The decision by the US to release higher-than-expected PPI (Producer Price Index) data on May 14th, 2024, has the potential to significantly impact the price movements of the XAUUSD currency pair. PPI measures the average change over time in the selling prices received by domestic producers for their goods and services. A higher PPI reading suggests inflationary pressures in the economy, which can lead to higher interest rates and a stronger US dollar. This document explores the potential implications of a higher PPI data on XAUUSD on that date.

Today’s given signal : https://t.me/calendarsignal/12096

Analysis of PPI Data

PPI data provides valuable insights into inflationary pressures and changes in production costs. When PPI rises, it indicates that producers are receiving higher prices for their goods and services, which can impact consumer prices and inflation. Higher PPI data can be a leading indicator of future inflation, as producers tend to pass on their increased costs to consumers.

Impact on XAUUSD

Higher PPI data can lead to several implications for XAUUSD, which is the gold-backed US dollar currency pair.

1. Interest Rate Impact: A higher PPI reading can lead to expectations of higher interest rates, as the Federal Reserve may tighten monetary policy to combat inflation. Higher interest rates can strengthen the dollar, making it more expensive for foreign investors to buy gold. As a result, the price of XAUUSD may decline.

2. US Dollar Strength: When the PPI data is higher than expected, the US dollar tends to appreciate against other currencies. This is because a higher PPI reading suggests that the US economy is performing well, which can attract more investment flows into the US dollar. As a result, XAUUSD may depreciate as the US dollar strengthens.

3. Investor Sentiment: Higher PPI data can have an impact on investor sentiment, both positively and negatively. Investors may perceive a higher PPI reading as an indication of stronger economic fundamentals, leading to increased confidence in the US dollar. This positive sentiment can push XAUUSD lower as investors sell their gold holdings in favor of the US dollar. Conversely, investors who are worried about inflation may see XAUUSD as a hedge against rising prices, leading to increased buying pressure and the price of the precious metal appreciating.

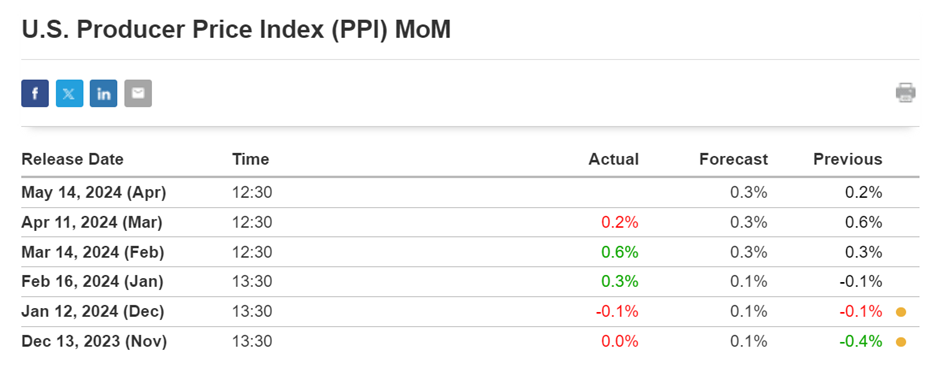

Previous released data results :

The release of higher-than-expected PPI data on May 14th, 2024, has the potential to significantly impact the XAUUSD currency pair. A higher PPI reading can lead to higher interest rates and a stronger US dollar, which can result in a decline in the price of gold. Investors should closely monitor PPI data and its potential impact on the XAUUSD price, as they may need to make adjustments to their investment strategies accordingly.