On 18th September 2024, the Federal Reserve (FED) announced a 25bps rate cut, which will have implications on the forex market and gold price. A rate cut is a reduction in a key interest rate, usually the central bank’s benchmark interest rate, which can have both positive and negative effects on various markets. Let’s examine the potential impact of this rate cut on the forex market and gold price.

The Fed’s Balancing Act

The unsettled predictions are a reflection of the difficult decision Fed policymakers face.

The Fed is preparing to begin reversing the campaign of interest rate hikes it started in March 2022 to subdue a spike in inflation. Between March 2022 and July 2023, the Fed raised its benchmark interest rate from near zero to a range of 5.25% to 5.5%, the highest level since 2001.

The hikes were an effort to push up borrowing costs on mortgages, credit cards, car loans and other debt in an effort to discourage borrowing and spending—and in turn, cool down an economy central bankers saw as overheating.

Since then, the inflation rate has fallen from its highest level in more than 40 years and is now nearing the Fed’s annual goal of 2%. At the same time, the Fed’s high interest rates have slowed the economy nearly to the point where the unemployment rate could rise too high for comfort. The Fed’s mission, set by Congress, is to keep interest rates low enough to prevent mass layoffs but high enough to keep a lid on inflation.

Several key reports on the state of inflation and the labor market have sent mixed signals about whether inflation or unemployment poses the greatest threat to the economy’s health. That’s given ammunition to people who argue for the Fed to take a cautious approach and cut rates slowly, as well as to those who contend that fast and furious rate cuts are needed.

Impact on FOREX Market:

The forex market is globally interconnected, and changes in interest rates can influence the movement of currencies. When interest rates fall, it becomes more attractive to lend money, leading to an increase in demand for the currency of a country with lower interest rates. In this case, the FED’s 25bps rate cut is likely to impact the forex market in several ways:

1. Increased Demand for US Dollar: The rate cut suggests that the FED wants to stimulate economic growth, which can make the US dollar a more attractive investment compared to currencies with higher interest rate levels. As a result, the demand for the US dollar may increase, causing its value to rise against other currencies.

2. Decreased Demand for High-Interest Yielding Currencies: Conversely, the rate cut may lead to a decrease in the demand for currencies that offer higher interest yields. Investors may shift their funds towards currencies with lower interest rates, as they can generate higher returns. This could negatively impact the value of currencies with higher interest levels, especially those of countries with higher interest rates than the US.

3. Uncertainty and Volatility: Rate cut announcements often cause uncertainty and volatility in the forex market as investors try to understand the potential implications. This can result in sharp price swings and changes in exchange rate trends. Traders and investors may engage in arbitrage activities, buying and selling currencies to capitalize on price fluctuations.

Gold Price Forecast: 18th September 2024

As market sentiment remains optimistic, the likelihood of a FED interest rate cut over 50bps has gained significant attention. This heightened anticipation has resulted in an overbought condition within the gold market, suggesting that a downward correction could be imminent.

Based on the technical analysis and recent developments, it is likely that the price of gold will fall today, specifically from its current high level. The target range for this decline is expected to be between 2540 and 2520.

Investors should consider these factors when deciding whether to buy or sell gold. It is important to note that the price fluctuations of gold can be highly volatile and are influenced by various external factors. Therefore, before making any investment decisions, it is advisable to conduct thorough research and analysis.

In conclusion, the price of gold is expected to fall today, specifically within the range of 2540 to 2520. Investors should closely monitor market conditions and consider the factors influencing the price of gold before executing any trades.

2024 Committee Members

- Jerome H. Powell, Board of Governors, Chair

- John C. Williams, New York, Vice Chair

- Thomas I. Barkin, Richmond

- Michael S. Barr, Board of Governors

- Raphael W. Bostic, Atlanta

- Michelle W. Bowman, Board of Governors

- Lisa D. Cook, Board of Governors

- Mary C. Daly, San Francisco

- Beth M. Hammack, Cleveland

- Philip N. Jefferson, Board of Governors

- Adriana D. Kugler, Board of Governors

- Christopher J. Waller, Board of Governors

Alternate Members

- Susan M. Collins, Boston

- Austan D. Goolsbee, Chicago

- Alberto G. Musalem, St. Louis

- Jeffrey R. Schmid, Kansas City

- Sushmita Shukla, First Vice President, New York

What Lies Ahead

In the end, the most consequential decision Fed officials make this week may not be whether to go for a 50- or 25-basis-point cut but the message they send their future plans.

The Fed’s policy announcement on Wednesday is set to include quarterly economic and interest rate projections by FOMC members. Kearney-Lederman said she would be keeping a close eye on those to better understand how fast interest rates could fall in the coming months.

“The magnitude and the timing of future rate cuts is really what we’re all starting to question now because we know the time is now to ease,” she said. “That, I think, is going to be a much bigger focus for the meeting.”

According to the CME’s FedWatch tool, the market is pricing in about a 65% chance that the Fed will slice at least 125 basis points from the benchmark rate by the end of the year. That means the market expects the Fed will carry out 50-basis-point cuts at two of the remaining three policy meetings in 2024.

verify our blog with our 3 year FOMC signal performance

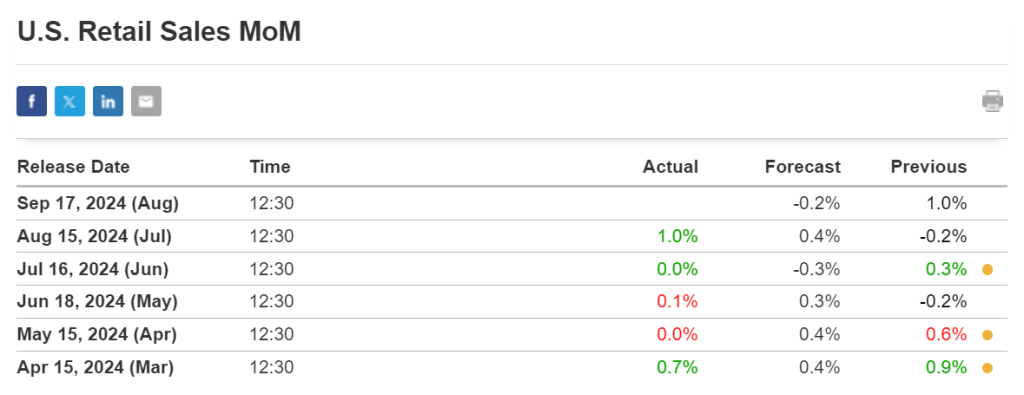

Previous released data results :

On last FOMC DICISION data (31-8-2024) we predict to BUY XAUUSD as for Powell dovish speech and predicted to September rate cut, GOLD price was raised.

Check the previous blog : https://blog.forextrade1.co/fomc-insights-key-takeaways-from-the-latest-fed-rate-cut-announcement-for-gold/

Check last given signal : https://t.me/calendarsignal/14136

Performance : https://t.me/calendarsignal/14162