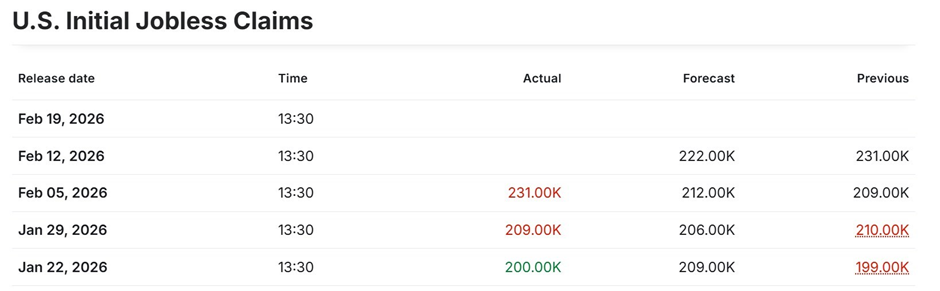

Markets are awaiting the US Initial Jobless Claims release at 13:30 GMT. As per our 12th February 2026 forecast, we expect lower jobless claims, reinforcing labor market resilience. Simultaneously, March Fed no-rate-cut probabilities have jumped from 80% to 95%, signaling that markets are increasingly confident the Federal Reserve will keep rates unchanged.

Today’s given signal : https://t.me/calendarsignal/23588

Reasons Behind Our Prediction

1️⃣ Strong Labor Market Indicators

Recent employment components, including steady payroll trends and stable unemployment levels, suggest companies are not aggressively cutting jobs. This supports lower weekly claims.

2️⃣ Sticky Inflation & Fed Communication

Recent Fed commentary emphasizes caution on premature easing. With inflation risks lingering, policymakers prefer maintaining restrictive policy.

3️⃣ Rising Treasury Yields

Bond markets are pricing out March cuts, pushing yields higher. Higher yields reduce gold’s attractiveness as a non-yielding asset.

4️⃣ Dollar Momentum

The surge in no-cut probability (80% → 95%) strengthens USD demand, adding downside pressure on XAUUSD.

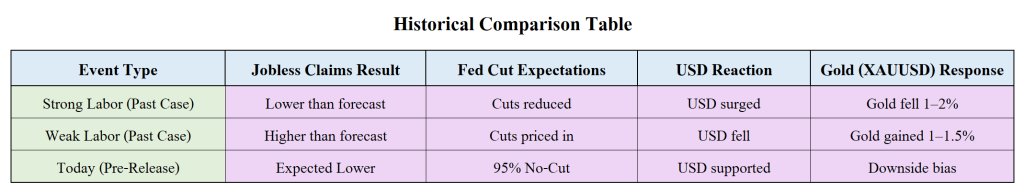

Scenario Analysis for Gold (Pre-Release Outlook)

🔹 Scenario 1: Claims Come Lower Than Expected (Base Case)

- USD strengthens further

- Yields extend gains

- Rate cut expectations remain near zero

Impact on XAUUSD:

Gold may decline toward key support zones.

Example:

If XAUUSD trades at $2025 before 13:30 GMT and claims print significantly lower, gold could fall intraday as dollar buying accelerates.

🔹 Scenario 2: Claims Surprise Higher

- USD weakens

- Yields soften

- Markets slightly reprice rate-cut odds

Impact on XAUUSD:

Short-covering rally possible.

Previous released data results :

On last US Initial Jobless claims data (5-2-2026) we predicted bad data, & as per that we suggest to BUY XAUUSD & as a result, we made a profit of 409 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/23436

Performance : https://t.me/calendarsignal/23468

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11