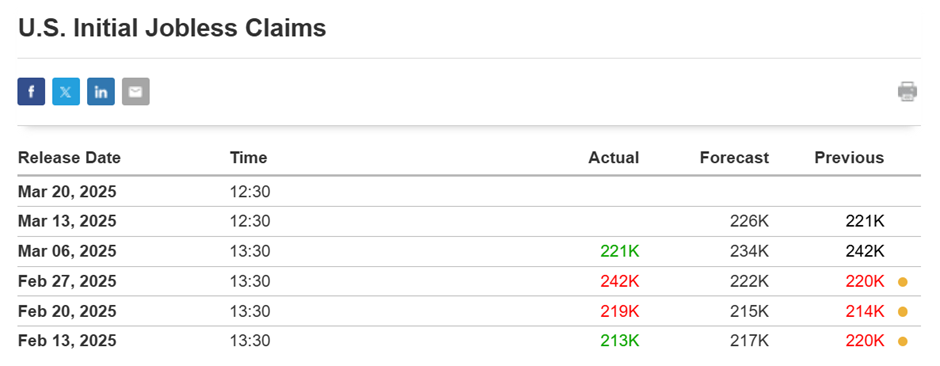

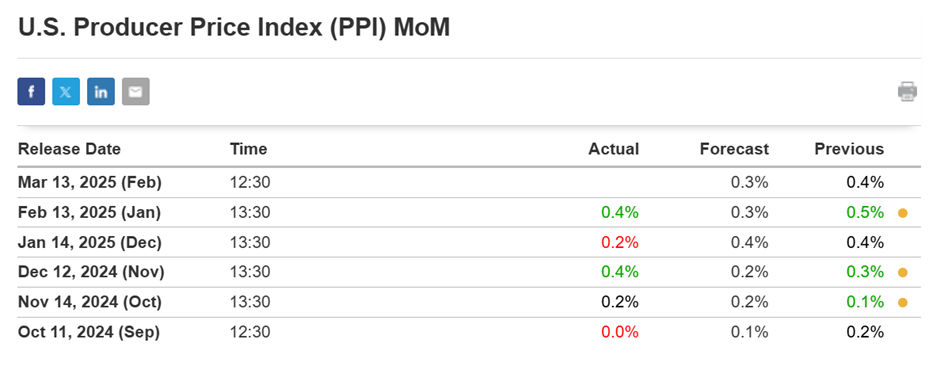

On March 13, 2025, the United States reported higher-than-expected Producer Price Index (PPI) and Jobless Claims data. The PPI, which measures the average change over time in selling prices received by domestic producers, rose by 0.4% in January, surpassing forecasts. Simultaneously, Initial Jobless Claims increased to 217,000 for the week ending January 11, 2025, up from the previous week’s 203,000, indicating a softening labor market.

Today’s given signal : https://t.me/calendarsignal/17446

Impact on Gold Prices (XAU/USD):

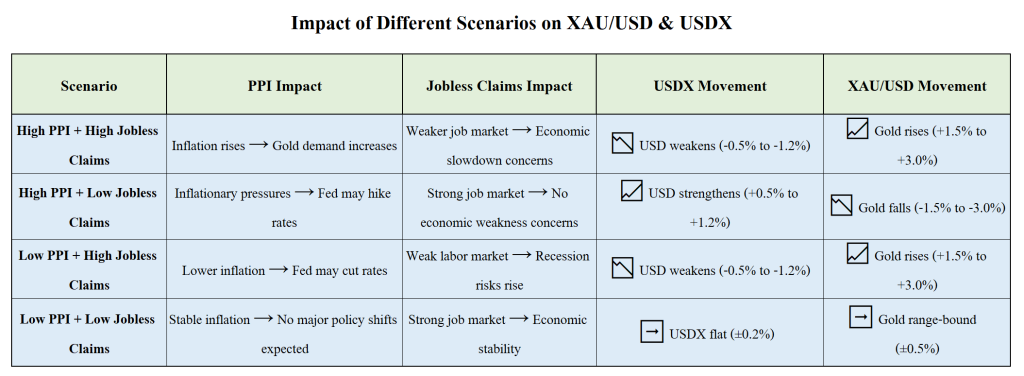

Gold is often viewed as a hedge against inflation and economic uncertainty. Higher PPI figures suggest rising inflationary pressures, which can lead investors to seek refuge in gold, potentially driving its price upward. Conversely, an increase in jobless claims may signal economic slowdown, reinforcing gold’s appeal as a safe-haven asset.

📌 Key Takeaways

✔ Higher PPI generally supports gold if inflation fears rise, but a strong labor market may counterbalance this effect.

✔ Higher jobless claims signal economic weakness, often leading to USD weakness and gold strength.

✔ A strong job market and lower PPI reduce gold’s appeal, strengthening the USD.

✔ Neutral PPI and jobless data result in minimal impact, keeping gold and USD stable.

Understanding these relationships helps traders predict gold price movements based on inflation and employment data trends.

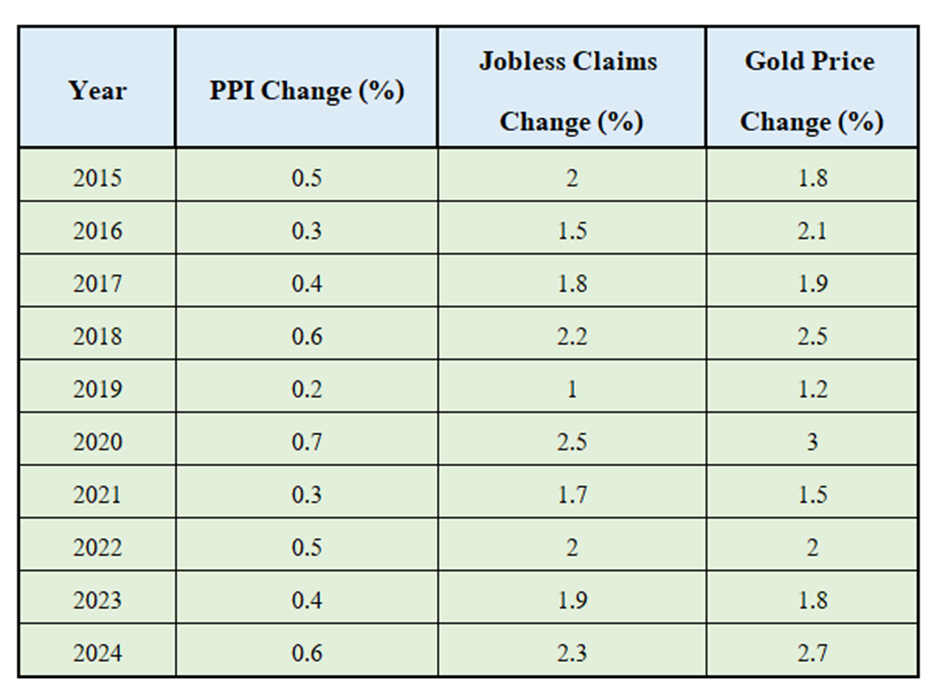

Previous released data results :

On last initial jobless data (6-3-2025) we predicted higher data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 69 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/17327

Performance : https://t.me/calendarsignal/17347

On last U.S. PPI data (14-1-2025) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 30 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/16602

Performance : https://t.me/calendarsignal/16612

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11