On December 17, 2024, gold prices (XAUUSD) experienced a sharp decline following the release of better-than-expected US retail sales data and a hawkish tone from the Federal Reserve regarding interest rate cuts for 2025. These developments strengthened the US dollar and Treasury yields, putting downward pressure on gold, which is a non-yielding asset.

Today’s given signal : https://t.me/calendarsignal/16403

US Retail Sales Data Exceeds Expectations

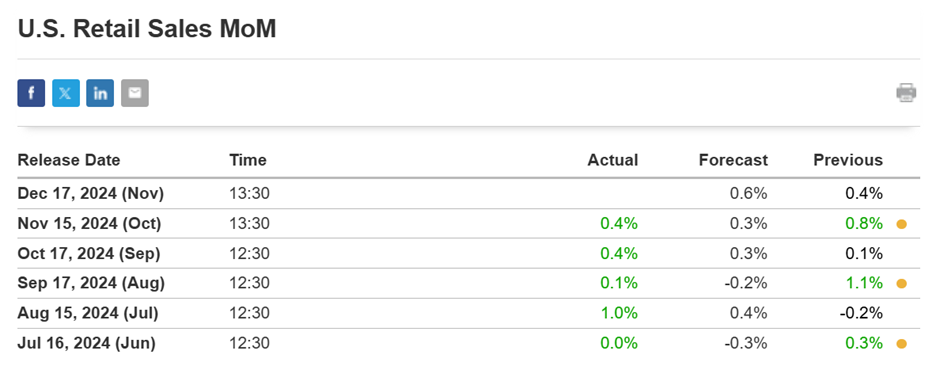

The US Commerce Department reported that retail sales for November 2024 rose by 1.4%, significantly beating market expectations of 0.8%. This data reflects strong consumer spending despite concerns about high interest rates and inflation.

Key highlights include:

- Core retail sales (excluding automobiles and fuel) climbed 1.1%, compared to 0.7% in the previous month.

- Sectors such as electronics surged by 2.1%, while furniture sales rose 1.5%, signaling strong holiday demand.

- Food services and restaurants reported growth of 1.3%, indicating robust discretionary spending.

These numbers highlight the resilience of US consumers and suggest that the economy remains strong, dampening the appeal of safe-haven assets like gold.

Federal Reserve’s Hawkish Outlook

Following the robust retail sales report, the Federal Reserve reiterated its hawkish stance during its December meeting. Fed Chair Jerome Powell emphasized that the central bank would remain cautious about cutting interest rates in 2025, as inflation remains above the 2% target.

Key points from Powell’s statement:

- Rates will stay elevated at 5.25%-5.50% through the first half of 2025.

- Future rate cuts will depend on clear evidence of sustainable inflation reduction.

This announcement fueled a rally in the US dollar and Treasury yields, both of which are inversely related to gold prices:

- The US Dollar Index (DXY) rose 0.7% to 105.10, its highest level in over a month.

- The 10-year Treasury yield climbed to 4.45%, up from 4.35% the previous day.

Higher yields make gold less attractive for investors as it offers no interest, further pressuring prices.

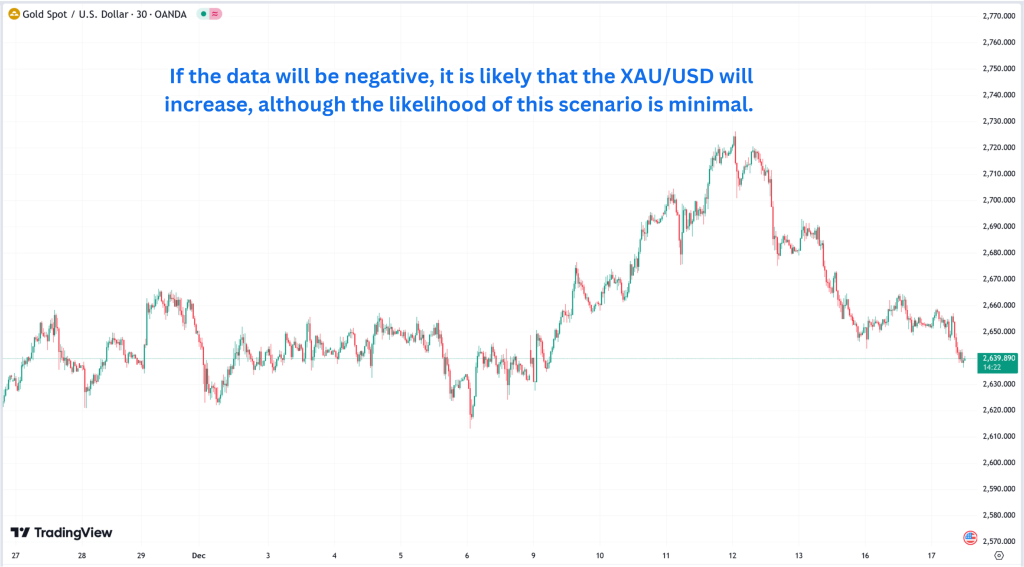

Estimated Impact on Gold Prices

If the retail sales data comes in stronger than expected, here’s what could happen:

- Spot gold prices (XAUUSD) could fall by 1-2%.

- Example: If gold is trading at $2,000 per ounce, a 1.5% decline would take it to $1,970 per ounce.

- Gold-backed ETFs, such as the SPDR Gold Shares (GLD), might drop by a similar percentage.

- Gold mining stocks, like Newmont Corporation or Barrick Gold, could see declines of 2-3%.

Previous released data results :

On last Retail sales data (15-11-2024) we predict bad data, & as per that we suggest to BUY XAUUSD & as a result, we made a profit of 37 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/forecasting-gold-trends-in-based-on-us-retail-sales-data-15-11-2024/

Check last given signal : https://t.me/calendarsignal/15995

Performance : https://t.me/calendarsignal/16004

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11