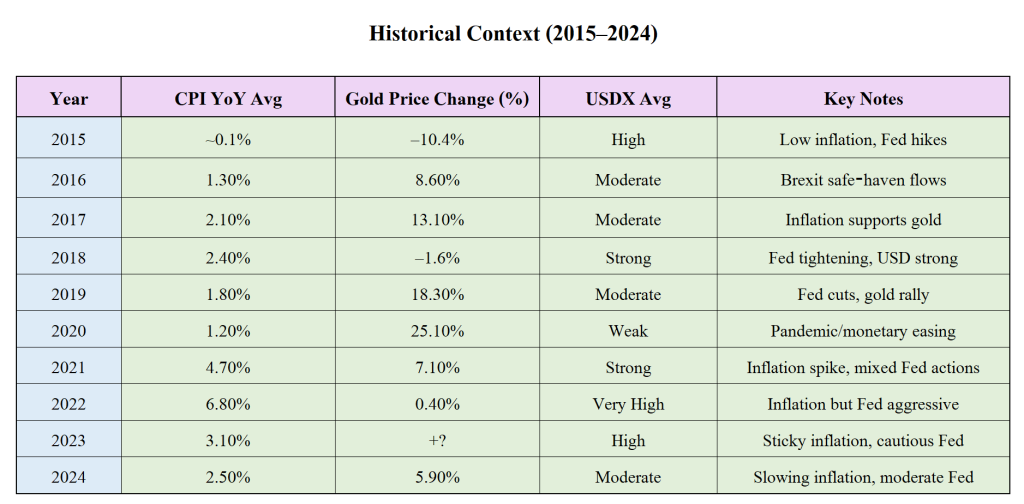

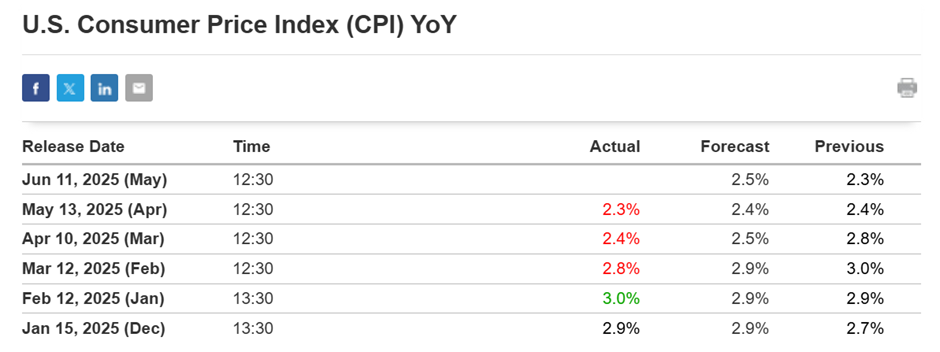

On June 11, 2025, the U.S. Consumer Price Index (CPI) report was released with higher‑than‑expected inflation, signalling a concerning rise in prices.

Today’s given signal : https://t.me/calendarsignal/18976

Key Data Highlights & Themes

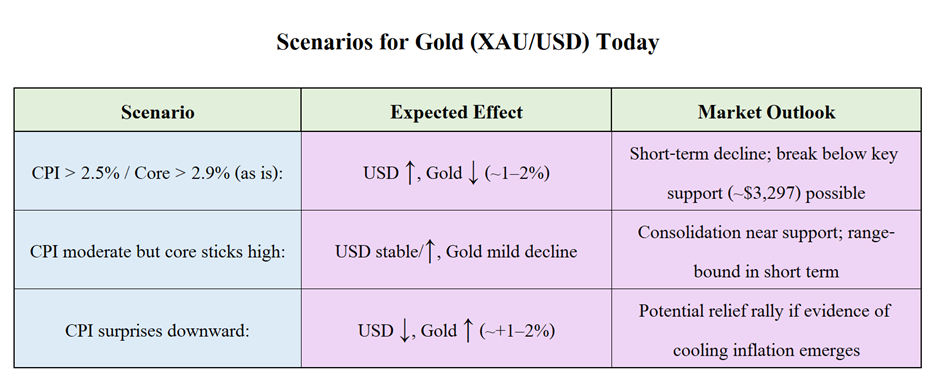

- Headline CPI jumped by +2.5% YoY in May, up from 2.3%, reversing several months of decline

- Core CPI (excluding food and energy) rose to +2.9%, the highest in four months.

- Analysts attribute the rise to tariff-induced price increases, particularly in consumer goods and services.

- Some suggest the increase may be temporarily magnified by base-year effects, not underlying demand pressures.

Why This Is “Bad” for Gold (XAU/USD)

- Fed Rate Hike Pressure

- Elevated CPI reduces near-term chances of rate cuts; might even prompt rate hikes, making gold less attractive compared to yield-bearing assets.

- Stronger U.S. Dollar

- Rising interest-rate expectations generally strengthen the USD, which typically pushes gold prices lower.

- Cost of Holding Gold Rises

- Gold’s appeal diminishes when real yields turn positive: inflation up and rates higher means higher opportunity cost.

What New Traders Should Know

- CPI is a key macro event: it directly influences Fed policy expectations and the USD/gold relationship.

- Core CPI matters most: the Fed treats this as its preferred inflation indicator.

- Trade tariffs are working: tariff pressures are now filtering through consumer prices.

- Expect volatility: sharp CPI moves often cause strong, swift swings in gold price—traders should use stop-loss and risk limits.

Today’s stronger CPI data signals inflation persistence—bad news for gold. Expect downward pressure on gold prices (~1–2%) if markets confirm Fed stays hawkish. Traders should watch for follow-up statements (Fed speakers, tariffs) and use well-defined risk management strategies amid heightened volatility.

Previous released data results :

On last CPI data (13-5-2025) we predicted higher data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 102 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/gold-moves-on-inflation-news-what-cpi-means-for-xau-usd-today-13-5-2025/

Check last given signal : https://t.me/calendarsignal/18456

Performance : https://t.me/calendarsignal/18476

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11