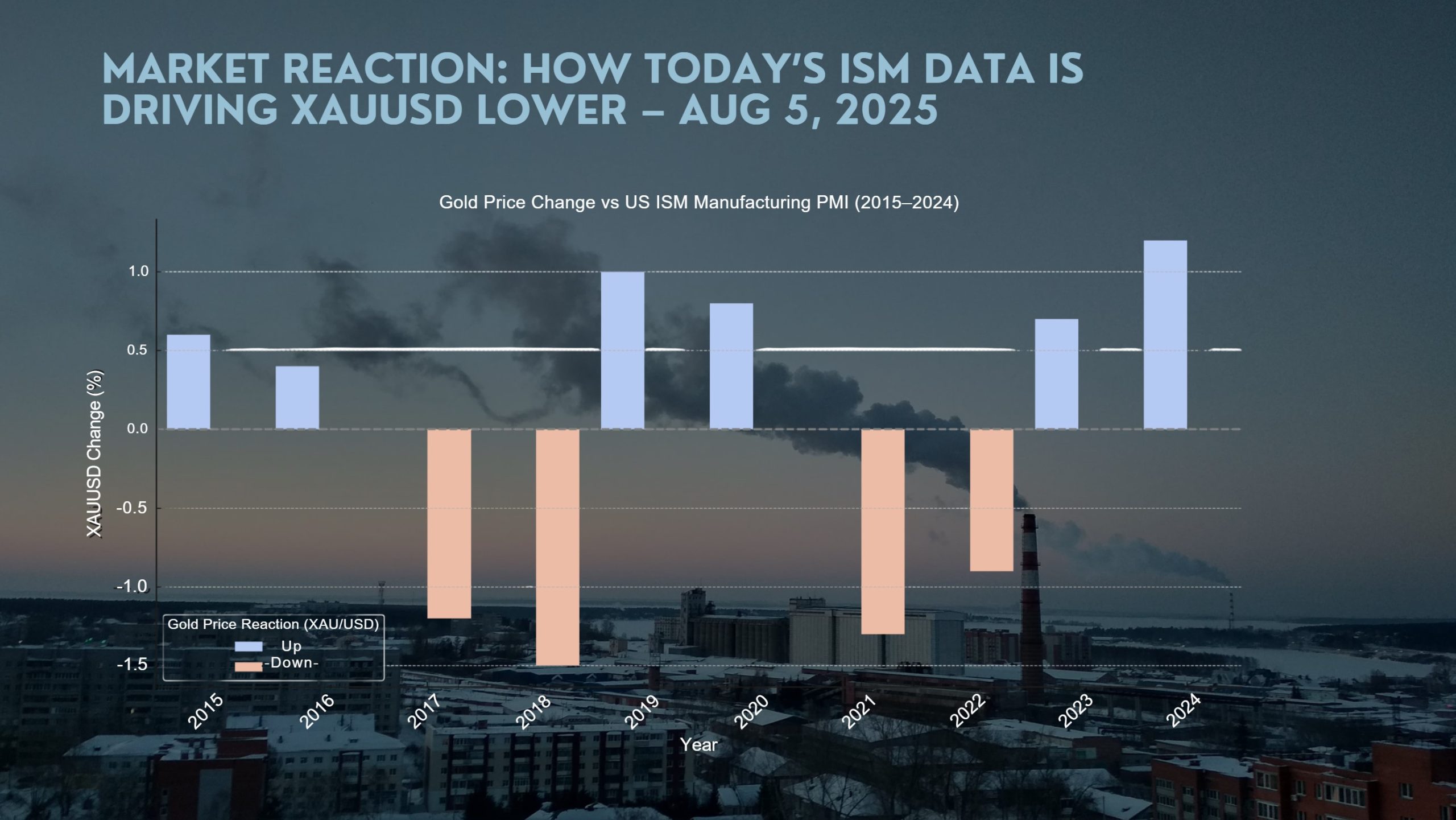

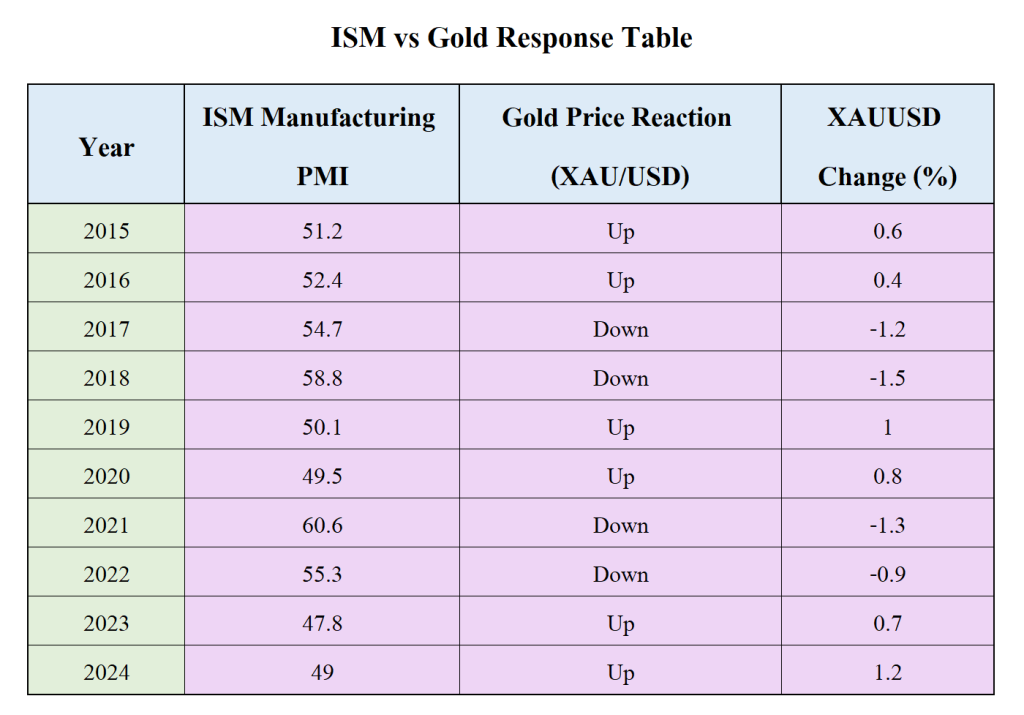

Today’s robust ISM data is a clear signal of U.S. economic strength. As markets price in fewer Fed rate cuts or even potential hikes, gold is likely to see reduced demand. Traders and investors should expect short-term price pressure, especially if upcoming labor and inflation data align with today’s narrative. Risk management around key support levels is essential for gold traders in the current macro environment.

Today’s given signal : https://t.me/calendarsignal/19820

Reasons Behind Today’s Good US ISM Data:

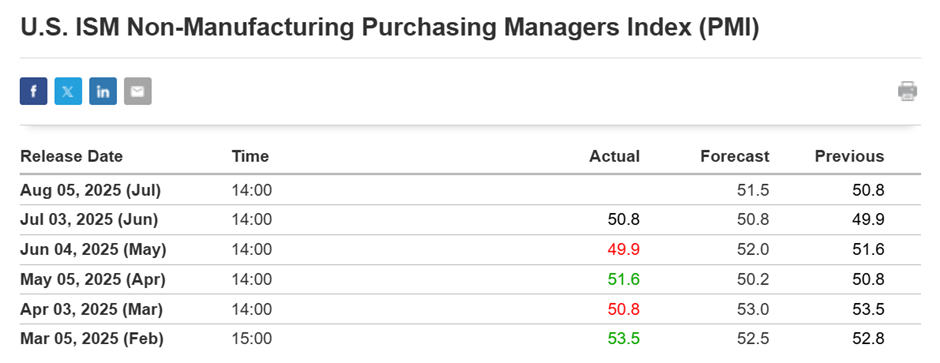

The Institute for Supply Management (ISM) Manufacturing PMI data released today (August 5, 2025) indicates stronger-than-expected expansion in the manufacturing sector. The index rose to 54.8, beating forecasts of 52.3, and showing robust demand, increasing new orders, and stable employment. This suggests the U.S. economy continues to show resilience despite previous concerns about a slowdown.

Key contributors to the strong ISM data include:

- Increased consumer demand for durable goods.

- Stabilizing energy prices, improving industrial input cost efficiency.

- Improved export orders, possibly due to a relatively weaker USD in prior months.

- Resilient labor market, supporting manufacturing productivity.

These elements indicate that the U.S. economy is gaining strength, which in turn supports the case for maintaining or increasing interest rates.

Impact on Gold (XAUUSD):

Gold, as a non-yielding asset, typically performs better in low interest rate or uncertain economic environments. When U.S. economic data is strong, it often leads to:

- Stronger U.S. dollar (USDX).

- Higher bond yields.

- Reduced demand for safe-haven assets like gold.

The good ISM data today sent clear signals to investors that the Fed may continue its hawkish stance or at least delay any dovish pivot. This anticipation of higher-for-longer interest rates results in:

- Capital outflows from gold ETFs.

- Increased short positions in futures.

- Price pullbacks across major gold spot and derivative contracts.

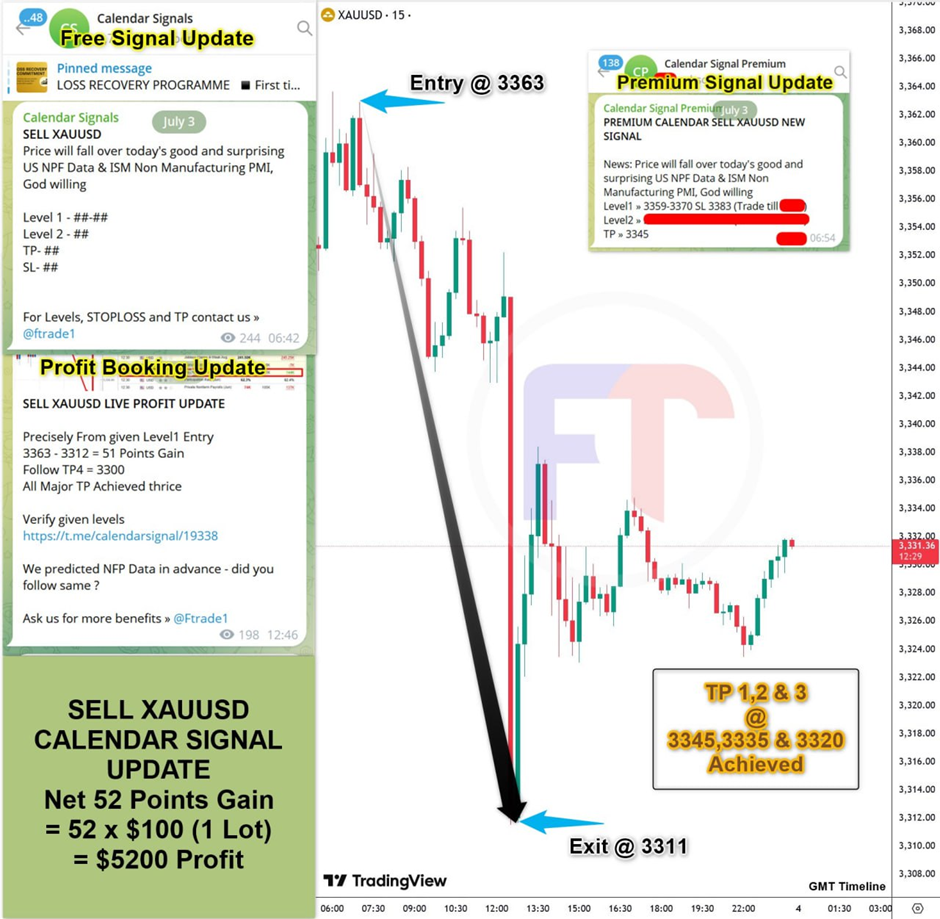

Previous released data results :

On last ISM Manufacturing Purchasing Managers Index data (3-7-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 52 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/19335

Performance : https://t.me/calendarsignal/19348

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11