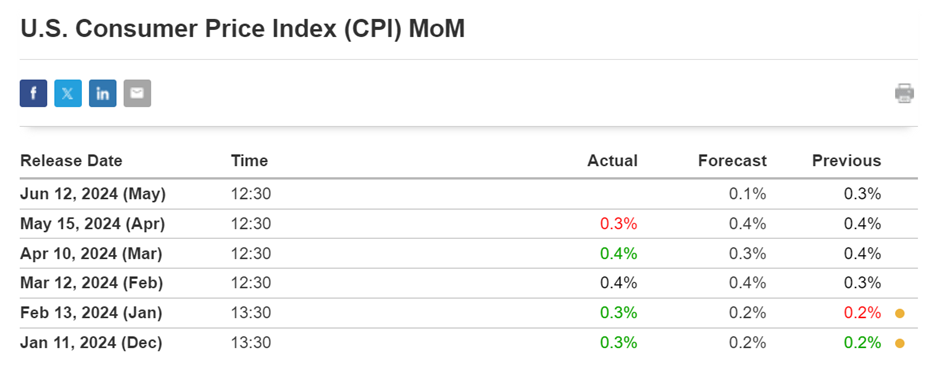

On 12th June 2024, the United States Consumer Price Index (CPI) decreased, while the Federal Reserve made a statement expressing dovish sentiment. These developments had a significant impact on gold prices, which are traditionally sensitive to changes in inflation and monetary policy. This document will explore the factors that led to these changes and the resulting impact on gold.

Today’s given signal : https://t.me/calendarsignal/12942

The simultaneous occurrence of a lower US Consumer Price Index and a dovish Federal Reserve statement had a profound impact on gold prices. As investors sought safe haven assets during times of economic uncertainty, gold gained significant value. The precious metal is often considered a hedge against inflation and a safe haven during times of market volatility.

The decline in the CPI raised concerns about future inflation and the potential for further monetary tightening. This, in turn, increased the appeal of gold as a store of value, as it has historically performed well during periods of high inflation.

Moreover, the Federal Reserve’s dovish statement reassured investors that the central bank was not inclined to raise interest rates, which could have a negative impact on gold prices. lower interest rates tend to support gold prices by reducing opportunity costs and increasing the appeal of non-yielding assets.

As a result, gold prices surged on 12th June 2024, as investors sought protection and stability amidst the decline in the CPI and the Federal Reserve’s dovish stance. The precious metal continued to gain value in the following days, reflecting the market’s perception of these events.

The simultaneous occurrence of a lower US Consumer Price Index and a dovish Federal Reserve statement had a significant impact on gold prices. The decline in the CPI raised concerns about inflation, while the Federal Reserve’s dovish stance reassured investors about the central bank’s commitment to maintaining low interest rates. These factors combined to drive up gold prices, as investors sought safe haven assets amidst economic uncertainty. Moving forward, any further developments in these areas will continue to impact gold prices, making it an important asset to consider for investors seeking diversification and protection against market volatility.

Previous released data results :

On last CPI data (15-5-2024) we predict to BUY XAUUSD as for weak CPI Data, GOLD price was raised.

Check the previous blog : https://blog.forextrade1.co/gold-is-going-to-impact-as-per-the-us-cpi-data-15-5-2024/

Check last given signal : https://t.me/calendarsignal/12132

Performance :