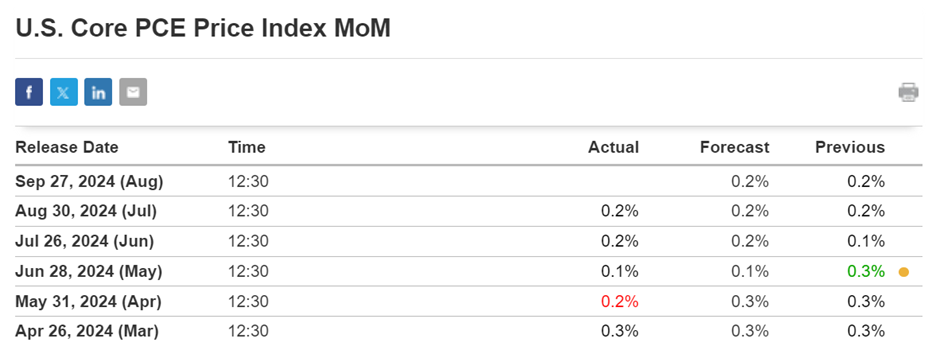

On September 27, 2024, higher-than-expected U.S. Core PCE (Personal Consumption Expenditures) data, coupled with a reduced probability of a 50 basis points (bps) rate cut in November (from 62% to 50%), would likely have the following effects on gold prices and market expectations.

Today’s given signal : https://t.me/calendarsignal/15289

Personal income increased $75.1 billion (0.3 percent at a monthly rate) in July, according to estimates released today by the U.S. Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $54.8 billion (0.3 percent) and personal consumption expenditures (PCE) increased $103.8 billion (0.5 percent).

The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.2 percent. Real DPI increased 0.1 percent in July and real PCE increased 0.4 percent; goods increased 0.7 percent and services increased 0.2 percent.

1. Higher PCE Data:

The Core PCE is the Federal Reserve’s preferred measure of inflation. Higher-than-expected PCE data suggests that inflation remains elevated, which increases the likelihood that the Fed will maintain or even hike rates, rather than cut them as previously anticipated. This scenario strengthens the U.S. dollar and raises bond yields, reducing the demand for non-yielding assets like gold.

2. Reduced Probability of November Rate Cut:

The market had been pricing in a 62% chance of a 50 bps rate cut in November, but this has now dropped to 50% due to the elevated inflation signals from the PCE data. A reduced chance of rate cuts implies tighter monetary conditions for longer, which supports a stronger dollar and higher yields on interest-bearing assets, further diminishing the appeal of gold. When rate cuts are expected, gold tends to rally, but if those cuts are delayed or reduced, gold’s attractiveness fades.

Impact on Gold Prices:

- Bearish Outlook: Both higher inflation and the decreased likelihood of rate cuts contribute to a bearish outlook for gold. The combination of higher PCE data and reduced rate cut expectations will likely push gold prices lower as investors move toward assets that benefit from higher interest rates, such as U.S. Treasuries and the dollar.

- Stronger Dollar: A stronger U.S. dollar, bolstered by the expectation of fewer rate cuts, would put additional pressure on gold prices, as a stronger dollar makes gold more expensive for foreign investors, decreasing demand.

Overall, these developments create a challenging environment for gold, leading to a potential decline in prices in the short term.

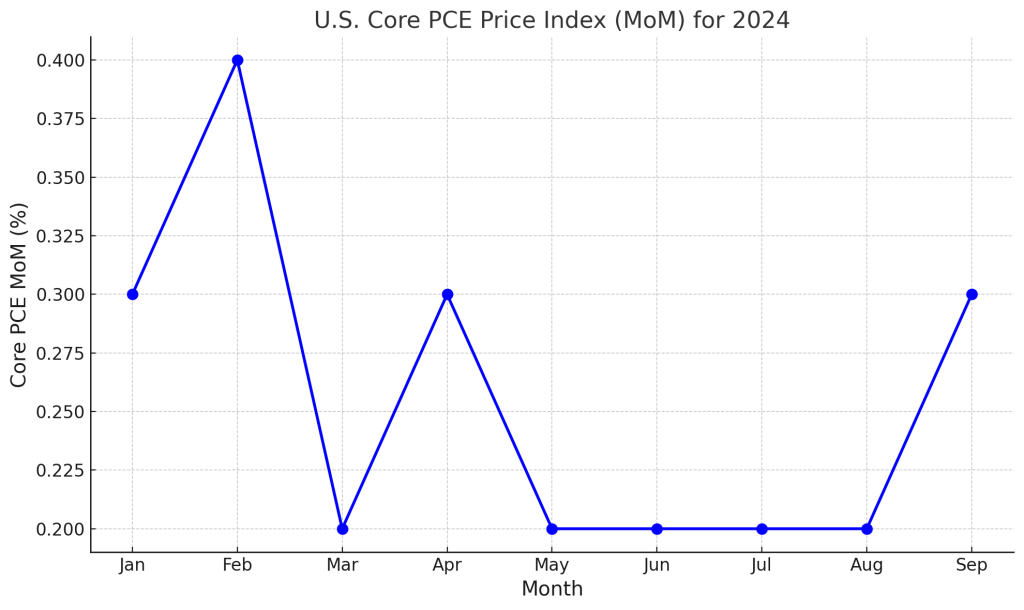

Previous released data results :

Following the August 30, 2024 PCE data, we recommended selling XAUUSD due to high inflation and an anticipated rate cut in September. Our prediction was correct, as gold prices fell.

Check the previous blog : https://blog.forextrade1.co/factors-influencing-gold-prices-todays-us-pce-data-and-expectation-of-big-rate-cut-in-sep/

Check last given signal : https://t.me/calendarsignal/14812

Performance : https://t.me/calendarsignal/14843

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11