U.S. Jobs Growth Slows: Cooling Labor Market

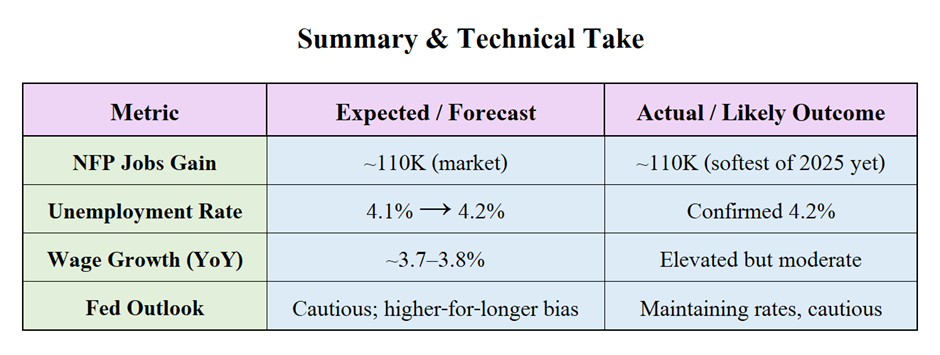

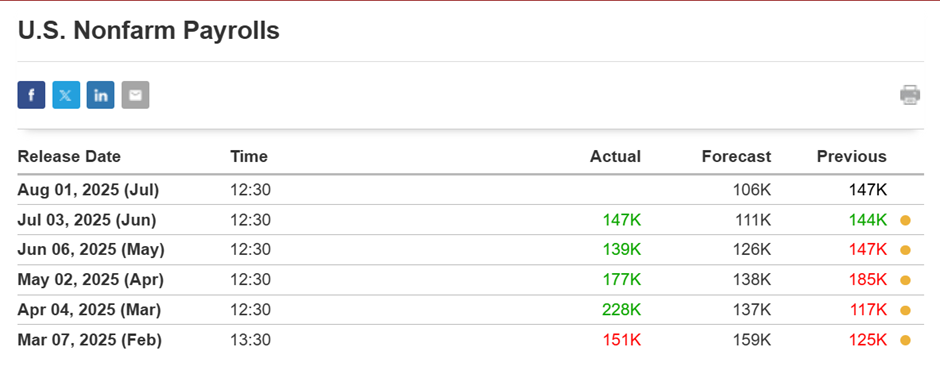

- July added ~110K nonfarm jobs, down considerably from June’s 147K, marking the weakest monthly gain of the year.

- The unemployment rate ticked up to 4.2%, from 4.1% in June, signaling a modest loosening of labor conditions.

- Private-sector strength showed through with ADP reporting 104K new jobs, surpassing its own expectations.

Today’s given signal : https://t.me/calendarsignal/19762

🔍 What It Means: Fed Policy, Inflation & Markets

Federal Reserve’s Tightrope

- With labor-softening signs but inflation still sticky—as core PCE came in higher at 2.8% YoY—the Fed remains in “wait‑and‑see” mode.

- Chair Powell has repeatedly emphasized that the unemployment rate is the primary metric guiding policy decisions.

- Rate cuts in September now appear less likely—a slowdown, yes, but not enough pain to compel easing.

Inflation Pressures Remain

- The core PCE reading of 2.8% is signaling that inflationary momentum hasn’t broken—despite tariff-driven price rises being only a small contributor.

That keeps the Fed on guard—any premature move could undermine its fight against long-term inflation.

⚖️ Market Reactions & Potential Scenarios

💵 U.S. Dollar & Bond Yields

- The USD strengthened this week, hitting fresh highs as tariff fears and hawkish Fed expectations weighed on sentiment.

- A weaker job print but still-resilient wage growth may still support the dollar; a sharper-than-expected slowdown could stabilize or weaken it modestly.

📉 Equities & Risk Assets

- Mixed signals in labor data and inflation continue to shake risk appetite. Broader equity indexes dipped while tech giants like Microsoft and Meta rallied in contrast.

- A stronger-than-anticipated job report (above 140K) might have triggered a USD rally, but the current moderation likely keeps indices range-bound.

If July’s job growth stays modest with a rising unemployment rate, markets may interpret it as a soft landing: enough slowdown for cooling, but not enough for a full-blown reversal.

Still-solid wage trends and sticky inflation data, however, limit immediate easing expectations. The Fed remains data-driven, not politically influenced.

Bottom Line: Fed Still in Charge

Today’s NFP data supports the view of a cooling U.S. labor market but not a broken one. Inflation remains sticky, and wage growth steady—giving Powell the cover to delay rate cuts further. Markets are likely to remain jittery until both inflation and jobs show sustained weakening, potentially pushing Fed action into late 2025.

Previous released data results :

On last NFP data (3-7-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 52 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/gold-reacts-to-us-nfp-report-july-3-2025-market-insights/

Check last given signal : https://t.me/calendarsignal/19335

Performance : https://t.me/calendarsignal/19348

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11