Lower PPI (Producer Price Index) data has consistently been associated with an upward trend in the price of XAUUSD (Gold Futures). The PPI measures the average change in selling prices received by domestic producers for their goods and services. When PPI data is released and shows a decrease in prices, it can have a positive impact on the precious metal market, specifically on the price of XAUUSD.

Today’s given signal : https://t.me/calendarsignal/12976

There are several reasons why lower PPI data can lead to an increase in the price of XAUUSD:

1. Deflationary Pressures: When PPI data indicates a declining trend in prices, it is typically indicative of deflationary pressures in the economy. Investors and traders often perceive deflation as a potential threat to the value of fiat currency, such as the US dollar. They turn to assets such as gold, which historically have held their value during deflationary periods, as a hedge against inflation.

2. Currency Deprecation: Lower PPI data often triggers a weakening of the US dollar. As the dollar depreciates, the value of gold in other currencies such as the euro or British pound tends to increase. Since XAUUSD is traded in US dollars, a decline in the greenback’s value can lead to a higher price for XAUUSD. This inverse relationship between the US dollar and gold price is a fundamental factor that influences the price of XAUUSD.

3. Interest Rate Expectations: Lower PPI data can also impact interest rate expectations. When inflationary pressures decline, central banks may lower interest rates to stimulate economic growth. Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold, which can result in increased investor demand for XAUUSD. This increased demand for the precious metal drives up its price.

4. Risk-Off Sentiment: Lower PPI data often coincides with a shift toward risk-off sentiment in the markets. Investors and traders may perceive lower PPI data as a sign of slowing economic growth and potential economic instability. This risk-off sentiment can lead to a flight to safe haven assets like gold, as investors seek to protect their wealth from potential market downturns.

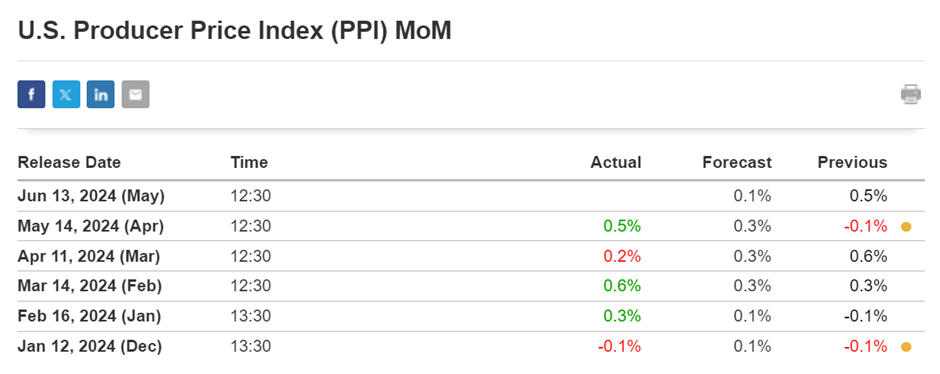

Previous released data results :

On last PPI data (14-5-2024) we predict to SELL XAUUSD as for higher PPI Data, GOLD price was fall.

Check the previous blog : https://blog.forextrade1.co/impact-of-us-ppi-data-on-gold-14-5-2024/

Check last given signal : https://t.me/calendarsignal/12096

Performance :

HERE YOU CAN SEE OUR GIVEN SIGNAL BUY XAUUSD PERFORMANCE OF YESTERDAY’S CPI DATA

Check given signal : https://t.me/calendarsignal/12942

Performance :