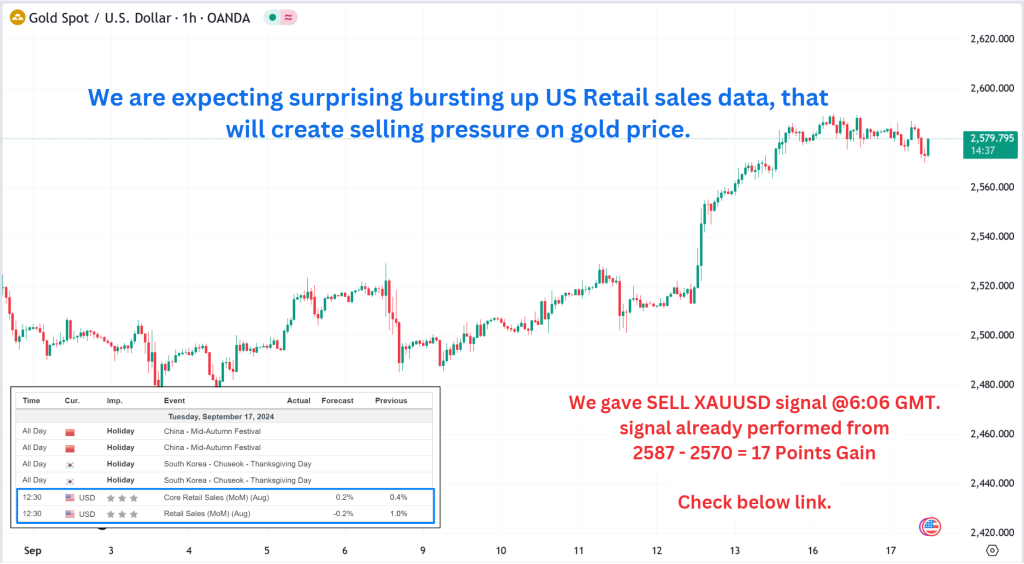

Today, on 17th September 2024, the United States will release its retail sales data for the previous month, which could potentially have a significant impact on the gold price. The unexpected upside data may cause a sudden drop in the value of the precious metal as investors reassess their expectations.

Today’s given signal : https://t.me/calendarsignal/15106

Market Sentiment

Market sentiment also plays a significant role in the gold market. Positive news, such as surprising retail sales data, can shift investor sentiment towards riskier assets. This change in sentiment may cause investors to sell their gold holdings in favor of stocks, bonds, or other assets that they perceive as offering better returns.

US Dollar Strength

The US dollar is inversely correlated with the gold price, as a stronger dollar tends to make gold more expensive for foreign investors. If the retail sales data surprises on the upside, the US dollar may gain strength and appreciate against other currencies, further pressuring gold prices.

Expected Impact on Gold Price

Based on historical patterns and current market conditions, it is anticipated that the surprising upside US retail sales data on 17th September 2024 will lead to a decline in the gold price. The positive economic data will likely boost investor confidence and shift their focus towards riskier assets, resulting in a decrease in demand for gold. Additionally, a stronger US dollar may further contribute to downward pressure on the gold price.

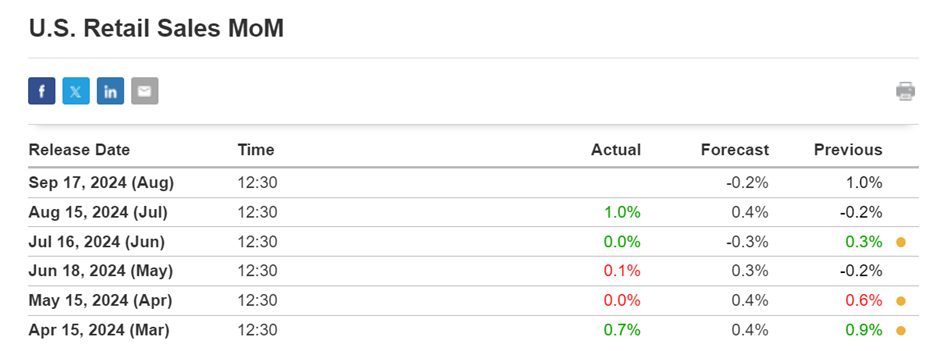

Previous released data results :

On last Retail sales data data (15-8-2024) we predict to BUY XAUUSD as for bad Data, GOLD price was raised.

Check the previous blog : https://blog.forextrade1.co/key-usd-data-points-that-influence-gold-prices/

Check last given signal : https://t.me/calendarsignal/14508

Performance : https://t.me/calendarsignal/14530