Positive US Durable Goods Orders and Consumer Confidence Data generally signal a strong economy, which often leads to a decline in gold prices. Both indicators highlight economic optimism, reducing the appeal of gold as a safe-haven asset.

Today’s given signal : https://t.me/calendarsignal/16774

Factors Affecting the Data Releases

- Durable Goods Orders:

- Business and Consumer Spending: High durable goods orders reflect strong spending on big-ticket items like appliances, machinery, and vehicles.

- Interest Rates: Lower borrowing costs drive higher investment in durable goods.

- Global Trade Conditions: Increased exports of durable goods boost overall order volumes.

- Consumer Confidence Index:

- Job Market Stability: Confidence rises when unemployment is low, indicating economic strength.

- Income Growth: Increased consumer income encourages spending, reflecting higher confidence.

- Inflation Expectations: If inflation is stable or declining, confidence tends to improve.

Effect on Gold Prices

- Stronger US Dollar:

- Positive Durable Goods and Consumer Confidence data strengthen the US dollar as they boost economic sentiment. A strong dollar makes gold more expensive for foreign investors, reducing demand.

- Positive Durable Goods and Consumer Confidence data strengthen the US dollar as they boost economic sentiment. A strong dollar makes gold more expensive for foreign investors, reducing demand.

- Higher Treasury Yields:

- Economic optimism often leads to tighter Federal Reserve policies, increasing Treasury yields and making non-yielding gold less attractive.

- Economic optimism often leads to tighter Federal Reserve policies, increasing Treasury yields and making non-yielding gold less attractive.

- Reduced Safe-Haven Demand:

- As confidence in the economy grows, investors shift to riskier assets like equities, reducing gold’s appeal.

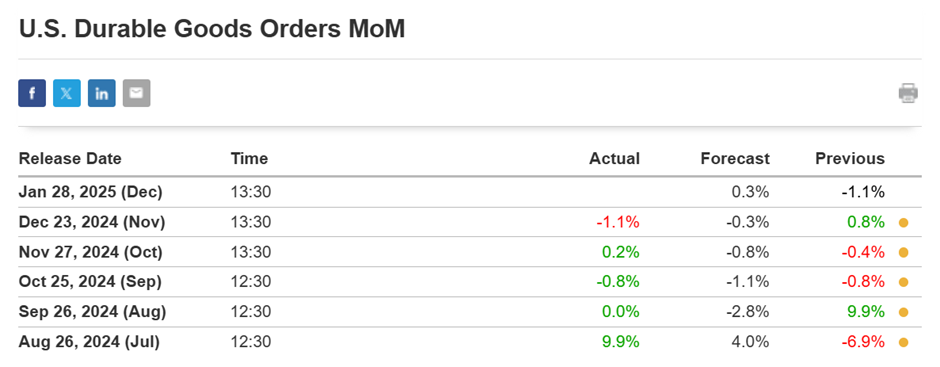

Historical Trend Analysis (Last 10 Years)

Durable Goods Orders (Billion USD):

- 2020: $290.1B (pandemic drop)

- 2021: $320.5B (rebound)

- 2023: $315.4B (stabilized)

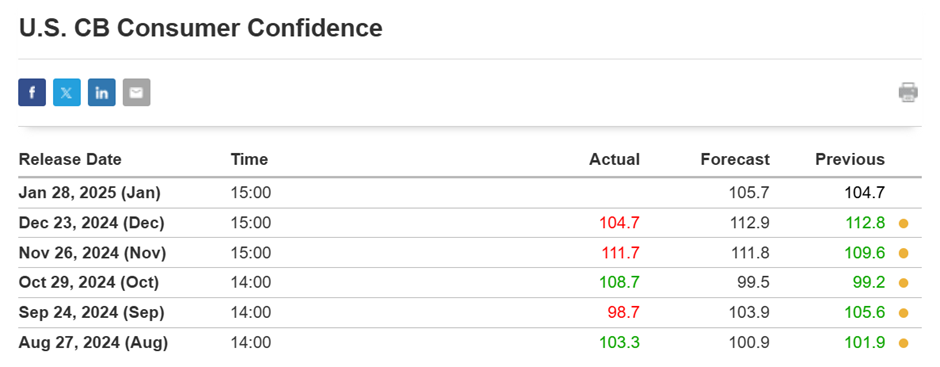

Consumer Confidence Index:

- 2018: 128.5 (peak confidence)

- 2020: 85.7 (pandemic low)

- 2023: 102.5 (moderate recovery)

Previous released data results :

On last U.S. CB Consumer Confidence Data (23-12-2024) we predicted good data, as per that we suggest to SELL XAUUSD & as a result, we made a profit of 31 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/16479

Performance : https://t.me/calendarsignal/16494

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11