The Federal Open Market Committee (FOMC) is a branch of the Federal Reserve System responsible for overseeing open market operations and guiding U.S. monetary policy.

The Federal Open Market Committee (FOMC) is the main monetary policymaking body of the Federal Reserve. It is responsible for setting interest rates and other monetary policies to achieve the Fed’s dual mandate: price stability and maximum sustainable employment. FOMC data and decisions have significant implications for Forex traders. Here’s an overview:

Key Aspects of FOMC Data:

- Interest Rate Decisions:

- The FOMC meets eight times a year to set the federal funds rate, which influences interest rates across the economy. Changes in the rate can impact the U.S. dollar’s value.

- A rate hike typically strengthens the dollar as higher interest rates attract foreign investment, while a rate cut can weaken the dollar.

- Economic Projections:

- The FOMC provides economic projections, including GDP growth, inflation, and unemployment forecasts. These projections help traders understand the Fed’s economic outlook and future policy direction.

- Meeting Minutes:

- The minutes from FOMC meetings are released three weeks after each meeting. They provide detailed insights into the discussions and considerations of committee members, helping traders anticipate future policy moves.

- Press Conferences:

- After select meetings, the Fed Chair holds a press conference to explain the committee’s decisions and provide additional context. Traders closely watch these for any hints about future policy changes.

Membership: The FOMC consists of 12 members: seven members of the Federal Reserve Board and five of the 12 regional Federal Reserve Bank presidents. The president of the Federal Reserve Bank of New York always has a voting seat, while the other presidents serve on a rotating basis

Impact on Forex Trading:

Decisions made by the FOMC can significantly affect the economy, influencing everything from inflation to employment rates. The committee’s announcements are closely watched by investors and policymakers worldwide for indications of future economic conditions and policy directions

- Market Volatility:

- FOMC announcements often lead to significant market volatility. Traders must be prepared for rapid price movements in currency pairs involving the U.S. dollar.

- Anticipation and Reaction:

- Markets often move in anticipation of FOMC decisions based on expectations. If the actual announcement differs from expectations, it can lead to sharp market reactions.

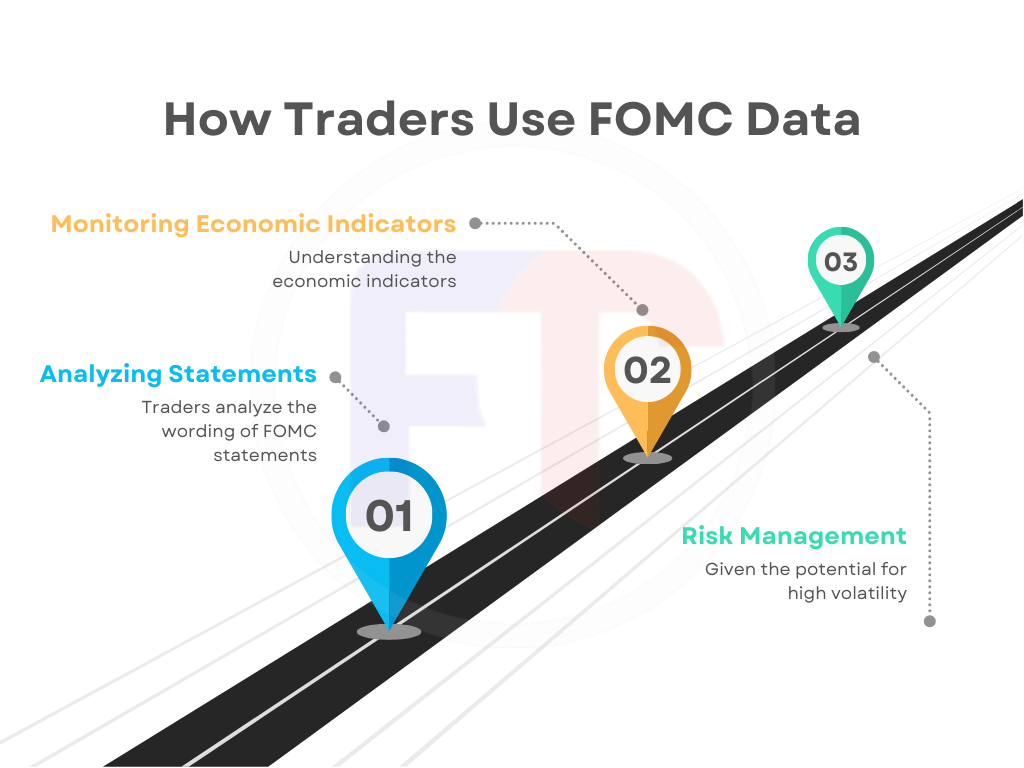

How Traders Use FOMC Data:

- Analyzing Statements:

- Traders analyze the wording of FOMC statements for clues about the future direction of monetary policy, paying attention to changes in language regarding economic conditions and inflation.

- Monitoring Economic Indicators:

- Understanding the economic indicators that influence FOMC decisions (like employment data and inflation rates) helps traders anticipate policy changes.

- Risk Management:

- Given the potential for high volatility, effective risk management strategies are crucial when trading around FOMC announcements. This includes setting appropriate stop-loss orders and position sizing.

Role and Function: The FOMC primarily influences monetary policy through the federal funds rate, the interest rate at which banks lend to each other overnight. Additionally, it uses tools such as balance sheet policies and forward guidance to manage economic conditions. The committee meets eight times a year to review economic conditions and set policies accordingly

In summary, FOMC data is crucial for Forex traders as it provides insights into U.S. monetary policy and economic outlook, impacting the value of the U.S. dollar and global currency markets.

1 thought on “WHAT IS FOMC?”

Comments are closed.