On 29th October 2024, the consumer confidence index released by the Conference Board (CB) and the job openings data released by the Job Openings and Labor Turnover Survey (JOLTS) are both expected to be favorable. These positive indicators could raise concerns about the demand and perception of gold prices. This document explores the potential impact of these favorable data on gold prices.

Today’s given signal : https://t.me/calendarsignal/15742

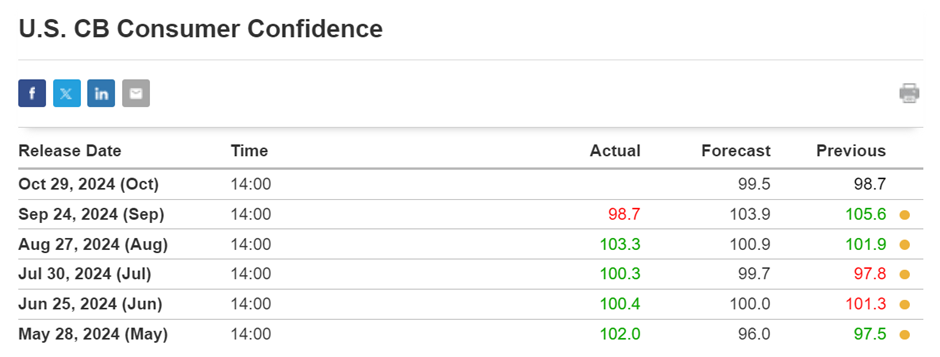

Positive Consumer Confidence

Consumer confidence plays a significant role in the overall economic health of a nation. When consumer confidence is high, it indicates that individuals are more likely to spend, invest, and make big-ticket purchases. A rise in the CB Consumer Confidence Index could indicate a positive economic outlook, which may lead to a decrease in gold prices. Investors may shift their focus away from gold as an inflation hedge and towards other investments that provide better returns.

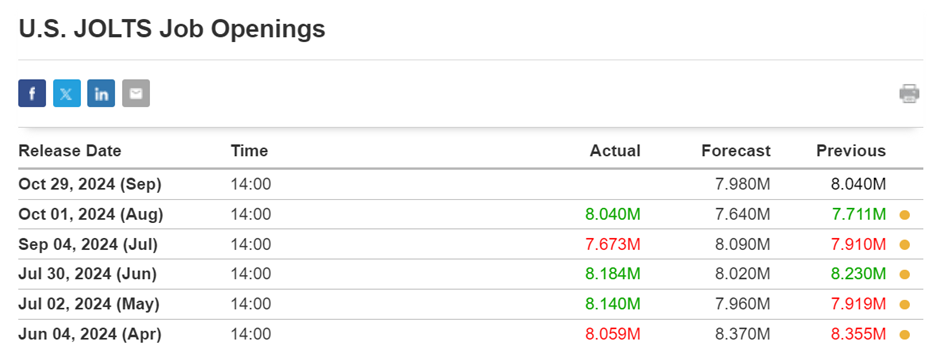

Good JOLTS Job Openings Data

The JOLTS Job Openings data provides a comprehensive picture of the job market. When the job openings data shows strong demand, it suggests that businesses are looking to hire more employees. This indicates economic stability and the potential for increased consumer spending. A positive JOLTS report could further decrease gold prices as investors are more willing to allocate their funds towards other investment options, such as stocks or bonds, that yield higher returns.

Impact on Gold Prices

The combination of good CB Consumer Confidence Index and good JOLTS Job Opening data could potentially lead to a decrease in the gold price. The positive indicators could indicate increased confidence in the economy, leading to a decline in the demand for gold as a safe-haven asset. Investors may perceive less of a need for gold as a hedge against inflation or a decline in the value of the dollar.

Furthermore, investors may shift their focus towards other assets that offer more potential returns. This could include stocks, bonds, or even cryptocurrencies. As investors reallocate their portfolios, gold prices may decline due to the decreased demand.

Previous released data results :

On last data (24-9-2024) we suggest to SELL XAUUSD as for good US Consumer Confidence data, & our prediction was right & GOLD price was fall.

Check last given signal : https://t.me/calendarsignal/15221

Performance : https://t.me/calendarsignal/15231

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11