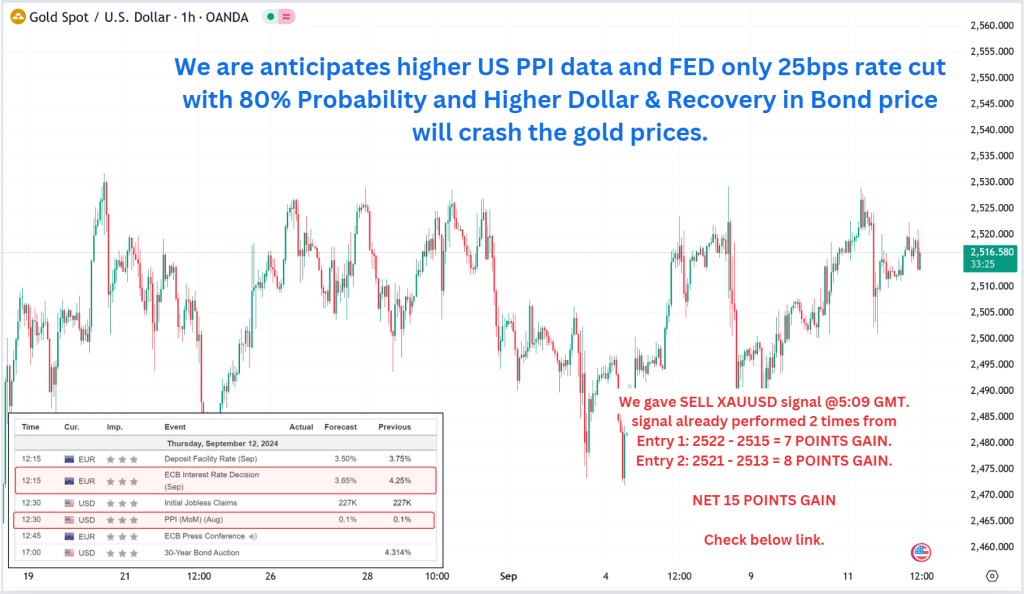

Today, the release of higher U.S. PPI data is expected to have a significant impact on the gold price and the probabilities associated with the upcoming Federal Reserve (FED) interest rate cut. This document analyzes the implications and factors contributing to this dynamic.

Today’s given signal : https://t.me/calendarsignal/15044

Higher US PPI Data and Selling Pressure in Gold Price

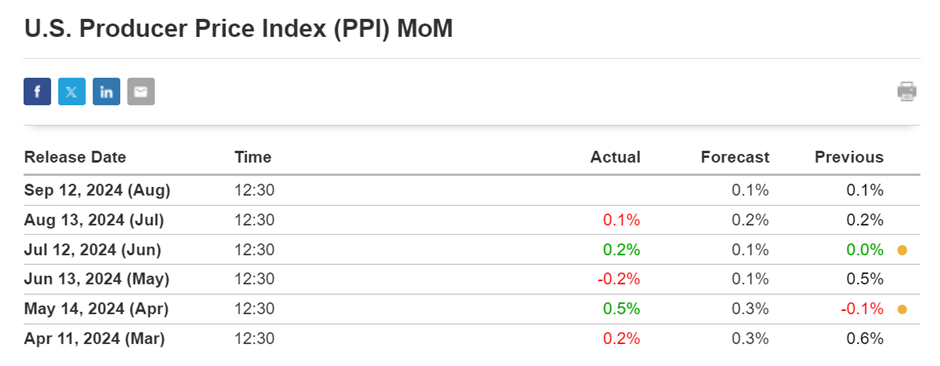

The Producer Price Index (PPI) measures the average change over time in selling prices received by domestic producers for their output. Higher PPI data is typically viewed as a warning sign of economic inflation, as it reflects rising production costs and suggests a possible increase in prices for consumers.

In the context of gold, which is typically seen as a hedge against inflation, higher PPI data can translate into selling pressure in the gold price. Investors may shift their portfolios away from gold and seek alternative assets perceived as less vulnerable to inflationary pressures. This selling pressure can further exacerbate the existing downtrend in gold prices.

FED Interest Rate Cut Probability and 80% Probability

As inflation concerns rise, there is increased speculation about the possibility of a FED interest rate cut. The FED is the central bank of the United States and is responsible for regulating interest rates and maintaining monetary stability.

Based on recent market expectations and analysis, the probability of a FED interest rate cut in the upcoming meeting is estimated to be around 80%. This probability is influenced by several factors, including inflationary pressures, economic growth, and investor sentiment.

Higher Dollar and Recovery in Bond Price

Higher PPI data can also impact the value of the dollar and bond prices. The dollar index, which measures the value of the dollar against a basket of currencies, tends to appreciate during periods of high inflation. Investors may sell their gold holdings and invest in dollar-denominated assets, leading to a higher dollar index.

Impact on Gold Prices:

Scenario 1: Bullish for Gold

- Initial Jobless Claims: Above 240K

- PPI: Below 0.2%

A higher jobless claims number and lower PPI reading will likely boost gold prices and weaken the US Dollar Index (DXY).

Scenario 2: Bearish for Gold

- Initial Jobless Claims: Below 227K

- PPI: Above 0.2%

Conversely, a lower jobless claims number and higher PPI reading will likely pressure gold prices and strengthen the DXY.

Previous released data results :

On last PPI data (13-8-2024) we predict to BUY XAUUSD as for lower PPI data, GOLD price was raised.

Check the previous blog : https://blog.forextrade1.co/factors-influencing-gold-prices-todays-us-ppi-data-and-escalating-tensions-in-the-middle-east/

Check last given signal : https://t.me/calendarsignal/14440

Performance : https://t.me/calendarsignal/14469

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn: https://www.linkedin.com/company/forextrade11