On 4th October 2024, the United States released a higher Non-Farm Payrolls (NFP) data, which had a significant impact on the gold price. This document aims to explore the reasons behind this decline and its significance within the global financial markets.

Today’s given signal : https://t.me/calendarsignal/15408

Higher US NFP Data on 4th October 2024

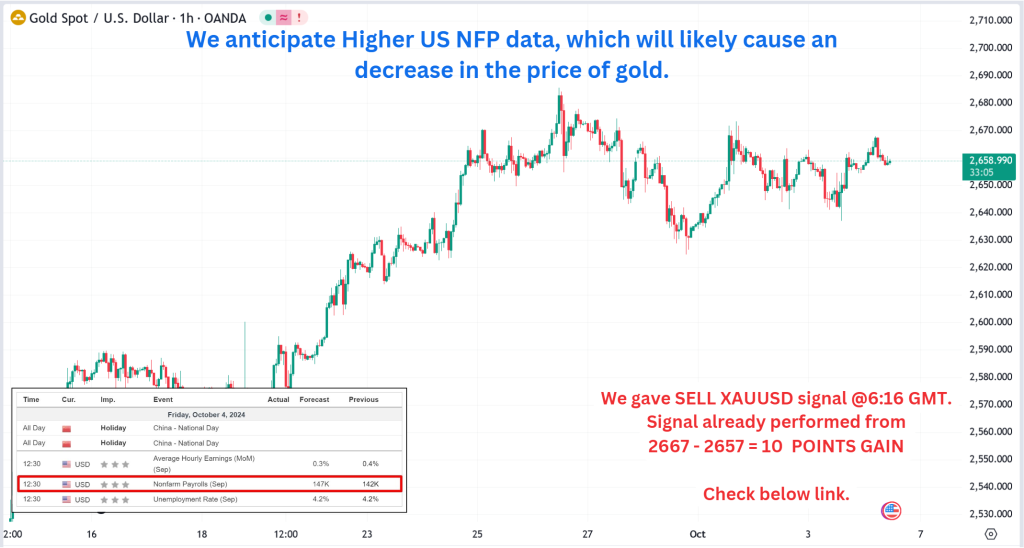

On 4th October 2024, the United States released a higher NFP data, which reflected positive employment growth. This data indicated that the economy was performing better than expected, leading to a decline in gold prices.

Factors Contributing to the Decline

Several factors contributed to the decline in gold prices on 4th October 2024. Firstly, the relatively strong NFP data boosted investor confidence in the US economy, reducing the demand for safe haven assets such as gold. Additionally, higher employment rates usually indicate higher consumer spending, which can indirectly impact gold prices by reducing the need for investment in the precious metal.

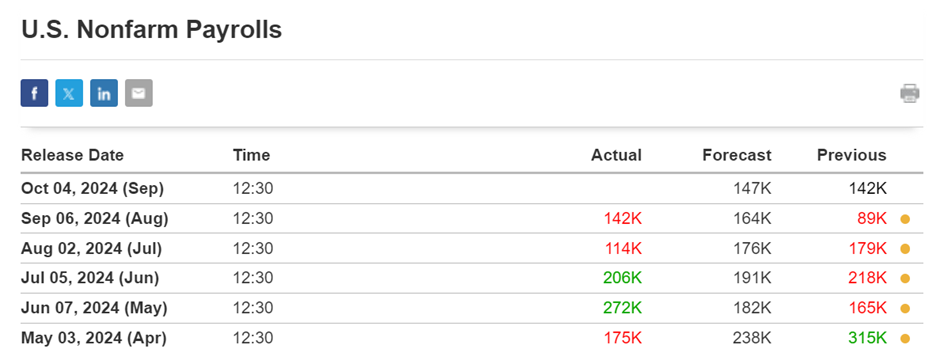

Previous released data results :

August Jobs Report Summary:

- Unemployment: The rate stayed at 4.2%, with 7.1 million people unemployed, higher than the previous year (3.8%, 6.3 million).

- Major Groups: Unemployment rates were little changed across adult men (4.0%), women (3.7%), teens (14.1%), Whites (3.8%), Blacks (6.1%), Asians (4.1%), and Hispanics (5.5%).

- Temporary Layoffs: Decreased by 190,000 to 872,000.

- Permanent Job Losses: Unchanged at 1.7 million.

- Long-term Unemployment: Unchanged at 1.5 million (21.3% of total unemployed).

- Labor Force Participation: Remained at 62.7%; employment-population ratio unchanged at 60.0%.

- Part-time Workers for Economic Reasons: 4.8 million, up from 4.2 million last year.

- Not in Labor Force Wanting a Job: Unchanged at 5.6 million.

- Marginally Attached Workers: 1.4 million, unchanged. Discouraged workers: 367,000, unchanged.

Job Gains:

- Total Nonfarm Payroll: Increased by 142,000, below the average 202,000 in the prior 12 months.

- Sectors with Gains:

- Construction: +34,000 jobs.

- Health Care: +31,000 jobs.

- Social Assistance: +13,000 jobs.

Job Losses:

- Manufacturing: Decreased by 24,000 jobs, mostly in durable goods.

Wages:

- Average Hourly Earnings: Increased by 0.4% (+14 cents) to $35.21, up 3.8% over the year.

- Workweek: Average workweek increased by 0.1 hours to 34.3 hours.

Revisions for June and July reduced total job gains by 86,000 combined.

On the last NFP data release (6-9-2024), we suggested selling XAUUSD due to strong NFP data, and the gold price declined as predicted.

Check the previous blog : https://blog.forextrade1.co/what-will-happen-to-gold-as-per-todays-nfp-data-6-9-2024/

Check last given signal : https://t.me/calendarsignal/14943

Performance : https://t.me/calendarsignal/14969

WHERE TO CONTACT US

Website: https://forextrade1.co/

Twitter: www.twitter.com/forextrade11

Telegram: telegram.me/ftrade1

Facebook: www.facebook.com/Forextrade01

Instagram: www.instagram.com/forextrade1

YouTube: www.youtube.com/ForexTrade1

Skype: forextrade01@outlook.com

Email ID: info@forextrade1.com