This document aims to explore the impact of US consumer confidence and the Chicago PMI on the gold pair, specifically on 30-4-2024. By analysing the correlation between these two economic indicators and the gold pair’s movement, we can gain insights into how the fluctuations in consumer confidence and the Chicago PMI can affect the price of gold.

Today’s given signal : https://t.me/calendarsignal/11787

Consumer Confidence

Consumer confidence is an important indicator of consumer sentiment and spending patterns. It reflects how optimistic or pessimistic consumers are about the economy and their personal financial situation. When consumer confidence is high, it suggests that consumers are more likely to make purchases and invest in assets such as gold. Conversely, when consumer confidence is low, it suggests that consumers may be more cautious with their spending, which could potentially impact the demand for gold.

Chicago PMI

The Chicago PMI, also known as the Chicago Business Barometer, is a monthly economic index that measures the overall health of the manufacturing sector in the Chicago region. It provides valuable insights into manufacturing activity, production levels, new orders, employment, supplier deliveries, and prices. A higher Chicago PMI suggests that manufacturing activity is strong and may lead to increased demand for gold, as investors consider gold a safe haven during times of economic uncertainty. Conversely, a lower Chicago PMI may indicate a slowdown in manufacturing activity, which could potentially lower the demand for gold.

Impact on GOLD

In conclusion, the impact of US consumer confidence and the Chicago PMI on the gold pair, specifically on 30-4-2024, can vary significantly. Consumer confidence is a significant indicator of consumer sentiment and spending patterns, while Chicago PMI provides insights into manufacturing activity. when consumer confidence is low and the Chicago PMI weakens, it suggests that demand for gold may be lower. However, it is crucial to consider other factors, such as geopolitical events and central bank policies, to gain a comprehensive understanding of the gold pair’s price movements.

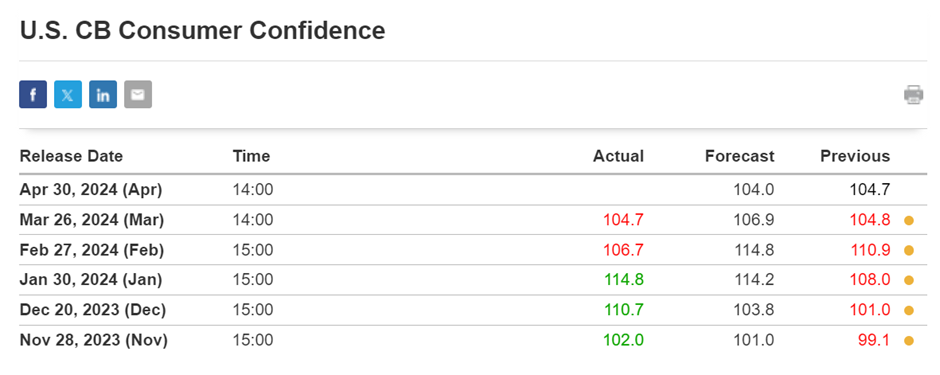

Previous released data results :

On last CB Consumer confidence data (26-3-2024) we predict to SELL XAUUSD as for good Data, XAUUSD price was fall.

Check last given signal : https://t.me/calendarsignal/11110

Performance :