On 24th October 2024, the release of key economic indicators provided insights into the overall health of the U.S. economy. The decline in initial jobless claims and the simultaneous rise in S&P Manufacturing and Services PMI indicated a stronger economy, which exerted selling pressure on gold prices.

Today’s given signal : https://t.me/calendarsignal/15687

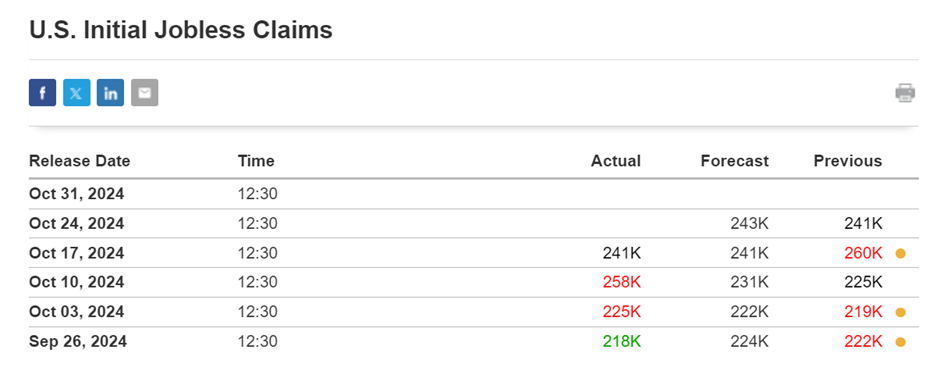

Lower Initial Jobless Claims

One of the positive economic indicators released today was the lower initial jobless claims. This data represents a count of individuals who filed for new unemployment benefits during the week. The decline in initial jobless claims suggests that the job market is improving, with fewer individuals losing their jobs. This improvement in the labor market is a bullish signal for the economy, as it suggests that businesses are expanding and hiring more workers.

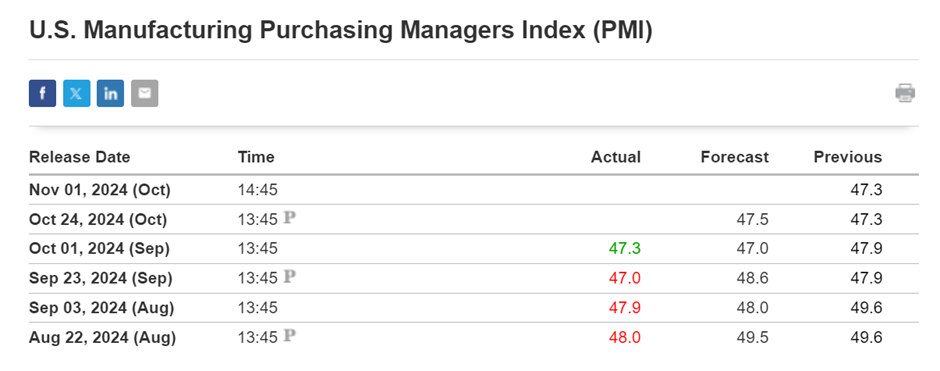

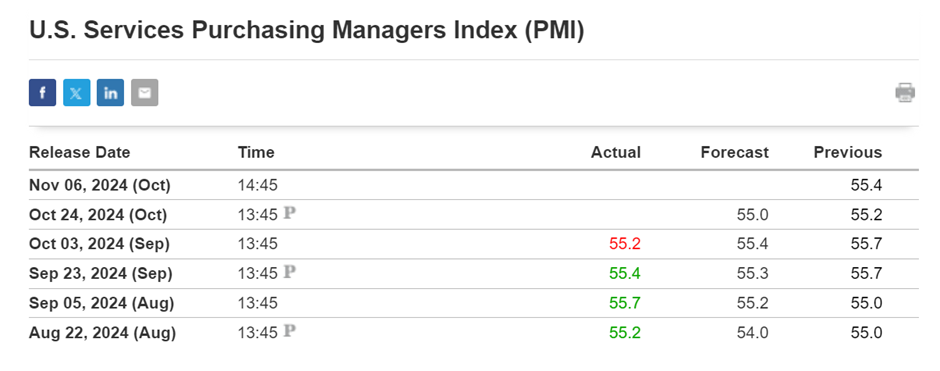

Higher S&P Manufacturing and Services PMI

Another significant indicator that contributed to gold prices falling was the increase in S&P Manufacturing and Services PMI. The Purchasing Managers’ Index (PMI) is a measure of economic activity that tracks the purchasing managers’ assessment of current business conditions. A higher PMI suggests that businesses are expanding and confident in their future outlook. This positive economic sentiment created selling pressure on gold, as investors were less concerned about hedging against potential economic uncertainties.

Selling Pressure on Gold Prices

The stronger economy and the increase in S&P Manufacturing and Services PMI resulted in selling pressure on gold prices. When investors are confident about the economy and the future growth prospects, they tend to allocate their capital towards riskier assets, such as stocks and bonds, rather than gold.

Gold is typically seen as a safe-haven investment during times of economic uncertainty or inflation fears. However, when economic conditions improve and investors are optimistic about the future, they are less likely to seek the protection of gold. This selling pressure on gold prices contributed to the decline in its price on 24th October 2024.

Previous released data results :

WHERE TO CONTACT US

Website: https://forextrade1.co/

Twitter: www.twitter.com/forextrade11

Telegram: telegram.me/ftrade1

Facebook: www.facebook.com/Forextrade01

Instagram: www.instagram.com/forextrade1

YouTube: www.youtube.com/ForexTrade1

Skype: forextrade01@outlook.com

Email ID: info@forextrade1.com