Today’s higher US (non-farm payrolls) data has significant implications for the gold pair. The NFP report measures the number of jobs added to the economy during the previous month and is an important indicator of the strength of the US economy. A higher NFP reading typically indicates stronger economic growth and, in turn, a stronger dollar.

Today’s given signal : https://t.me/calendarsignal/12828

Let’s examine the potential impact of today’s higher US (NFP) data on the gold pair on 6-6-2024:

1. Strengthening US Dollar: If the NFP data is better than expected, it could strengthen the dollar against the gold pair. Investors may perceive the US economy as more robust, leading to increased confidence in the US dollar and a decrease in gold demand. As a result, the gold price may decline relative to the dollar.

2. Increased Risk Appetite: A higher NFP reading can also indicate increased market risk appetite. Investors may view the data as a positive sign for the US economy and the broader market, leading to a decrease in demand for safe haven assets like gold. As a result, the gold price may decline in relative terms.

3. Market Volatility: Market volatility is a potential consequence of today’s higher US (NFP) data on the gold pair. Investors may react to the release by buying or selling gold, leading to fluctuations in the market. Therefore, traders should be prepared for heightened volatility in the gold pair during and immediately following the NFP release.

4. Long-Term Implications: While today’s higher US (NFP) data can impact the gold pair in the short term, its influence may vary over the long-term. Factors such as the Federal Reserve’s monetary policy decisions, geopolitical events, and economic indicators continue to shape the gold pair’s movements. Therefore, it is crucial to consider the broader market dynamics when analysing the potential impact of the NFP data on gold prices.

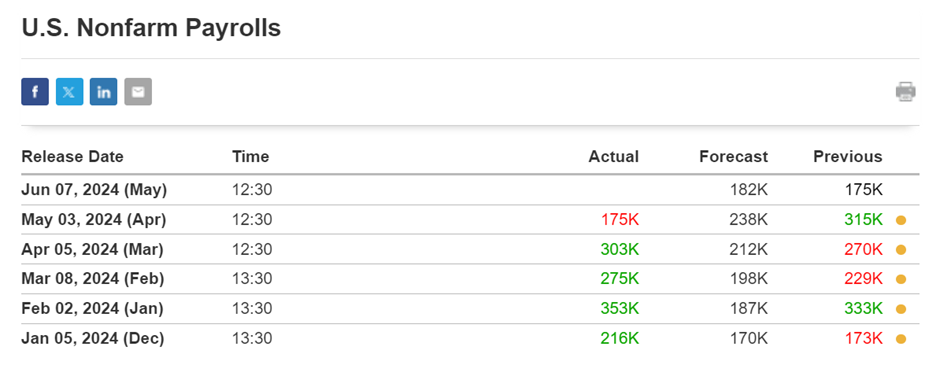

Previous released data results :

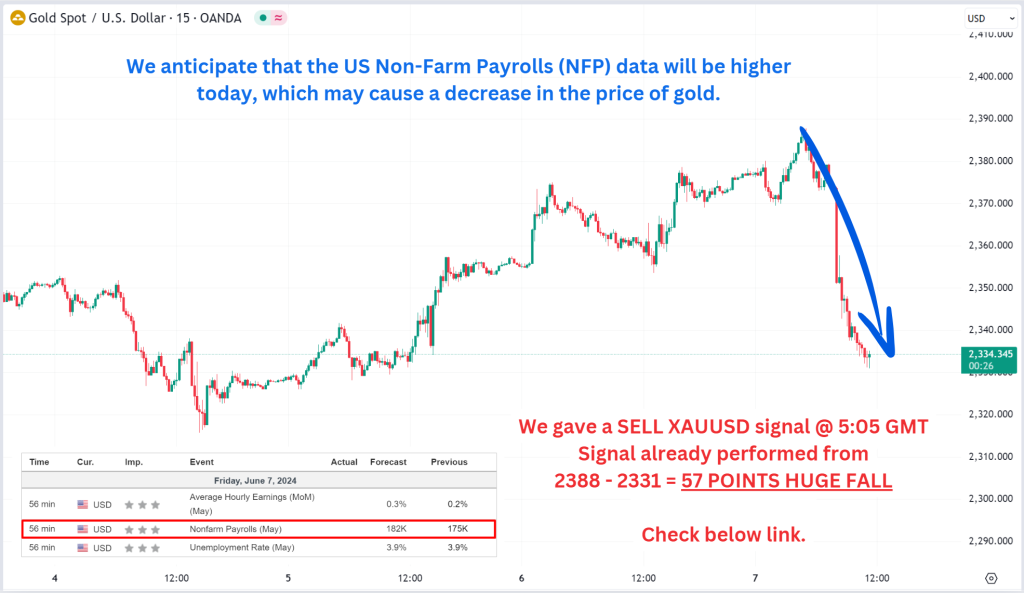

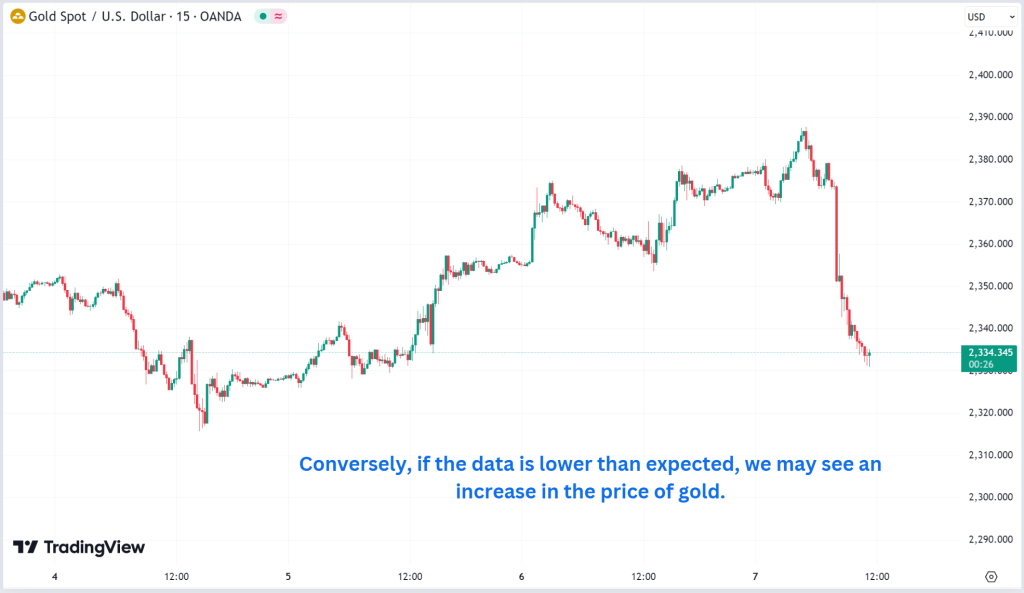

On last NFP data (3-5-2024) we predict to SELL XAUUSD as for higher NFP data, GOLD price was fall.

Check the previous blog : https://blog.forextrade1.co/analysis-based-on-us-non-farm-payrolls-data-3-5-2024/

Check last given signal : https://t.me/calendarsignal/11881

Performance :

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11