Gold prices (XAUUSD) are expected to fall as multiple factors bolster the US dollar and Treasury yields, reducing gold’s appeal as a safe-haven asset. The combination of Trump’s tariff plan, weak China economic data, strong US home sales, and the Federal Reserve’s rate cut pause decision are driving bearish sentiment in gold markets.

Today’s given signal : https://t.me/calendarsignal/16748

Reasons Behind Gold’s Decline

- Trump Tariff Plan:

- Former President Trump announced new tariffs to protect domestic industries, strengthening the US dollar as demand for US-made goods rises.

- Tariff uncertainty impacts global trade, but the dollar benefits as a global reserve currency.

- Weak China Data:

- China’s GDP growth rate dropped to 4.5%, below the forecast of 5.2%, signaling slowing global economic activity.

- Lower growth in China, a major gold consumer, reduces physical gold demand.

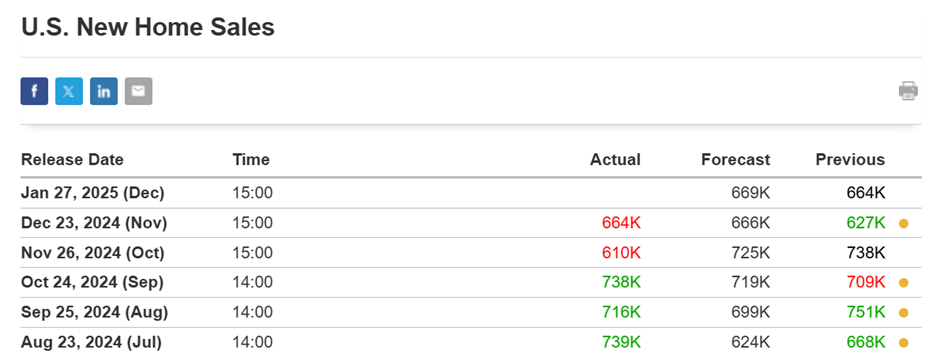

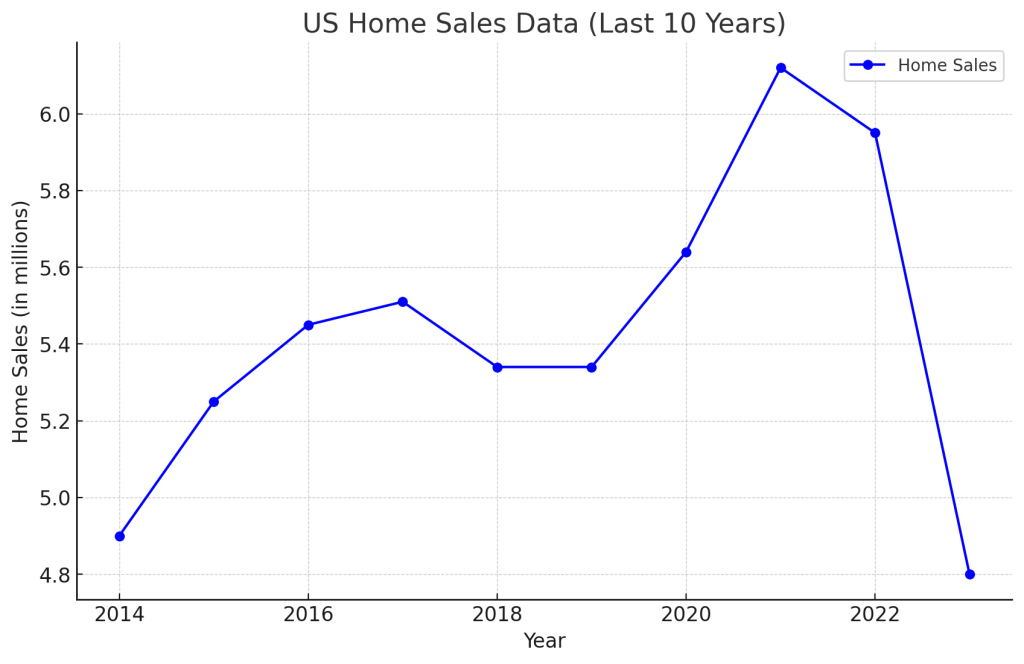

- Strong US Home Sales Data:

- US existing home sales rose 6.5% in December 2024, beating expectations of 4.8%, reflecting robust consumer confidence.

- Positive economic data strengthens the US dollar and signals economic resilience.

- Federal Reserve Rate Cut Pause:

- The Fed paused rate cuts, citing persistent inflationary risks, with rates held steady at 5.25%-5.50%.

- Higher rates boost Treasury yields, making yield-bearing assets more attractive than non-yielding gold.

Impact on Gold Prices (XAUUSD):

Typically, strong home sales data indicates a robust economy, which can lead to higher interest rates and a stronger U.S. dollar. These factors often reduce the appeal of gold as a non-yielding asset, potentially leading to a decline in its price.

However, gold prices are influenced by a multitude of factors, including inflation expectations, geopolitical events, and overall market sentiment. Therefore, while positive housing data can exert downward pressure on gold prices, the actual impact on any given day depends on a combination of these elements.

Previous released data results :

Check the previous blog :

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11