On December 17, 2024, gold prices (XAUUSD) are set to rise following the Federal Reserve’s decision to cut interest rates and Fed Chair Jerome Powell’s dovish speech. The move signals a shift in monetary policy toward easing financial conditions in response to slowing inflation and economic uncertainties. This change significantly supports gold, as it thrives in a lower interest rate environment.

Today’s given signal : https://t.me/calendarsignal/16422

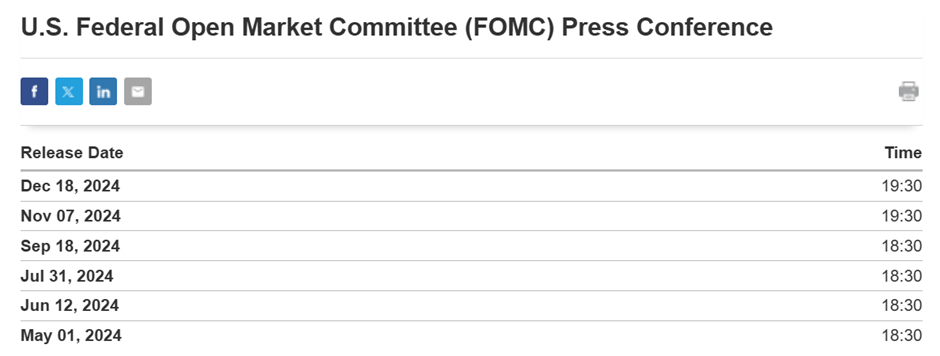

Fed Meeting Outlook – Wednesday, 19:00 GMT

Press Conference: 19:30 GMT

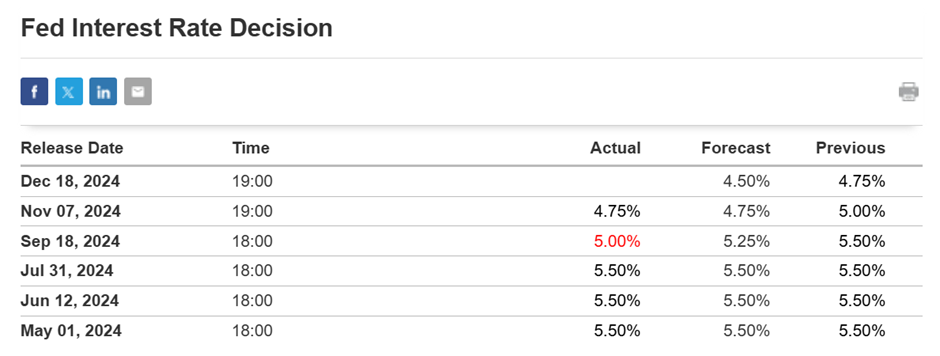

The Federal Reserve is expected to deliver its third consecutive rate cut, but investor focus shifts to 2025.

Key Focus: The Dot Plot

- What it shows: Forecasts for inflation, unemployment, growth, and interest rates.

- Expectation:

- A hawkish dot plot could signal a slower path for rate cuts in 2025.

- This would disappoint markets hoping for rapid easing of rates.

Mathematical Context for Impact

- Current Rate Expectations:

- Markets expect 3-4 cuts (0.25% each) in 2025 → Total 1.0% drop.

- Hawkish Scenario:

- Fed projects fewer cuts → Only 2-3 cuts in 2025 → Drop of 0.50% – 0.75%.

- Market Impact:

- DXY: Strengthens → Bullish USD.

- Gold (XAU/USD): Falls → Bearish due to higher borrowing costs.

- Dovish Scenario (if Powell calms markets):

- Fed assures rapid rate cuts if economic conditions worsen.

- Impact:

- DXY: Weakens → Bearish USD.

- Gold: Bullish momentum.

Powell’s Role

In the post-decision press conference, Chair Jerome Powell will attempt to strike a balanced tone:

- Acknowledging economic strength (hawkish).

- Offering reassurance to act swiftly if needed (dovish).

Summary

- Base Case: Hawkish dot plot → Slower rate cuts → Bullish USD, Bearish Gold.

- Press Conference: Powell may soften the hawkish tone to ease markets.

Mathematical Impact on Rates:

- Market expectation: 3-4 cuts = 1.0% drop.

- Hawkish projection: 2-3 cuts = 0.50% – 0.75% drop.

This meeting will have a significant impact on USD, Gold, and global markets.

Previous released data results :

On last rate cut decision Data (7-11-2024) we predicted higher rate cut data with less dovish statement by FED, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 38 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/powell-will-about-to-influence-gold-today-as-per-the-fomc-data-18-9-2024/

Check last given signal : https://t.me/calendarsignal/15889

Performance : https://t.me/calendarsignal/15901

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11