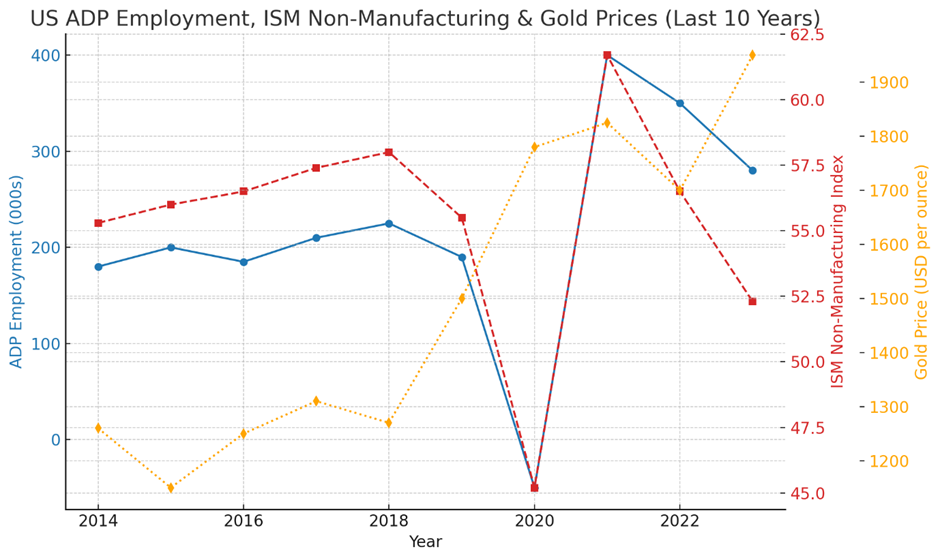

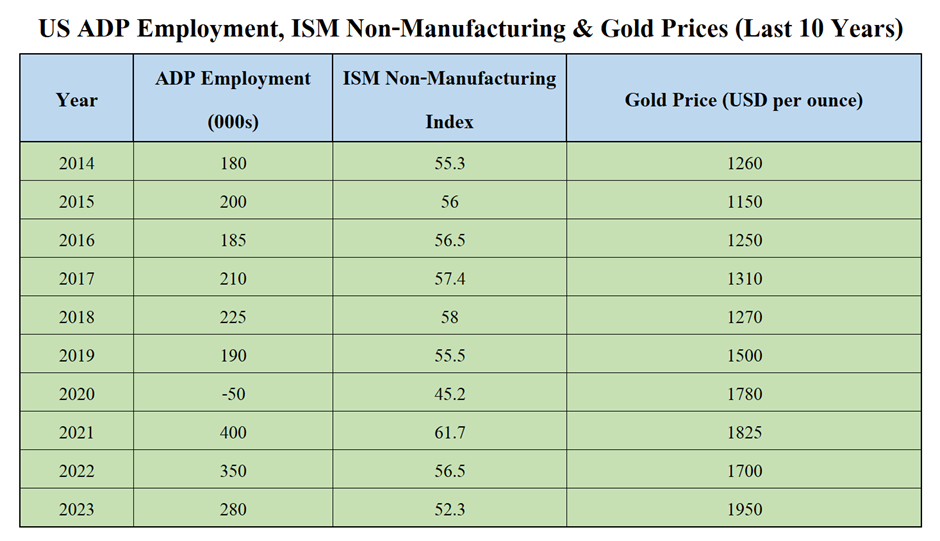

When the US ADP Employment Report and ISM Non-Manufacturing Index come in stronger than expected, it indicates job market strength and economic expansion. This increases expectations for higher interest rates, a stronger US dollar, and rising Treasury yields, which are bearish for gold prices.

Today’s given signal : https://t.me/calendarsignal/16875

Reasons Why Higher ADP & ISM Non-Manufacturing Data Lower Gold Prices

- Stronger Labor Market & Business Activity

- ADP Employment Growth shows that private businesses are hiring, indicating a healthy job market.

- ISM Non-Manufacturing Index above 50 signals expansion in the services sector, which contributes to overall GDP growth.

- Example: If ADP employment rises by 350K jobs and ISM Non-Manufacturing reaches 56.5, it reduces recession risks, lowering gold’s safe-haven appeal.

- Hawkish Federal Reserve Expectations

- Strong labor and services sector data allow the Federal Reserve to maintain or increase interest rates.

- Higher interest rates boost Treasury yields, making bonds more attractive than gold since gold does not yield interest.

- Stronger US Dollar Reduces Gold Demand

- A strong labor market and expanding services sector reinforce economic confidence, strengthening the US Dollar Index (DXY).

- A stronger USD makes gold more expensive for foreign investors, reducing its demand.

What Causes Strong ADP & ISM Non-Manufacturing Data?

✅ Factors Behind High ADP & ISM Data:

- Business Expansion: Companies hire more employees due to rising consumer demand.

- Government Spending: Infrastructure projects and stimulus programs drive hiring and services growth.

- Strong Corporate Earnings: Higher business profits lead to increased investment and hiring.

❌ Factors That Can Weaken ADP & ISM Data:

- High Inflation & Interest Rates: Businesses cut hiring and expansion.

- Recession Fears: Companies slow down hiring due to economic uncertainty.

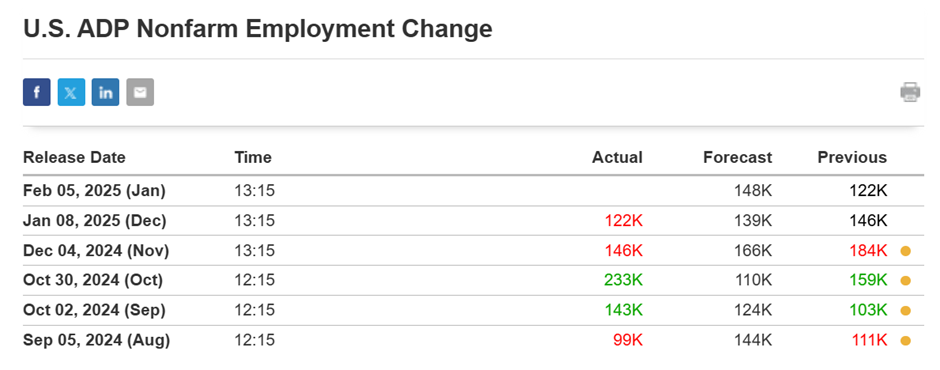

Previous released data results :

On last ADP data (8-1-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 36 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/analysis-based-on-todays-us-economic-events-8-1-2025/

Check last given signal :https://t.me/calendarsignal/16515

Performance : https://t.me/calendarsignal/16530

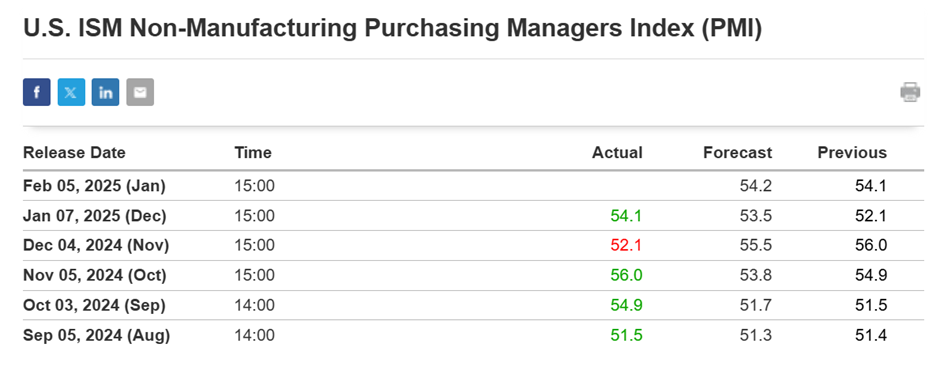

On last Non ISM Manufacturing data (7-1-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 27 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/forecasting-gold-trends-in-based-on-us-non-ism-manufacturing-jolts-job-opening-data-7-1-2025/

Check last given signal : https://t.me/calendarsignal/16501

Performance : https://t.me/calendarsignal/16511

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11