Trading gold can be a profitable investment strategy, especially when certain events occur in the market. Lower US CPI data and Middle East issues are two such factors that can impact the price of gold. By understanding the significance of these events and knowing how to trade gold effectively, investors can position themselves to make informed trading decisions.

Today’s given signal : https://t.me/calendarsignal/14477

Trading Gold Ahead of Lower US CPI Data

To trade gold ahead of today’s lower US CPI data, investors can follow these steps:

1. Analyze Market Conditions: Conduct a thorough analysis of the overall market conditions, including gold prices, interest rates, and any other relevant factors that could impact gold.

2. Monitor US CPI Data Release: Stay informed about the release of the lower US CPI data. The date and time of this release are typically announced by the Federal Reserve.

3. Study Technical Analysis: Utilize technical analysis to identify potential support and resistance levels for gold. This will help determine where the price may potentially move following the release of the US CPI data.

4. ConsiderElliott Wave Analysis:Elliott Wave Analysis is a trading strategy that utilizes waves to identify patterns in the market. By analyzing wave formations, traders can anticipate potential price movements.

5. Execute Trading Strategy: Based on the analysis conducted, develop a trading strategy that aligns with your risk tolerance and goals. Some popular strategies include buying gold on dips or selling gold on rallies.

Middle East Issues and Gold

Middle East issues can also impact the price of gold. Geopolitical tensions, conflicts, and instability in the region can lead to increased demand for gold as a safe-haven asset. Investors often turn to gold during times of uncertainty, as it can provide a hedge against currency devaluation and market volatility.

Trading Gold Ahead of Middle East Issues

To trade gold ahead of Middle East issues, investors can follow these steps:

1. Stay Informed: Monitor geopolitical developments in the Middle East region. News reports, geopolitical analysis, and expert opinions can shed light on potential conflicts or other issues that may arise.

2. Study Fundamental Analysis: Analyze the economic, political, and environmental factors specific to the Middle East region. These factors can impact the demand for gold, and understanding the dynamics can help inform trading decisions.

3. Monitor Gold Prices: Track the price of gold in relation to other assets, such as stocks and currencies. Look for any unusual movements or patterns that may indicate increased interest in gold as a safe-haven assetsss.

4. Execute Trading Strategy: Develop a trading strategy that takes into account the potential for Middle East issues to drive up the price of gold. Some popular strategies include buying gold on dips or selling gold on rallies.

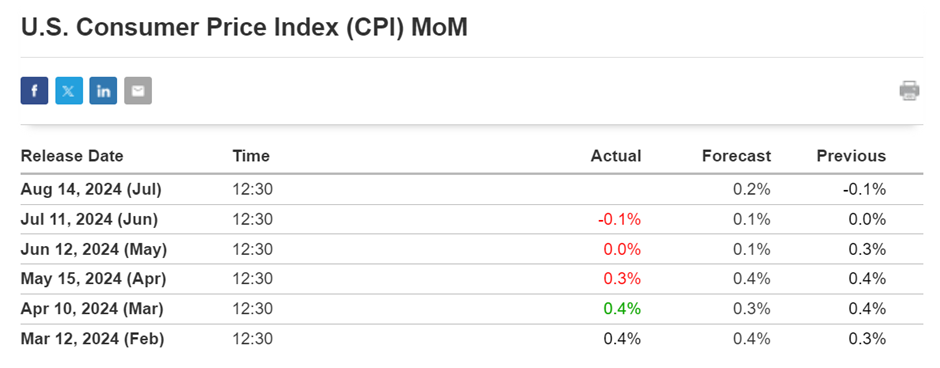

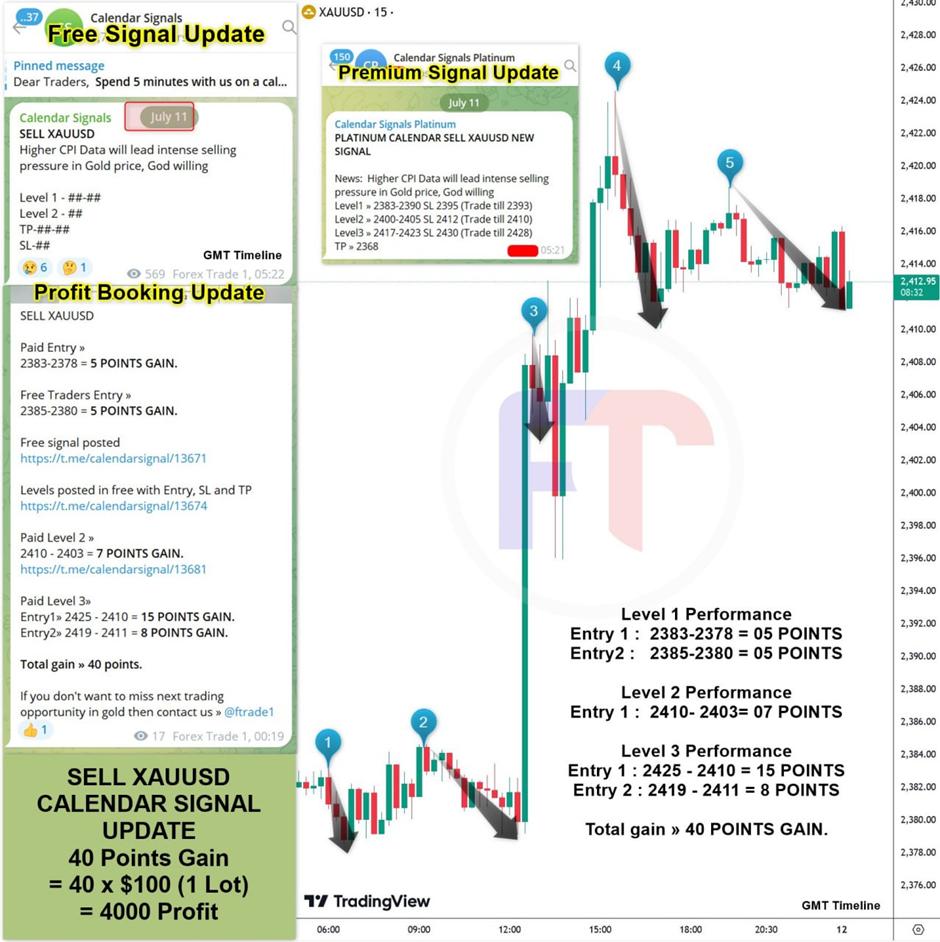

Previous released data results :

On last CPI data (11-7-2024) we predict to SELL XAUUSD as for higher CPI Data, GOLD price was fall.

Check the previous blog : https://blog.forextrade1.co/us-cpi-data-impact-on-todays-gold-prices-11-7-2024/

Check last given signal : https://t.me/calendarsignal/13671

Performance : https://t.me/calendarsignal/13691

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11