad data, & as per that we suggest to BUY XAUUSD & as a result, we made a profit of 183 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/21140

Performance : https://t.me/calendarsignal/21178

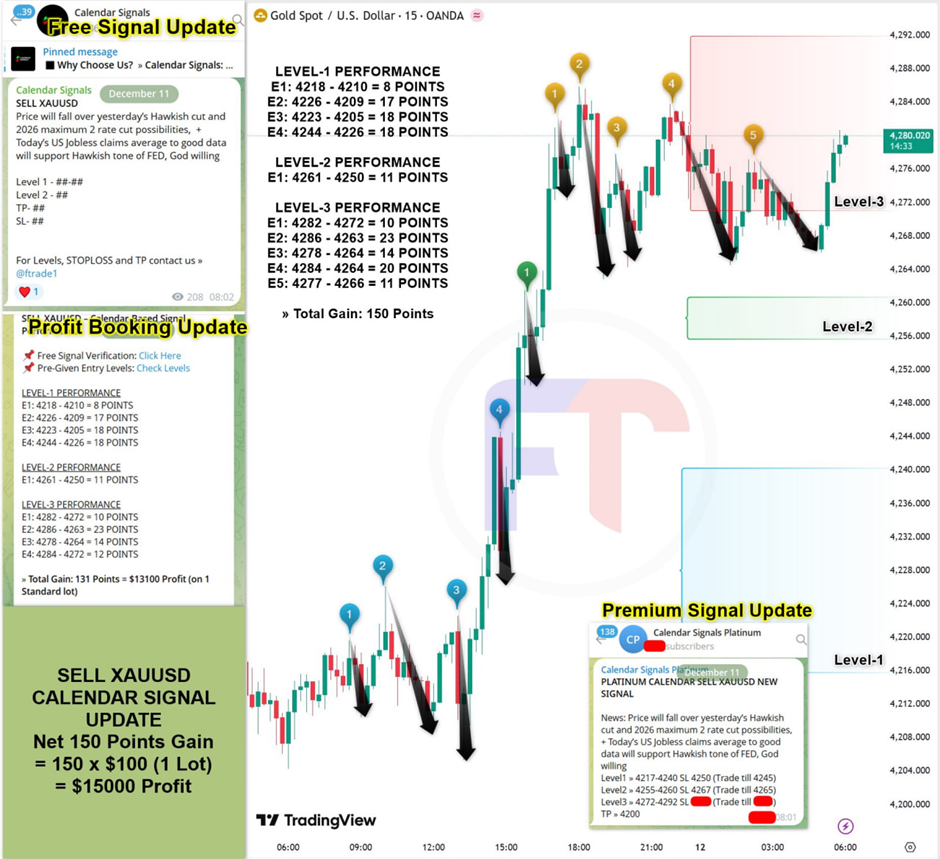

On last US Jobless claims data (11-12-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 150 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/22276

Performance : https://t.me/calendarsignal/22304

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11