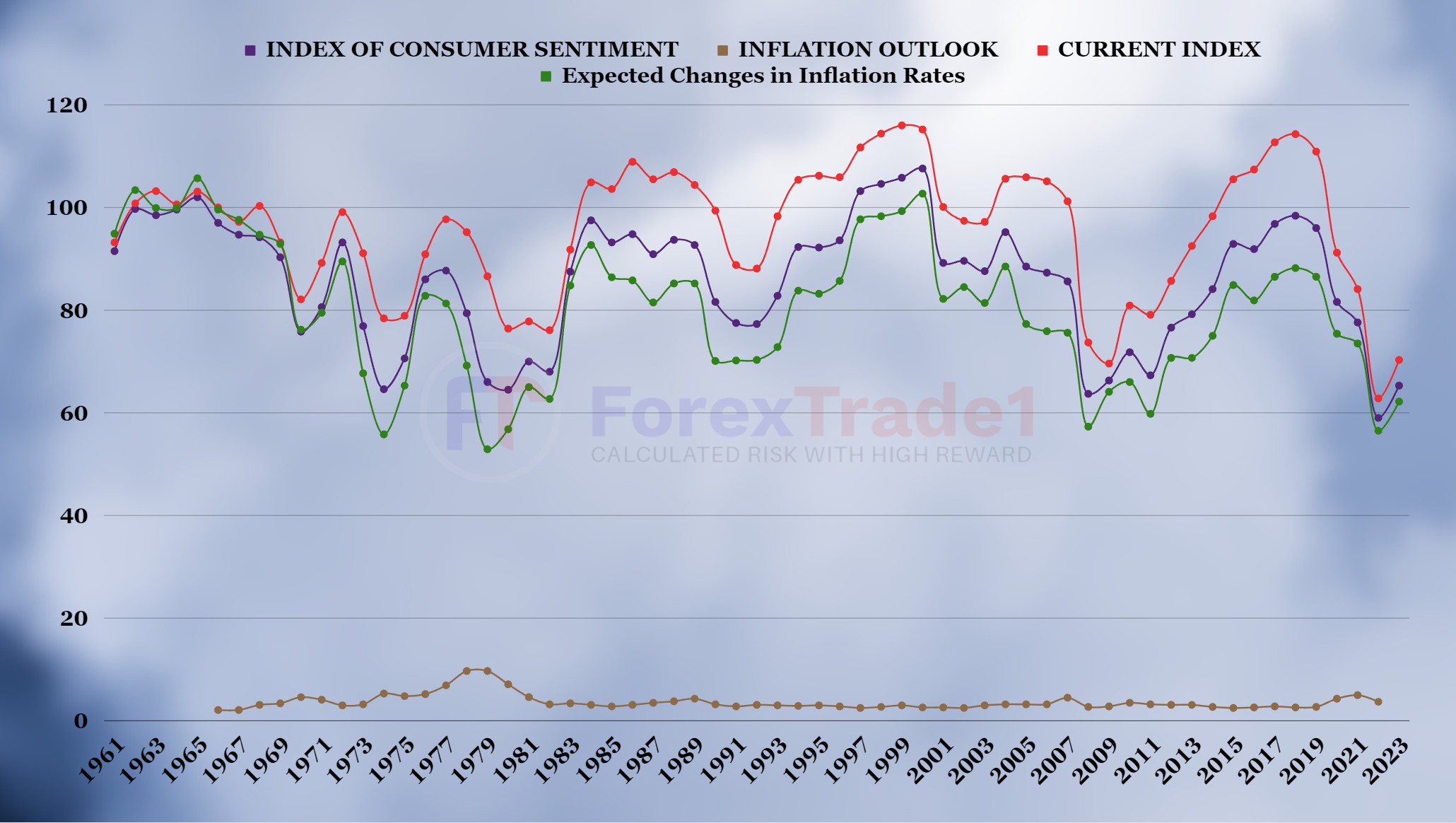

In December, the University of Michigan consumer sentiment index surged, reflecting a substantial decline in inflation expectations, as revealed by the final report released. The index surged to 69.7 in December, marking its first increase since July and setting a new high since that month. Inflation expectations improved dramatically. Median 12-month inflation expectations plunged from 4.5% to 3.1%—a new low since March 2021. Five-year expectations fell from 3.2% to 2.9%. The index was revised up from a preliminary 69.4. The shift in confidence from November was predominantly driven by the expectations component, which surged by 10.6 points. The current conditions component also registered a 5-point increase.

Today’s given signal : https://t.me/calendarsignal/10260

MCSI – What it is and what it means

University of Michigan’s Institute for Social Research created the Michigan Consumer Sentiment Index in the 1940s. Through his efforts, the university conducted and published a national telephone survey monthly. Consumers are asked about their own financial situation and the state of the economy in the short- and long-term.

The preliminary report is released in the middle of each month, summarizing survey data from the first two weeks. The final report, released at the end of the month, encapsulates the entire month’s data. It is designed to capture the mood of American consumers. Whether the sentiment is optimistic, pessimistic, or neutral, the survey signals information about near-term consumer spending plans.

Given consumer spending’s significant share of GDP, the MCSI holds significant value for business, policymakers, and investment communities.

Strengths

This data release provides one of the earliest, if not the earliest, indicators available in the marketplace, offering insights into current consumer conditions.

The business cycle is influenced by consumer expectations.

Providing valuable, timely information, this data release illuminates emerging trends and shifting consumer behaviours by providing a comprehensive picture of current conditions and expectations for the future.

Consumers are more likely to spend now or in the near future if they have better expectations for the future.

Weaknesses

Consumers lack necessary information to accurately assess the economy.

Unlike Conference Board index, regional indexes are not available. Index may be volatile.

Previous released data results :

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11