Gold, one of the most valuable and sought-after commodities, is influenced by various factors. One aspect that can have a significant impact on the price of gold is the release of economic data from the United States. Specifically, the good US S&P Global Service and Jobless Claim data can have significant effects on the price of gold on 22nd August 2024.

Today’s given signal : https://t.me/calendarsignal/14627

Relationship between S&P Global Service PMI and GOLD

The S&P Global Service PMI and the gold market have a complex relationship. On one hand, positive developments in the service sector such as increased business activity, job creation, and improved supplier delivery times can be supportive of gold prices. This is because a stronger economy often leads to higher demand for gold, as investors seek a safe haven during times of economic uncertainty.

Conversely, when the service sector experiences contraction or weak growth, gold prices may decline. This is because a weak economy can dampen investor sentiment, leading to reduced demand for gold as a store of value. Additionally, a higher unemployment rate can weigh on gold prices as investors prioritize more stable assets during times of economic instability.

Impact of Good US S&P Global Service and Jobless Claim Data on GOLD

On 22nd August 2024, if the S&P Global Service PMI shows strong expansion and the jobless claims report indicates a decrease in claims, it can have a positive impact on gold prices. Investors may perceive these data as positive signals for the economy, increasing their confidence in the market and leading to increased gold demand.

Conversely, if the S&P Global Service PMI shows contraction or the jobless claims report indicates an increase, it can have a negative impact. Investors may view these data as signs of economic weakness, leading to reduced gold demand as investors seek more stable assets.

It is important to note that the impact of good US S&P Global Service and Jobless Claim data on gold prices is highly dependent on the overall market conditions and investor sentiment. Other factors such as geopolitical tensions, central bank policies, and broader economic indicators can also influence gold prices.

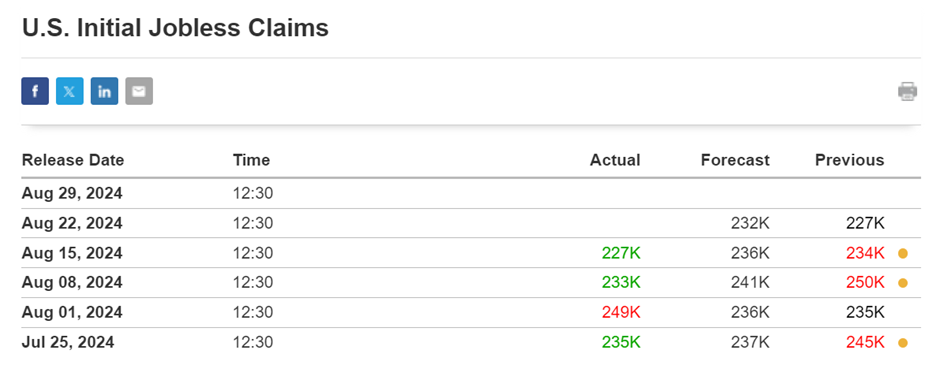

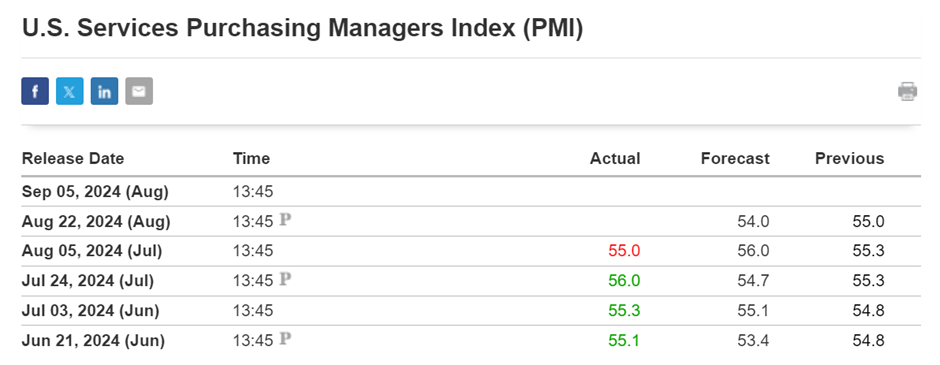

Previous released data results :

On last S&P Global Service PMI data (5-8-2024) we predict to SELL XAUUSD as for good Data, GOLD price was raised.

Check the previous blog : https://blog.forextrade1.co/impact-on-gold-pair-based-on-us-sp-global-services-pmi-and-ism-non-manufacturing-prices-today/

Check last given signal : https://t.me/calendarsignal/14253

Performance : https://t.me/calendarsignal/14279

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11