On 2nd August 2024, the United States will release its Non-Farm Payrolls (NFP) report, which is a closely watched indicator of employment growth. Historically, positive NFP data has been seen as a bullish indicator for the US Dollar, as it suggests that the economy is expanding and creating jobs.

Today, we’ll primarily focus on our July forecast for non-farm payrolls (NFP), which we published in our recent commentary on the U.S. job market.

Today’s given signal : https://t.me/calendarsignal/14213

This week, we also received a few new data points, including a downturn in JOLTS data for June as well as higher than expected unemployment claims. The data wasn’t a cause for concern, but they confirmed our belief that the downside risk of accelerating job market weakness is greater than the upside risk of resurgent inflation. Tomorrow’s below-consensus payrolls number will complete this week’s trifecta of data suggesting that rate cuts are long overdue.

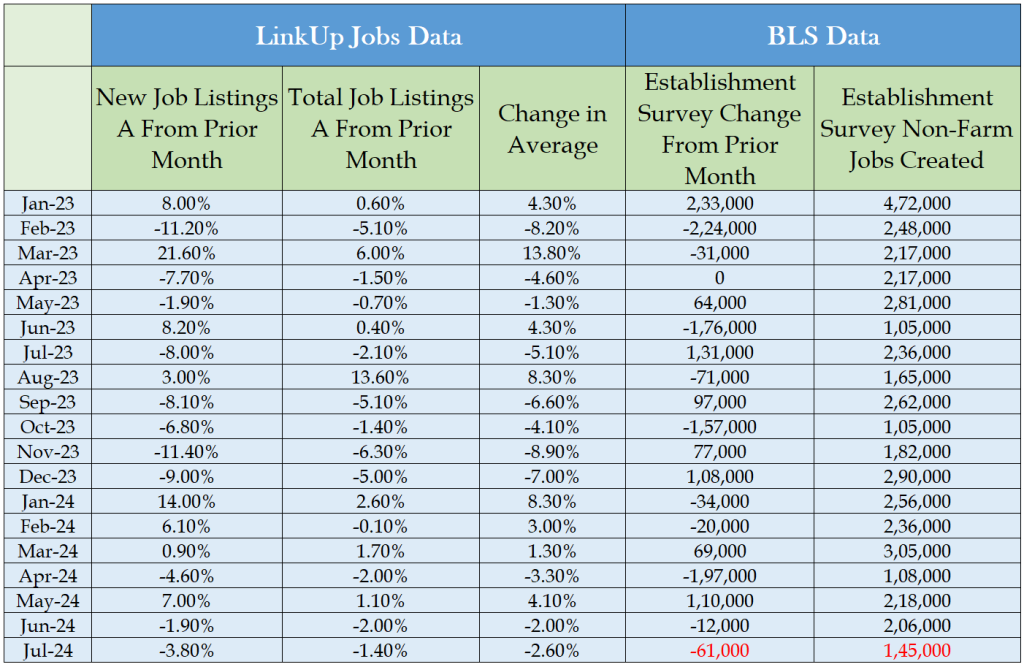

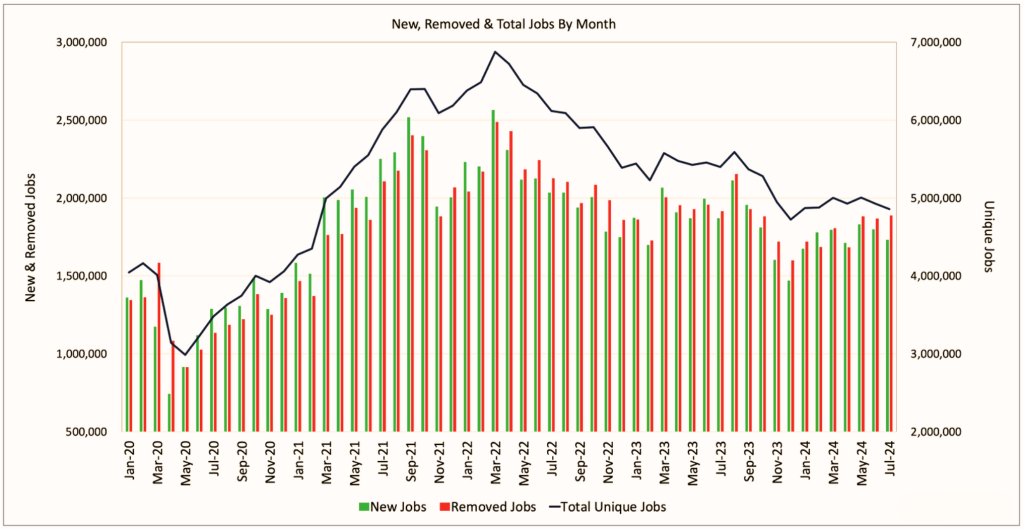

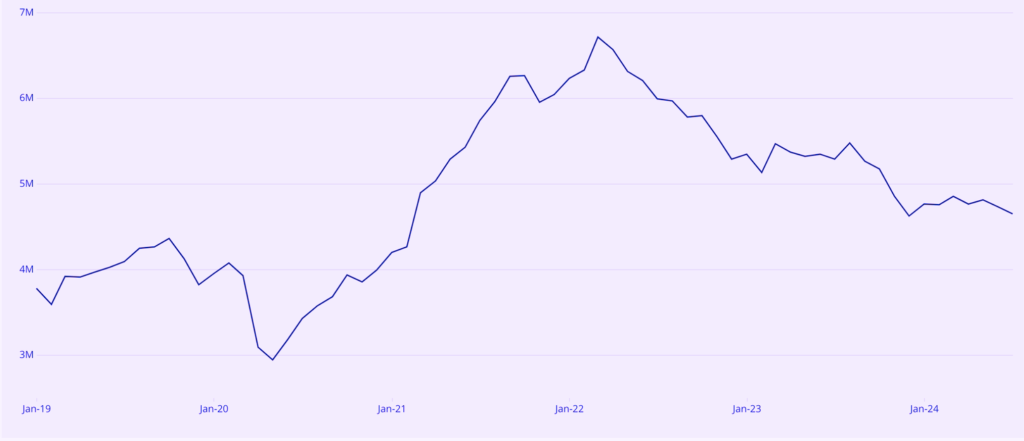

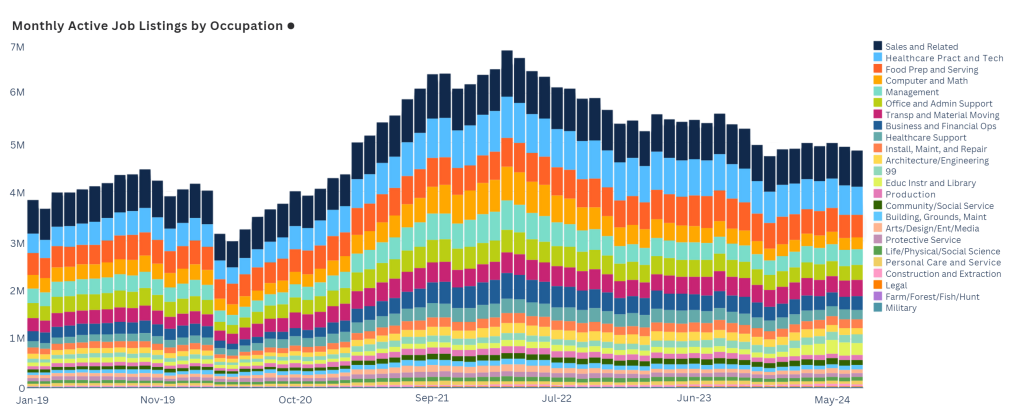

In July, total U.S. jobs indexed directly from company websites around the world rose 1%, while new jobs fell 4%.

In addition, LinkUp 10,000 – an index tracking total U.S. job openings from 10,000 global companies with the most U.S. job openings – fell 2% during the month.

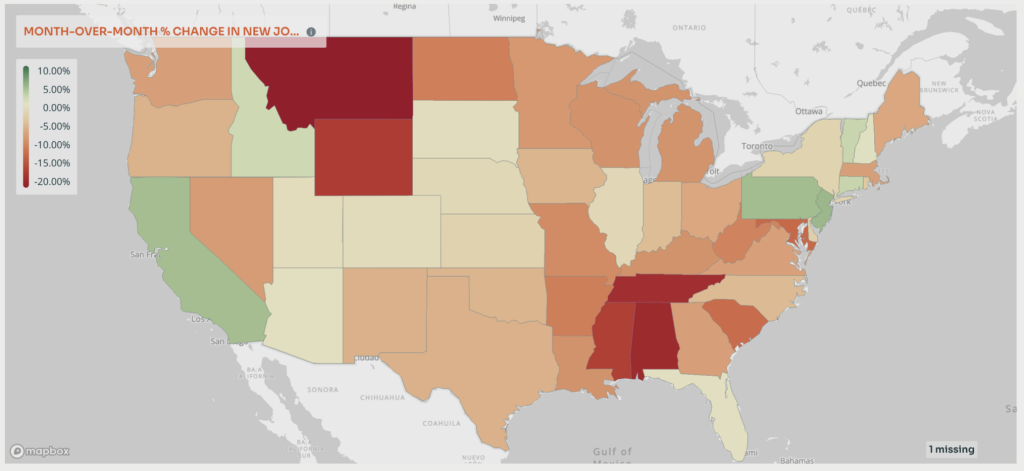

Montana, Alabama, and Tennessee saw the largest decreases in new job openings, while New Jersey, Pennsylvania, and California saw the biggest increases.

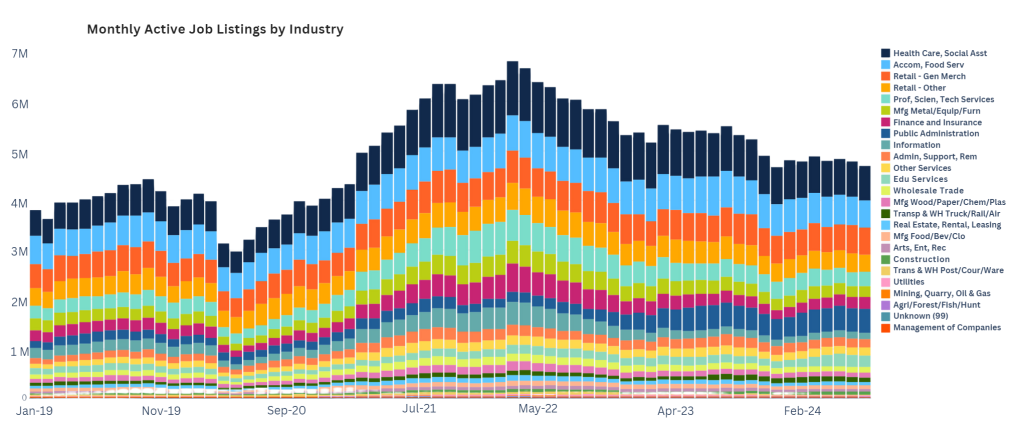

Food and beverage manufacturing, finance/insurance, and local delivery showed the largest increases in openings.

Personal Care & Services saw the largest gains while Sales, Life/Physical/Social Sciences, and Health Practitioners and Technical saw the largest declines.

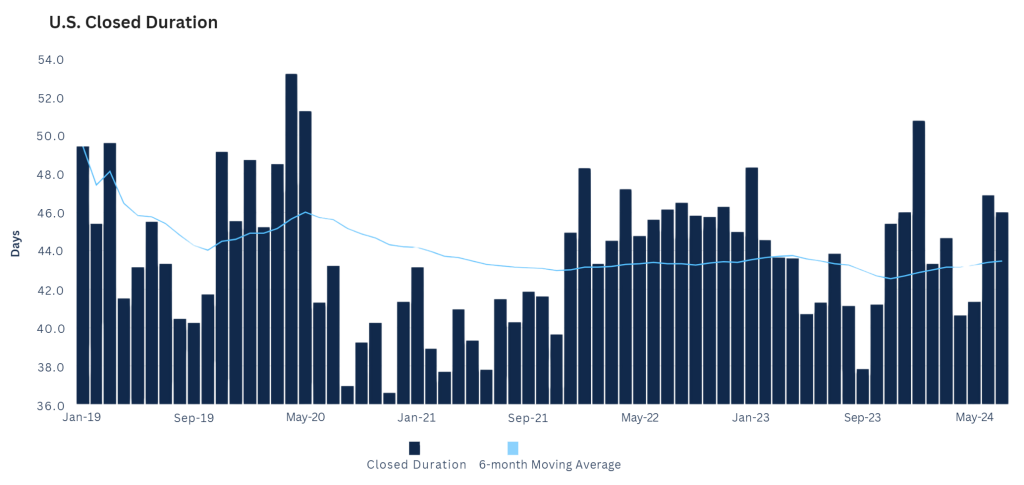

A 90-day moving average continued its steady climb as the labor market cools and employers slow their hiring pace as the 90-day closed duration decreased to 46 days in July.

Using Closed Duration, one can measure Time-to-Fill by determining how long an opening is open on a company’s corporate career portal on average before it is closed.

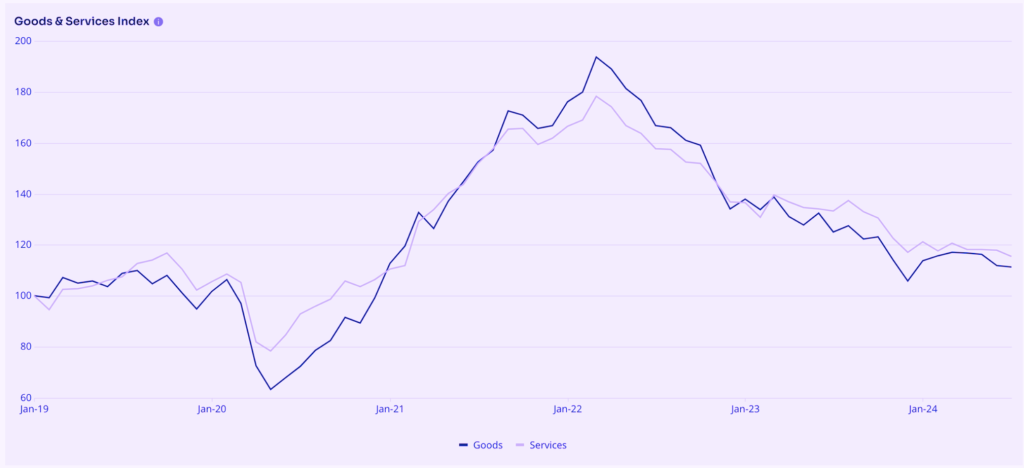

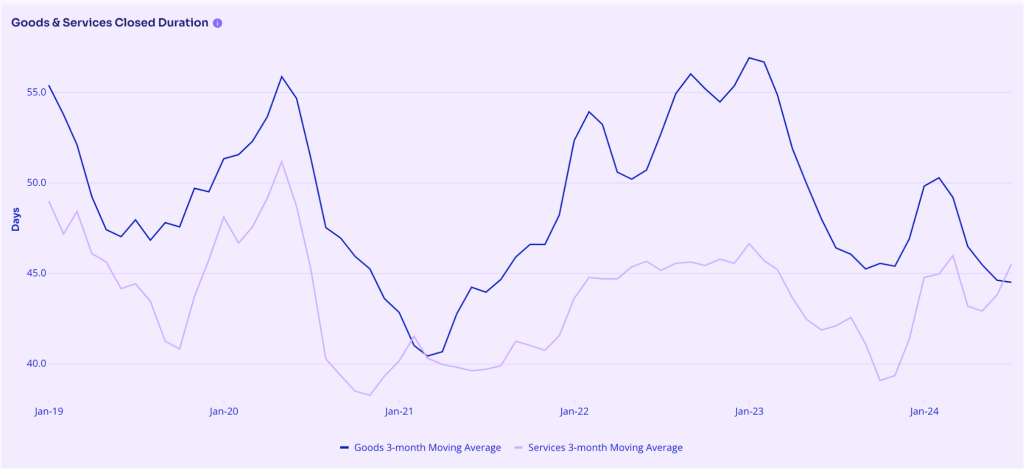

Compared to manufacturing, services saw a sharp increase in Closed Duration.

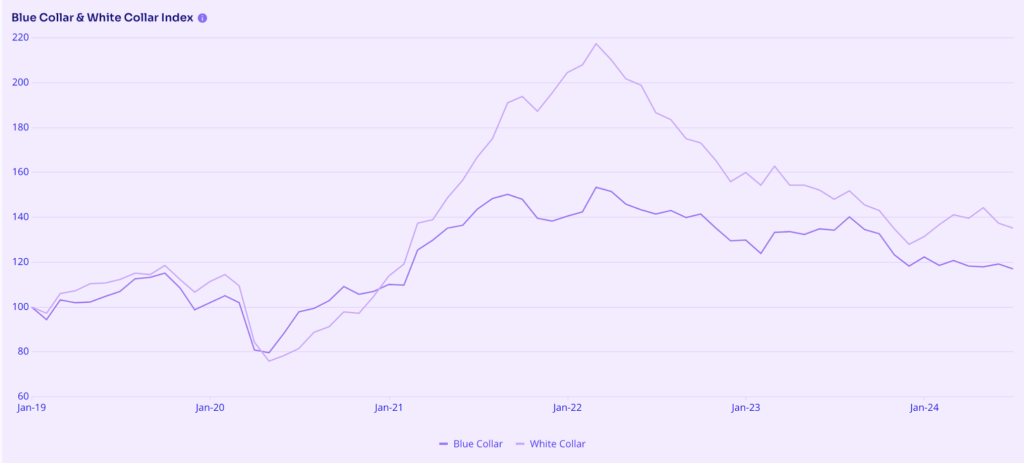

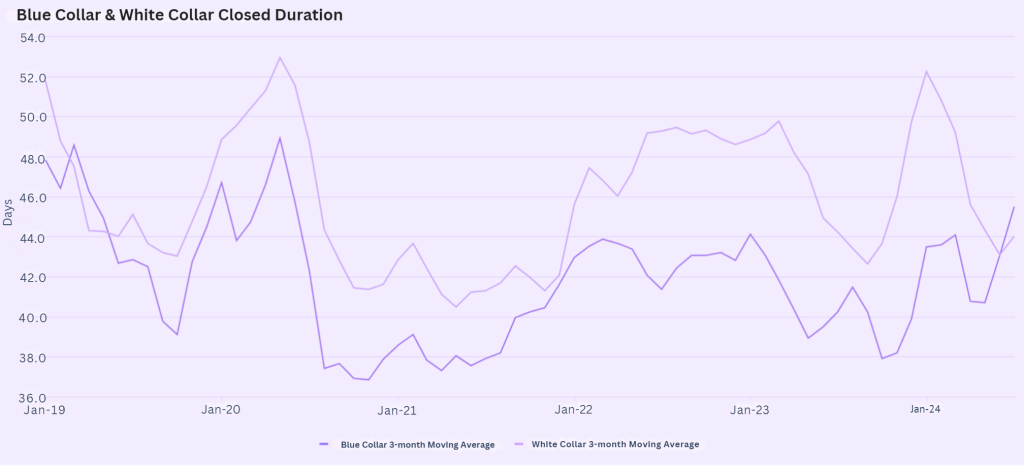

Blue-collar jobs have continued to rise while white-collar jobs have risen.

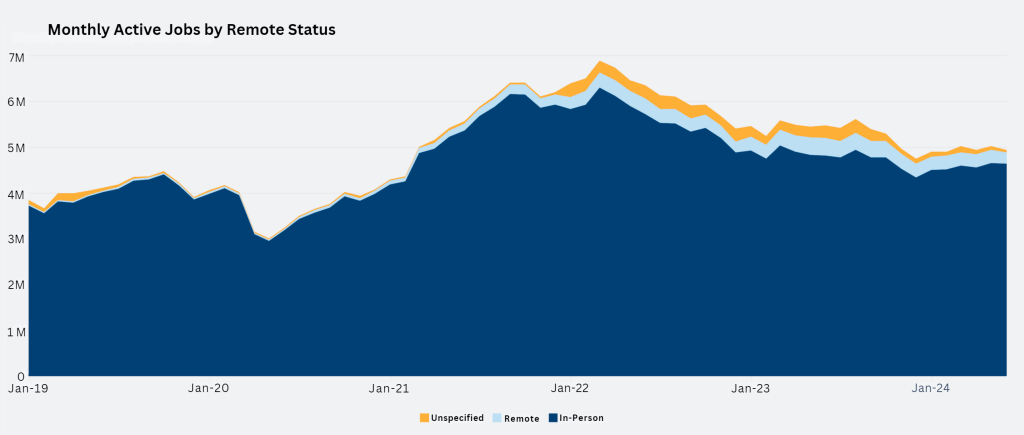

In our Macro Compass data visualization application, we’ve added two new charts, including remote jobs, which dropped 11bps to 4.70%…

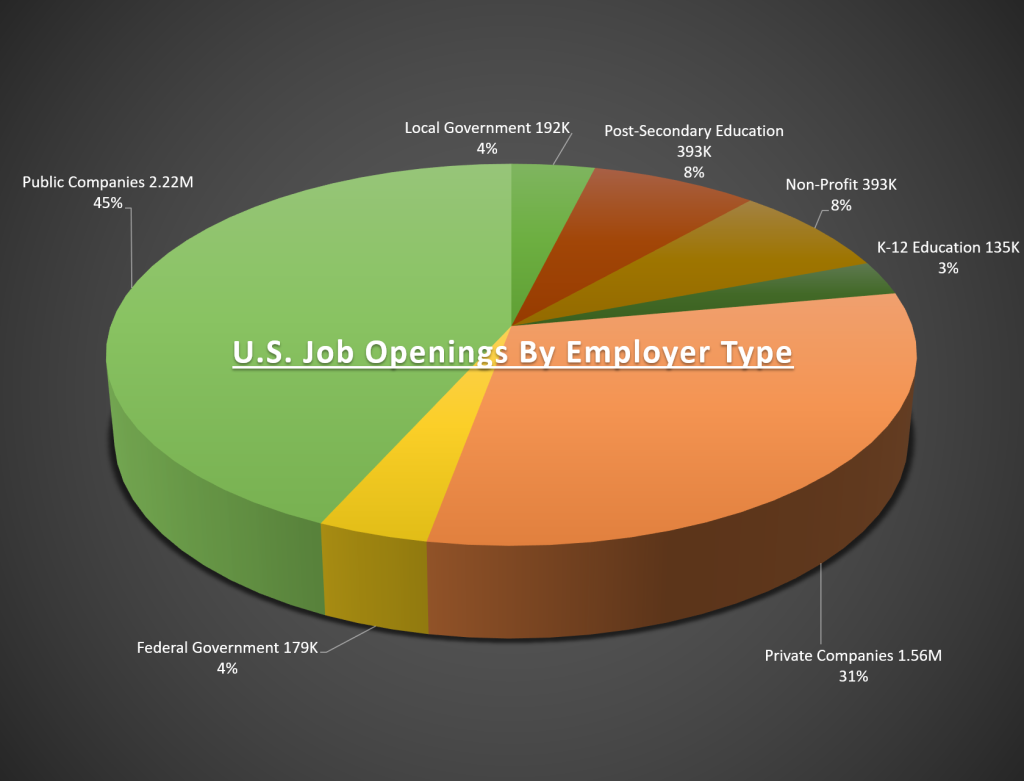

The report also shows that in July, 45% of the labor demand in the U.S. was accounted for by public companies.

Accordingly, we expect a net gain of 145,000 jobs in July, somewhat below consensus estimates of 175,000.

Previous released data results :

On last NFP data (5-7-2024) we predict to BUY XAUUSD as for weak Data, & XAUUSD price was raised.

Check the previous blog : https://blog.forextrade1.co/nfp-data-analysis-golds-reaction-on-5-7-2024/

Check last given signal : https://t.me/calendarsignal/13535

Performance : https://t.me/calendarsignal/13563

Firstly, the gold market is primarily driven by sentiment and investor appetite. While positive NFP data may boost confidence in the US Dollar, it could also lead to increased interest rates and bond yields, which could make gold less attractive as a safe-haven asset. As a result, investors may sell their gold holdings in favor of other investment options such as stocks or bonds.

Secondly, the gold market is also influenced by geopolitical factors. Any unexpected events or uncertainties, such as geopolitical tensions or monetary policy changes, can impact the gold price. In this case, the positive NFP data may not outweigh the other factors that are currently driving the XAUUSD price down.

Thirdly, the gold market tends to be sensitive to changes in market liquidity. If there is an absence of significant buying activity, prices may fall. In this case, the anticipated positive NFP data may not generate enough demand to push the gold price higher.

Overall, while the positive NFP data on 2nd August 2024 may boost the US Dollar, it is unlikely that it will significantly impact the gold price. Investors should monitor the situation closely and consider other factors that drive the gold market before making any investment decisions.

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11