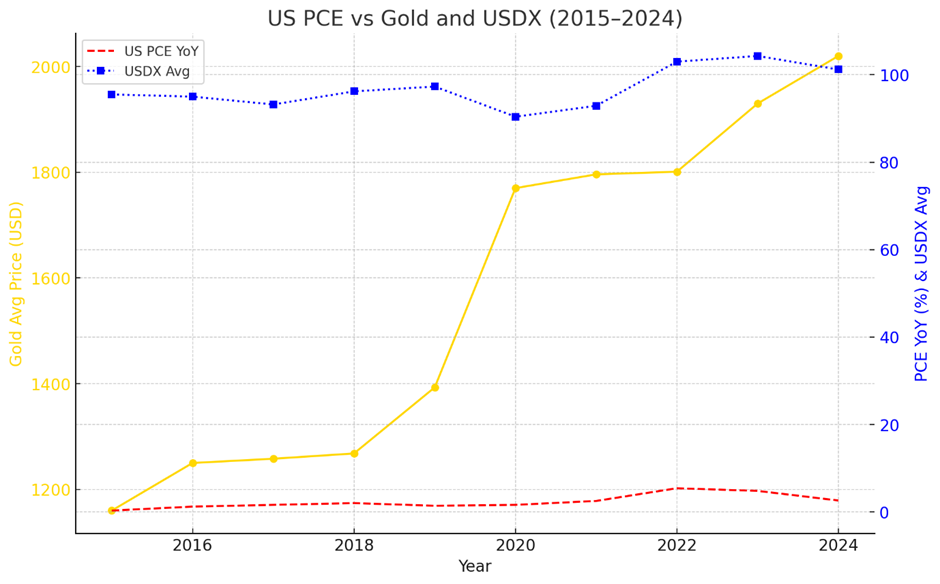

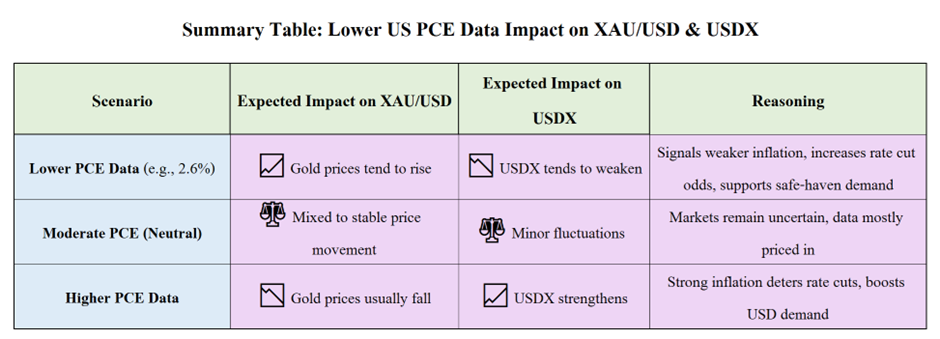

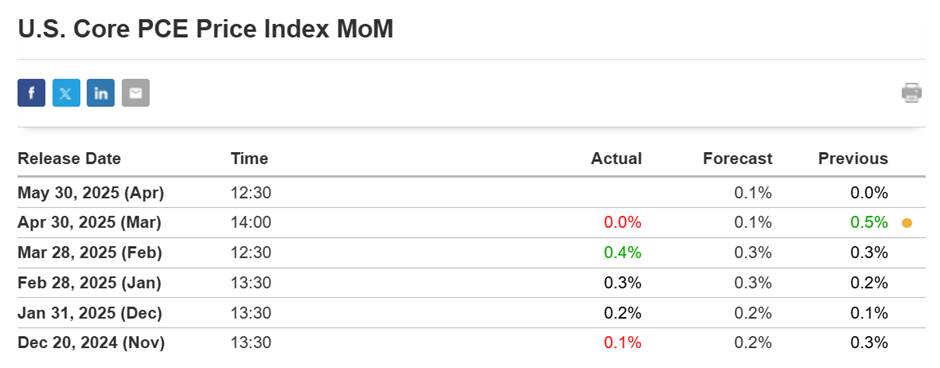

On May 30, 2025, the U.S. reported a lower-than-expected PCE (Personal Consumption Expenditures) price index, indicating slowing inflation. This is significant because the PCE is the Federal Reserve’s preferred inflation gauge. When PCE readings decline, it signals weakening price pressure in the economy, raising expectations for potential interest rate cuts. For gold (XAUUSD), this scenario often triggers a bullish response.

Today’s given signal : https://t.me/calendarsignal/18786

Lower inflation means that the Fed is less likely to maintain high interest rates, which reduces the opportunity cost of holding non-yielding assets like gold. In such an environment, investors typically rotate into safe-haven assets, particularly if the U.S. dollar (measured by USDX) also weakens in anticipation of easier monetary policy. Historically, these conditions tend to push gold prices higher while dragging down the dollar.

Today’s data release coincides with growing speculation about a broader economic slowdown. Lower consumer price growth adds to concerns about softening demand, and when paired with previous weak indicators like GDP or jobless claims, it amplifies dovish expectations. This sentiment increases demand for hard assets like gold and Bitcoin as inflation hedges and store-of-value assets.

What New Traders Should Know:

- PCE’s role: It measures household spending and is more comprehensive than CPI.

- Lower PCE = lower rate hike probability: This weakens USD and strengthens gold.

- Gold reacts not just to inflation but to Fed expectations.

- Always pair data with technical levels (support/resistance) before entering a trade.

- Watch Fed commentary that follows PCE releases—it drives price momentum.

In conclusion, the current drop in PCE supports the bullish case for gold, especially if paired with dovish signals from the Fed or weak growth figures.

Previous released data results :

On last PCE data (30-4-2025) we predicted negative data, & as per that we suggest to BUY XAUUSD & as a result, we made a profit of 84.5 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/gold-moves-explained-the-role-of-gdp-and-pce-in-shaping-xau-usd/

Check last given signal : https://t.me/calendarsignal/18231

Performance : https://t.me/calendarsignal/18252

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11