The USD core durable goods data measures the change in the total value of new orders for durable goods, excluding transportation, defense, and aircraft. It reflects the underlying demand for consumer and investment goods and provides insights into the overall health of the economy.

Today’s given signal : https://t.me/calendarsignal/12421

Impact on Gold Prices

When the core durable goods data disappoints, it can have a significant influence on gold prices. This is because investors perceive the weak economic data as an indicator of economic weakness and potential inflation. As a result, they flock to gold as a hedge against potential economic uncertainties.

On the day of the bad USD core durable goods data release, the USD experienced a significant decline against the major currencies, including the euro and the Japanese yen. This decline was a result of investors selling USD and buying other currencies, such as the euro or yen, which were seen as more stable.

The bad USD core durable goods data on May 24, 2024, had a significant impact on the gold pair. It caused gold prices to rise significantly as investors sought a safe haven asset, and weakened the value of the USD. This report serves as a reminder of the interplay between economic indicators and prices of financial instruments, such as gold and the USD.

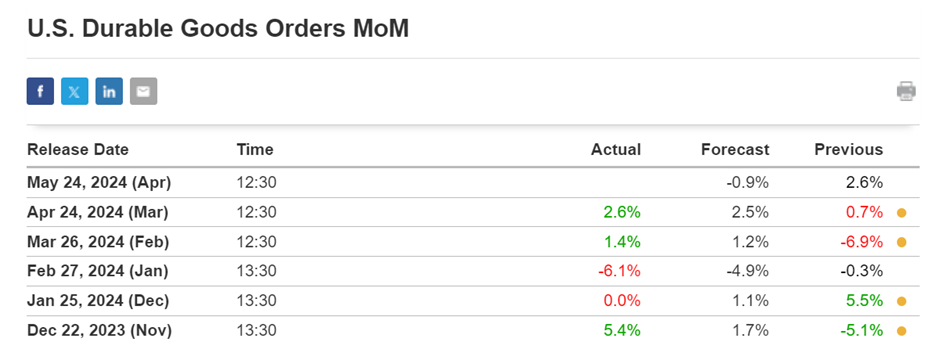

Previous released data results :

On last data (24-4-2024) we predict to SELL XAUUSD as for good Durable goods orders data, GOLD price was fall.

Check last given signal : https://t.me/calendarsignal/11677

Performance :