On February 6, 2025, the U.S. reported strong nonfarm productivity growth, moderate increases in unit labor costs, and lower-than-expected initial jobless claims. These indicators collectively suggest a robust economy, leading to a strengthening U.S. dollar and a decline in gold prices.

Today’s given signal : https://t.me/calendarsignal/16895

Reasons for Positive Economic Data:

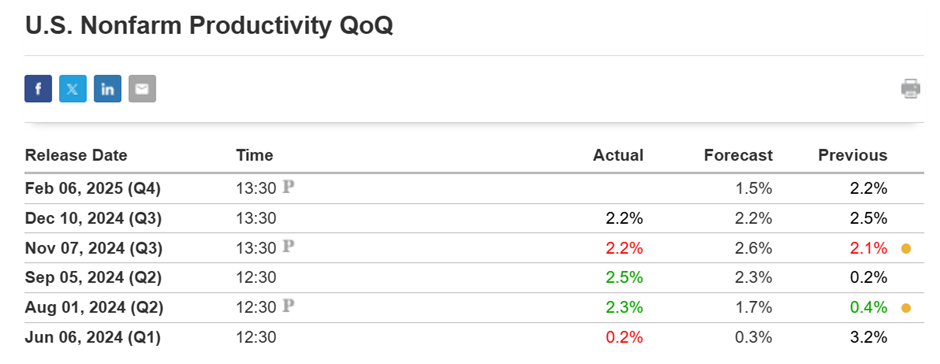

- Nonfarm Productivity: Enhanced by technological advancements and efficient business practices, leading to higher output per labor hour.

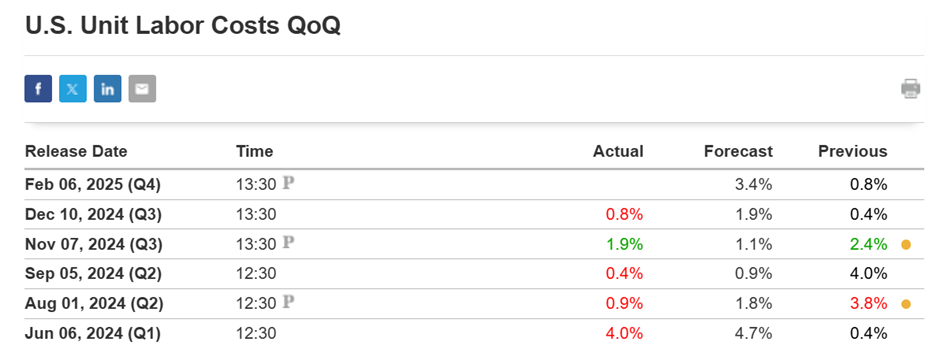

- Unit Labor Costs: Moderate increases indicate that wage growth is aligned with productivity, helping to control inflation.

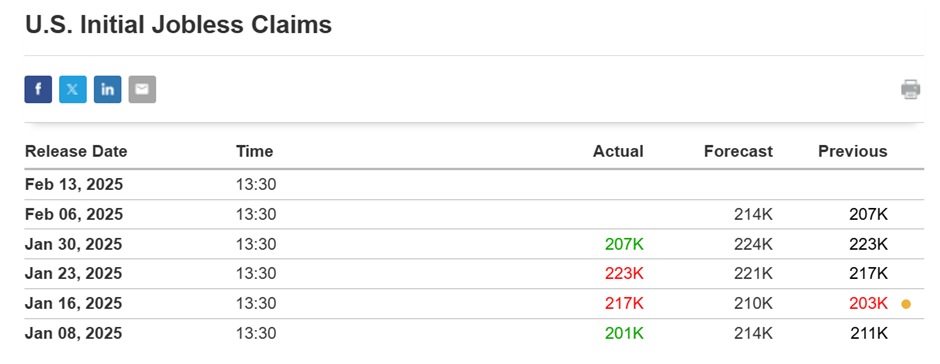

- Initial Jobless Claims: Lower claims reflect a strong labor market with fewer layoffs and steady job creation.

Impact on the U.S. Dollar and Gold Prices:

- U.S. Dollar: Improved productivity and controlled labor costs bolster economic confidence, leading to a stronger dollar.

- Gold Prices: A stronger dollar makes gold more expensive for foreign investors, reducing demand and causing prices to fall.

Specific Example:

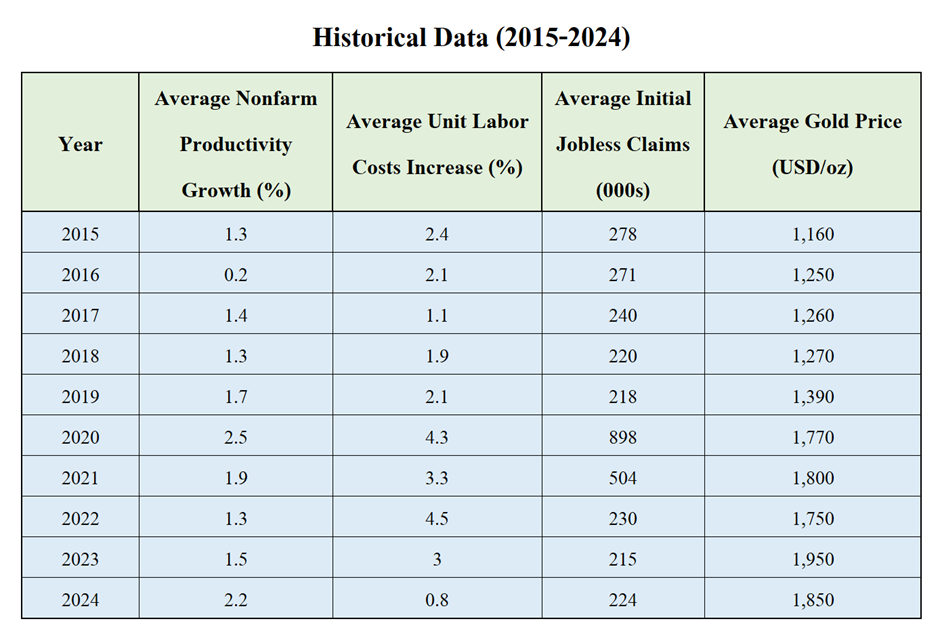

In the fourth quarter of 2024, U.S. nonfarm productivity increased by 3.2%, while unit labor costs rose by 0.5%. During the same period, initial jobless claims averaged around 224,000 per week. These positive indicators contributed to a stronger dollar and a subsequent decline in gold prices.

Today’s favorable economic data, including strong productivity growth, moderate labor cost increases, and low jobless claims, have strengthened the U.S. dollar. This has led to a decrease in gold prices, as a stronger dollar diminishes gold’s appeal as an alternative investment.

Previous released data results :

Check the previous blog : https://blog.forextrade1.co/gold-prices-set-to-react-to-us-pce-and-jobless-claims-data-january-30-2025/

On last U.S. Nonfarm Productivity & labor cost data (10-12-2024) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 27 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/what-recent-us-economic-data-says-about-xau-usd-trends-on-10-12-2024/

Check last given signal : https://t.me/calendarsignal/16307

Performance : https://t.me/calendarsignal/16320

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11