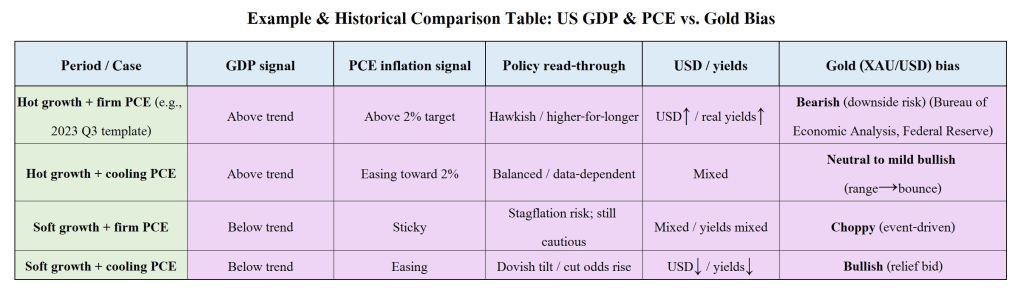

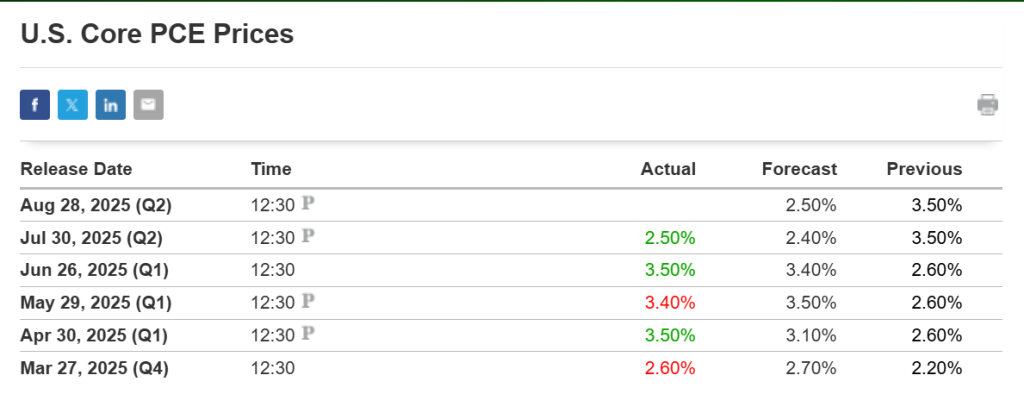

What “good” means here: stronger-than-expected GDP (firmer growth) and firm/higher PCE inflation (the Fed’s preferred gauge). Together they raise the odds of higher-for-longer rates, lifting the USD and real Treasury yields—conditions that usually pressure gold.

Today’s given signal : https://t.me/calendarsignal/20154

Why today’s GDP & PCE could look “good”

- Resilient consumption: real spending and services demand hold up, keeping growth firm. (BEA’s GDP reports routinely show consumption as the key driver.)

- Business investment & inventories: capex/inventory rebuilds add to topline GDP.

- Sticky services inflation: PCE stays above the 2% target, led by shelter, healthcare, and other services—exactly what the Fed watches.

- Tariff pass-through: recent tariff effects have fed into PCE prints, keeping inflation firm.

How that hits gold (mechanism)

- Rates & real yields up → opportunity cost of gold up. Gold has long shown an inverse link to real yields.

- USD up on growth + sticky inflation → XAU/USD down. The USD typically benefits when the Fed’s path is more hawkish.

- Risk appetite improves: strong growth reduces safe-haven demand for gold.

3 scenarios for XAU/USD (near term)

- Dovish twist (bounce risk): GDP fine but core PCE eases → USDX softer, yields slip, XAU/USD rebounds as rate-cut odds edge back in.

- Hawkish surprise (most bearish for gold): GDP beats and PCE re-accelerates → USDX up, real yields up, XAU/USD −1% to −2%, watching supports near recent swing lows.

- Mixed data (range): GDP solid but PCE in-line → sideways to mildly lower as markets wait for the next labor/inflation print.

Concrete example (playbook)

When growth ran hot in 2023 Q3 (GDP +4.9% annualized) while inflation was still above target, yields rose and the USD stayed firm—classic headwinds for gold. The underlying logic is the same: solid activity + sticky inflation → tighter (or not-easing) policy → pressure on XAU/USD.

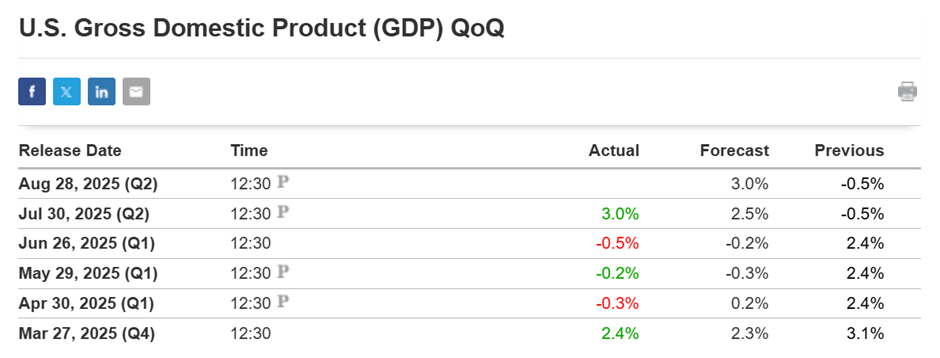

Previous released data results :

On last GDP data (30-7-2025) we predicted bad data, & as per that we suggest to BUY XAUUSD & as a result, we made a profit of 72 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/gold-price-outlook-amid-us-adp-gdp-data-fed-pressure-and-trumps-influence-30th-july-2025/

Check last given signal : https://t.me/calendarsignal/19713

Performance : https://t.me/calendarsignal/19737

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11