On 13th November 2024, the markets are expected to see a lower US Consumer Price Index (CPI) data and a dovish FED statement, which have the potential to drive the gold price higher. The combination of these two factors is expected to generate a bullish sentiment among investors, leading to a potential increase in gold prices.

Today’s given signal : https://t.me/calendarsignal/15961

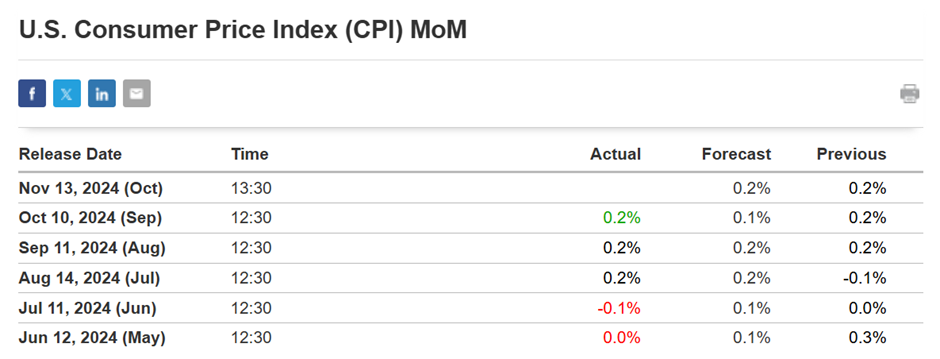

Lower US CPI Data

One of the key factors that could impact the gold price today is the release of a lower US CPI data. Inflation has been a closely watched metric by investors because it can influence monetary policy decisions. A lower CPI reading suggests that inflationary pressures may be easing, which may lead to expectations of lower interest rates.

Dovish FED Statement

Another factor that is likely to influence the gold price is the FED’s statement. A dovish FED statement, referring to a central bank’s intention to maintain low interest rates, can support gold prices. When interest rates are low, the value of gold tends to increase because it offers a higher yield compared to other assets. Investors may view a dovish FED statement as a sign that interest rates may remain accommodative, which can drive demand for gold as a store of value.

Impact on Gold Price

The combination of a lower US CPI data and a dovish FED statement creates an environment where investors may shift their attention away from other assets and seek safe havens, such as gold. Gold has historically performed well during periods of economic uncertainty and market volatility. The lower CPI data may lead investors to believe that inflationary pressures subsiding, which can support gold’s status as a store of value.

Furthermore, a dovish FED statement may signal a shift in monetary policy, which can also boost gold prices. Investors may interpret a dovish statement as a signal that the FED is willing to maintain low interest rates for longer, creating an environment of lower yields and weaker demand for bonds. In this case, gold may become an attractive alternative investment, as it is seen as a hedge against inflation and a potential hedge against future currency devaluation.

Previous released data results :

On last CPI data (10-10-2024) we predict lower data, & as per that we suggest to BUY XAUUSD & as a result, we made a profit of 41 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/15492

Performance : https://t.me/calendarsignal/15507

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11