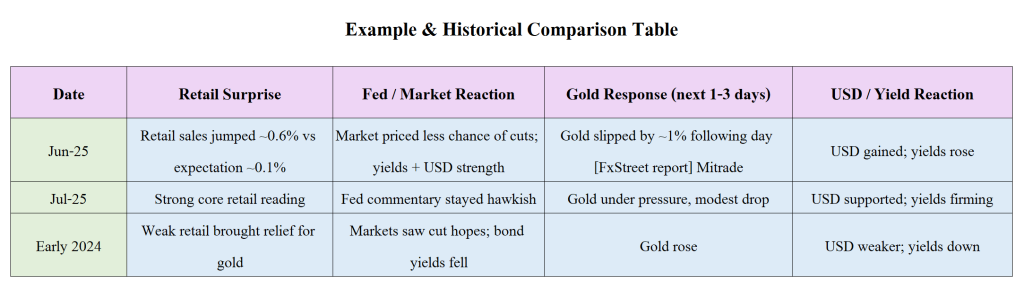

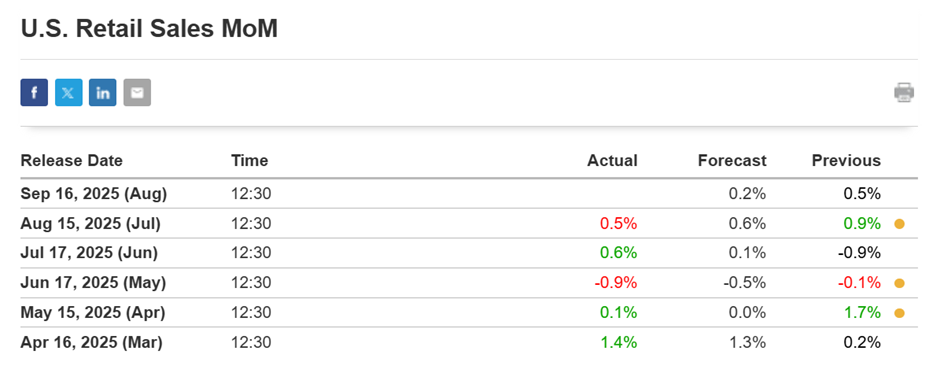

Here’s a blog-style breakdown of how good U.S. Retail Sales data on 16 September 2025 could push XAU/USD (gold) lower: reasons, scenarios, example, and a historical comparison.

Today’s given signal: https://t.me/calendarsignal/20443

Gold Under Pressure: Why Strong U.S. Retail Sales Hurt XAU/USD — 16 Sept 2025

Strong U.S. Retail Sales indicates that the consumer side of the economy is holding up well despite headwinds like inflation, higher interest rates, and geopolitical risks. When consumers buy more, businesses produce more, wages hold up, and expectations shift — all things that tend to reinforce a hawkish Federal Reserve stance. Since gold doesn’t pay interest, it becomes less attractive when rate hikes or tighter monetary policy are more likely.

Here are some of the main factors behind today’s good Retail Sales reading:

- Consumer Resilience: Shoppers continue spending on goods and services, showing that inflation has not yet wiped-out purchasing power entirely. Spending in retail shows confidence.

- Inflation Pass-Through: As the prices of goods rise (due to raw materials, supply chain costs, transport, tariffs etc.), consumers may buy before prices go up even more, giving a temporary boost to retail numbers.

- Strong Income / Employment / Credit Conditions: If wages, employment, or credit conditions remain supportive, people are more willing to spend despite higher cost of living.

- Seasonal or Goods-Shift Effects: Sometimes stronger sales in certain categories (autos, electronics, leisure) or before a seasonal shift (back-to-school, holidays) boost the headline numbers.

- Tariff / Policy Stimulus: If government policies, tax rebates, or stimulus programs are pushing spending, retail sales will appear “good” even in a more constrained economic backdrop.

Key Impact Dynamics on XAU/USD:

Technical levels: Gold’s resistance zones get reinforced; breakouts get harder; support zones become key areas to watch. Traders may get squeezed as stop-loss zones are tested.

Rising yields & USD strength: Strong retail sales tend to boost expectations of Fed holding rates or even increasing, which pushes up yields and strengthens USD. Both tend to pull gold down.

Demand reduction: With less urgency for safe-haven assets, money moves out of gold into yield-bearing or growth assets.

Previous released data results :

On last Retail sales data (15-8-2025) we predicted bad data, & as per that we suggest to BUY XAUUSD & as a result, we made a profit of 73 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/19997

Performance : https://t.me/calendarsignal/20012

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11