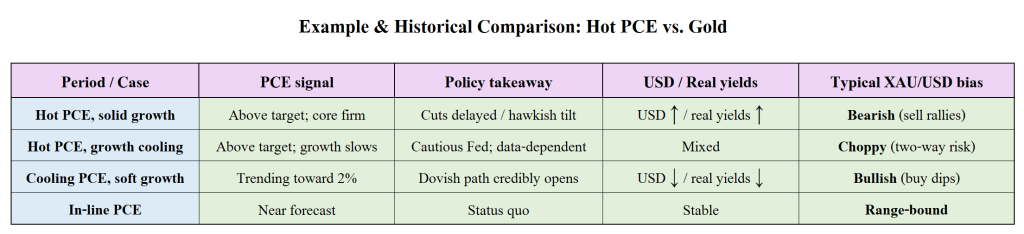

A hotter-than-expected US PCE Price Index (the Fed’s preferred inflation gauge) lifts the US dollar and real Treasury yields, raising the opportunity cost of holding gold. That typically pushes XAU/USD lower unless offset by a dovish shift from the Fed or a risk-off shock.

Today’s given signal : https://t.me/calendarsignal/20607

Why today’s PCE came in higher (key drivers)

- Sticky services inflation: Shelter, medical, insurance, education, and other services continue to rise faster than goods prices.

- Energy & transport pass-through: Recent fuel and freight costs filtered into broader prices.

- Wage pressure: A still-firm labor market keeps unit labor costs elevated, supporting higher services prices.

- Resilient demand: Consumers continue to spend (especially on experiences), letting firms pass on costs.

- Tariff/inputs effects: Import duties and dearer inputs (parts, logistics) nudge wholesale costs higher, which show up in PCE over time.

- Base effects: Comparatively soft prints a year ago can mechanically boost the YoY rate.

The US dollar also tends to firm after a hot PCE, as investors price tighter policy and relatively higher returns on US assets. Since gold is priced in dollars, USD strength makes gold more expensive for non-USD buyers, adding another headwind to XAU/USD. Unless there is a risk-off shock (geopolitical escalation, credit stress, or a sudden growth scare) that revives safe-haven demand, the path of least resistance in the short run is usually lower for gold.

Technically, traders will watch whether support zones (e.g., prior swing lows and 50/100-day moving averages) hold on the first test. If they fail, momentum systems can accelerate the slide. Conversely, intraday dips can attract tactical buyers—especially if bond auctions go poorly, equities wobble, or Fed speakers strike a softer tone. In such cases, gold may stabilize in a range as the market waits for the next labor or inflation print (NFP, CPI, next PCE).

In the medium term, the interplay between inflation and growth will dominate. If inflation remains sticky while growth cools (stagflation risk), gold’s reaction can be two-way: higher real yields are bearish, but recession fears can re-ignite safe-haven bids. If both inflation and growth ease in tandem, the Fed gains cover to cut, lowering real yields and supporting a gold rebound. For now, with PCE running hot, the bias tilts to sell rallies unless data soften or Fed guidance turns meaningfully dovish.

How higher PCE hits gold (the transmission)

- Higher real yields → gold down: Stronger PCE reduces odds of near-term cuts, lifting real yields; non-yielding gold loses relative appeal.

- Stronger USD → XAU/USD down: A hotter PCE supports the dollar via tighter policy expectations.

- Risk appetite steadies: Less need for safe havens when growth/inflation look firm (unless growth slows sharply).

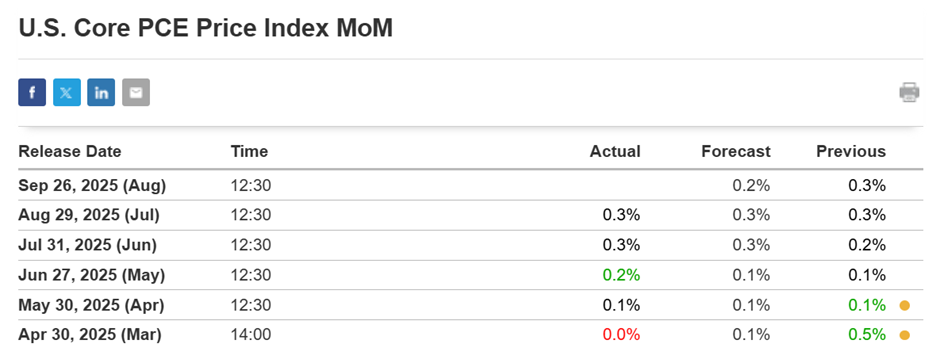

Previous released data results :

On last PCE data (29-8-2025) we predicted high PCE data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 24 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/the-role-of-gdp-pce-on-xau-usd-price-movements-today-28-8-2025/

Check last given signal : https://t.me/calendarsignal/20173

Performance : https://t.me/calendarsignal/20182

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11