The GOOD US PPI data and FED POWELL’s hawkish speech on 14th November 2024 had significant impacts on the gold pair. The PPI data demonstrated rising inflationary pressures, leading to increased expectations of rate hikes by the Federal Reserve. POWELL’s hawkish remarks reinforced the central bank’s commitment to combating inflation and hinted at a more aggressive tightening monetary policy.

Today’s given signal : https://t.me/calendarsignal/15979

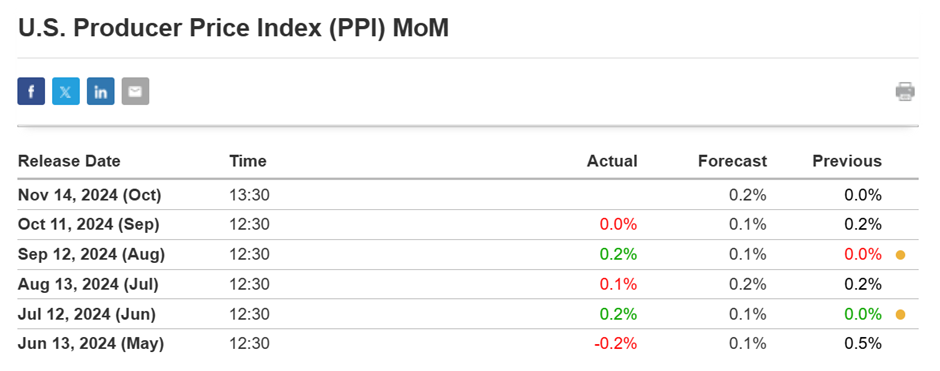

US PPI Data

On 14th November 2024, the PPI (Producer Price Index) data released by the US Census Bureau showed positive results. The PPI measures the average change over time in the selling prices received by domestic producers for their goods and services. It serves as a measure of inflationary pressures.

The GOOD US PPI data indicated that inflationary pressures in the domestic economy were increasing. This increase was driven by rising production costs and input prices. As a result, market participants interpreted the data as a sign that the Federal Reserve would need to tighten monetary policy to combat rising inflation.

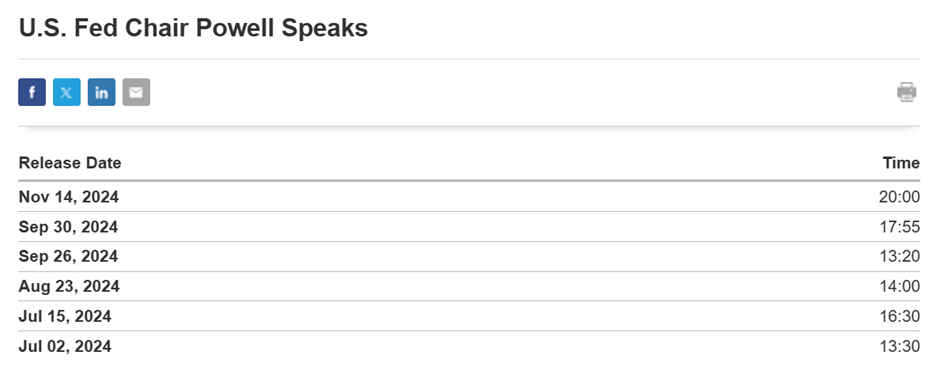

FED POWELL Hawkish Speech

On the same day as the GOOD US PPI data release, FED POWELL gave a speech that further strengthened market expectations of rate hikes. Powell highlighted the central bank’s commitment to maintaining price stability and ensuring that inflation remained under control.

In his hawkish remarks, Powell emphasized the need for the Federal Reserve to continue raising interest rates. He stated that the central bank was committed to using its tools to bring inflation back down to target levels. This hawkish stance from Powell sent shockwaves through the markets and intensified bets on future rate hikes.

Impact on GOLD Pair

The GOOD US PPI data and FED POWELL’s hawkish speech had a significant impact on the GOLD pair. The inflationary pressures indicated by the PPI data increased investor concerns about the potential devaluation of the US dollar. As the US dollar typically weakens in the face of higher inflation, the GOLD pair rallied.

The bullish momentum in the GOLD pair was fueled by the expectation that the Federal Reserve would need to tighten monetary policy to combat rising inflation. Higher interest rates tend to increase the cost of holding non-yielding assets such as gold, making it less attractive compared to higher-yielding assets. Therefore, investors sought refuge in gold, perceiving it as a potential hedge against inflation.

Previous released data results :

On last PPI data (11-10-2024) we predict higher data, & as per that we suggest to SELL XAUUSD & as a result, our prediction was right, so we made a profit of 25 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/15511

Performance : https://t.me/calendarsignal/15523

On last speech of Fed powell (30-9-2024) we predict the hawkish speech, & as per that we suggest to SELL XAUUSD & as a result, our prediction was right, so we made a profit of 37 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/15318

Performance : https://t.me/calendarsignal/15334

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11