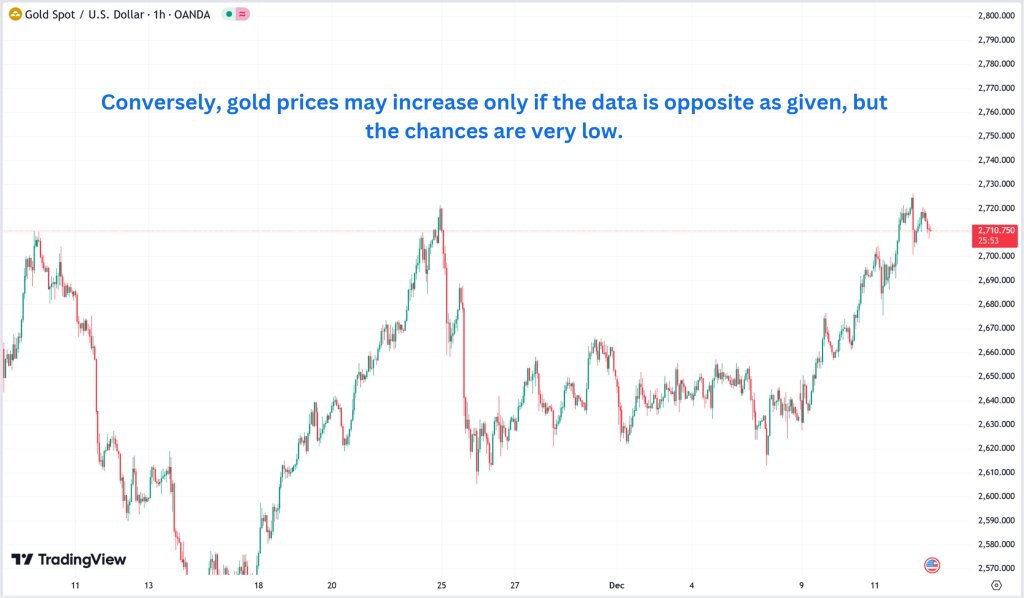

Today’s lower-than-expected jobless claims and higher Producer Price Index (PPI) figures have exerted bearish pressure on XAU/USD (gold prices). Lower jobless claims signal a stronger labor market, which often leads to expectations of tighter monetary policy, supporting the U.S. dollar. Simultaneously, higher PPI numbers indicate rising inflationary pressures, which can also strengthen the dollar as investors seek safer, dollar-denominated assets, reducing gold’s appeal.

Today’s given signal : https://t.me/calendarsignal/16347

The combination of these factors typically leads to a stronger dollar index (DXY), negatively impacting gold prices due to their inverse relationship. However, ongoing market speculation about future Federal Reserve rate cuts might provide some support to gold in the medium term, as rate cuts generally weaken the dollar and boost demand for the precious metal.

For XAU/USD traders, it is crucial to monitor further economic indicators and Federal Reserve communications for additional market direction.

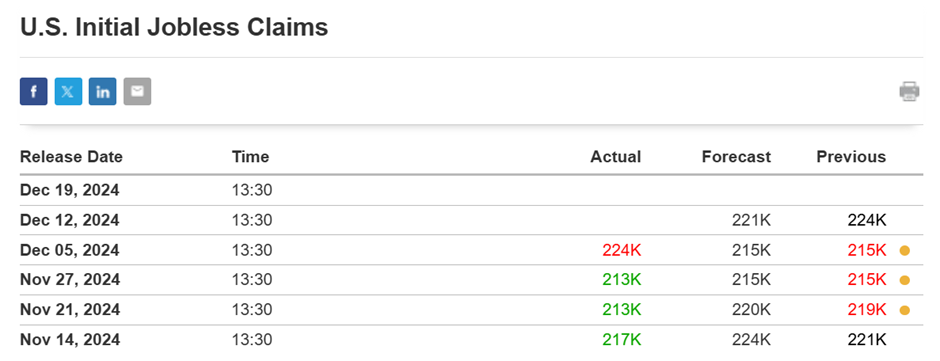

Jobless Claims: <227K, indicating labor market strength.

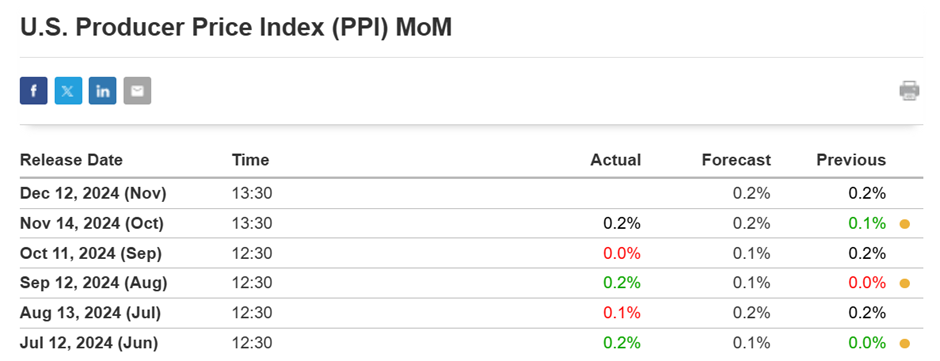

PPI Growth: >0.2%, signaling inflation pressures.

XAU/USD Impact: Bearish as the USD strengthens due to tighter monetary expectations and reduced gold demand

Combined Effect on XAU/USD:

- Short-Term Outlook: The combined effect of both factors could be a balancing act. While lower jobless claims might reduce demand for gold as a safe haven, higher PPI could lead to inflation concerns, pushing gold higher as a hedge. However, if the market interprets the combination of both as a signal that the Fed might tighten rates, that could strengthen the US dollar and pressurize gold prices.

- Sentiment: The overall market sentiment and expectations about future Federal Reserve actions will likely dictate the direction of XAU/USD. If the market expects more rate hikes in response to inflation concerns from higher PPI, it could be negative for gold. Conversely, if inflationary fears dominate, it could be supportive for gold prices.

Overall, the impact on XAU/USD will depend on how these economic indicators are interpreted in the context of broader monetary policy expectations and investor sentiment.

Previous released data results :

On last Jobless claims Data (5-12-2024) we predicted higher data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 50 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/16248

Performance : https://t.me/calendarsignal/16261

On last PPI Data (14-11-2024) we predicted good data, & as per that we suggest to BUY XAUUSD & as a result, we made a profit of 14 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/15979

Performance : https://t.me/calendarsignal/15989

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11