Forextrade1 anticipates potential downside pressure in XAUUSD (Gold vs US Dollar) as markets prepare for today’s key U.S. macroeconomic releases—GDP and PCE inflation data—alongside easing geopolitical concerns following Mr. Trump’s soft-toned remarks on the Greenland issue yesterday. Although the data has not yet been released, expectations of strong U.S. economic performance are already influencing market sentiment.

Today’s given signal : https://t.me/calendarsignal/23094

Key Reasons Behind Today’s Market Expectations

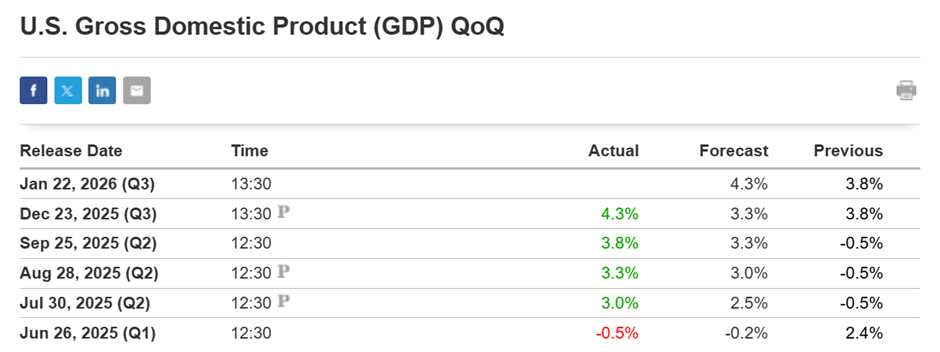

The U.S. GDP report is a primary indicator of economic strength. If GDP growth meets or exceeds expectations, it reinforces the narrative of a resilient U.S. economy. Strong growth typically supports the U.S. dollar and Treasury yields, both of which tend to move inversely to gold prices.

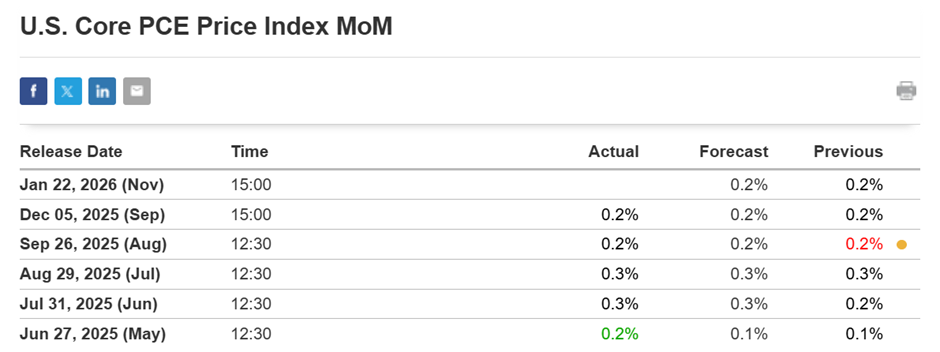

The Personal Consumption Expenditures (PCE) index, particularly the core PCE, is the Federal Reserve’s preferred inflation gauge. A firm or rising PCE reading would suggest that inflationary pressures remain persistent, potentially keeping interest rates higher for longer. Higher interest rate expectations reduce gold’s appeal, as gold does not generate yield.

Adding to this macro pressure is the soft diplomatic tone adopted by Mr. Trump in yesterday’s speech regarding the Greenland issue. Markets often price gold higher during periods of geopolitical uncertainty. A conciliatory approach lowers perceived risk, reducing demand for safe-haven assets like gold.

Important Factors Markets Are Watching Today

- GDP growth surprise (actual vs forecast)

- Core PCE inflation trend

- US dollar reaction post-data

- Bond yield movements

- Risk sentiment driven by geopolitical developments

Even before the official releases at 13:30 and 15:00 GMT, traders often position themselves based on expectations, which can cause pre-data volatility in XAUUSD.

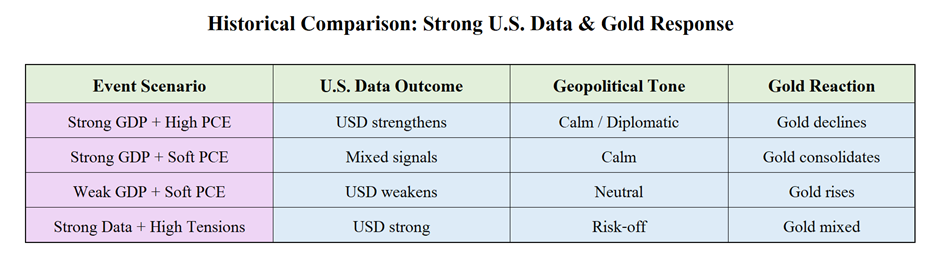

Possible Scenarios for Gold (XAUUSD)

Scenario 1: Strong GDP + Firm PCE (Bearish Gold)

If both GDP and PCE come in stronger than expected, the U.S. dollar could rally sharply. In this scenario, XAUUSD may break key support levels, extending intraday or short-term declines.

Scenario 2: Mixed Data (Range-Bound Gold)

Strong GDP but softer PCE (or vice versa) may keep gold trading sideways, as markets reassess the Fed’s policy outlook.

Scenario 3: Weak GDP + Soft PCE (Bullish Gold)

If both data points disappoint, gold could rebound as rate-cut expectations resurface. However, the calming geopolitical tone may limit upside momentum.

Previous released data results :

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11