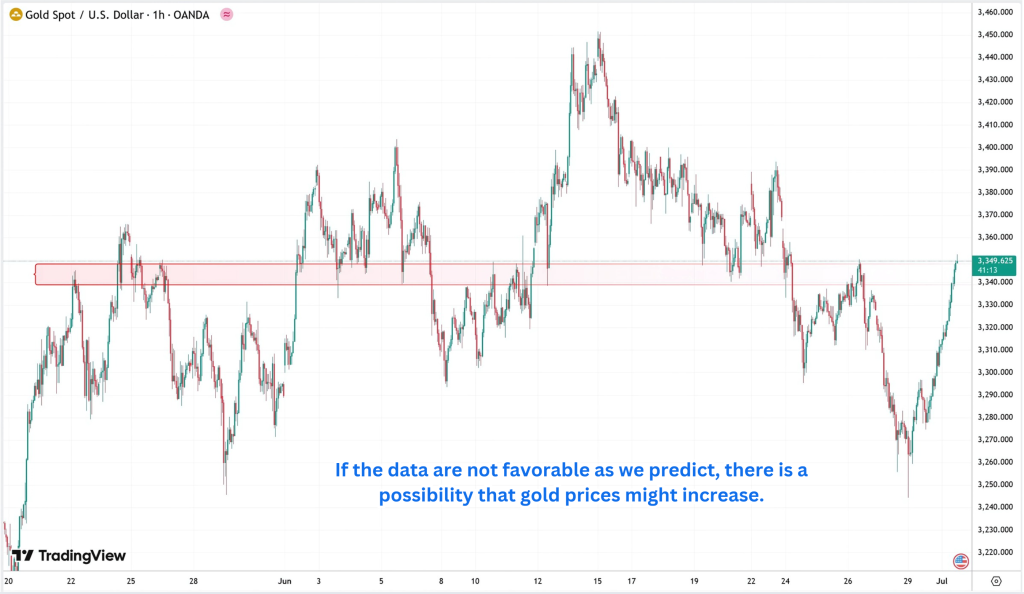

On 1st July 2025, gold prices are under pressure due to three key developments: stronger-than-expected U.S. ISM Manufacturing PMI data, a rise in JOLTS Job Openings, and a hawkish speech from Federal Reserve Chair Jerome Powell. These elements collectively reinforce expectations of a resilient U.S. economy and delay the prospects of monetary easing — both bearish signals for gold.

Today’s given signal : https://t.me/calendarsignal/19295

Reasons Behind Today’s Data:

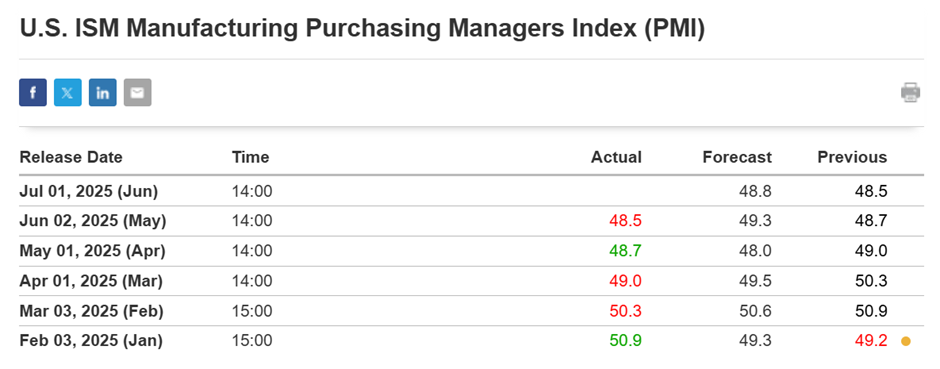

- Good ISM Manufacturing Data:

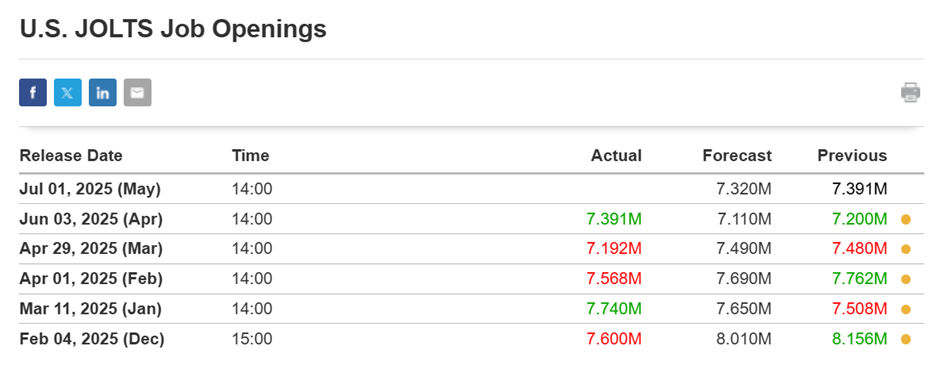

The ISM Manufacturing PMI showed a surprising rebound to 52.4, marking expansion in the sector for the first time in months. It suggests increased industrial activity and business confidence, pointing to economic resilience. - Higher JOLTS Job Openings:

Job openings exceeded expectations, rising to 9.5 million. This indicates sustained demand for labor, highlighting a tight labor market and reinforcing wage growth potential — a contributor to inflationary pressure. - Powell’s Hawkish Speech:

Powell reiterated the Fed’s commitment to maintaining higher interest rates until inflation moves sustainably toward the 2% target. He downplayed the probability of near-term rate cuts, citing continued economic strength and sticky services inflation.

Impact on Gold (XAU/USD):

Gold tends to move inversely to interest rates and the U.S. dollar. Strong economic data and hawkish Fed guidance typically strengthen the dollar and Treasury yields, reducing gold’s appeal since it pays no interest.

Today’s events suggest:

- Outflows from Gold ETFs: As yield-bearing assets become more attractive, investment flows often exit gold, adding to the downside pressure.

- Reduced Safe-Haven Demand: Strong labor and manufacturing data suggest less economic uncertainty.

- Stronger Dollar & Higher Yields: Powell’s tone supports continued restrictive monetary policy, which strengthens the USD and increases real yields, pressuring gold.

Previous released data results :

On last ISM data (2-6-2025) we predicted bad data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 63 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/how-junes-ism-manufacturing-figures-are-shaping-gold-movements-2-6-2025/

Check last given signal : https://t.me/calendarsignal/18809

Performance : https://t.me/calendarsignal/18828

On last JOLTS Job opening data (3-6-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 107 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/18831

Performance : https://t.me/calendarsignal/18856

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11