On May 27, 2025, the U.S. economy presented a complex picture, with a significant drop in durable goods orders, declining consumer confidence, and the passage of a substantial $3.8 trillion spending bill. These developments have implications for gold prices and the broader financial markets.

Today’s given signal : https://t.me/calendarsignal/18715

Key Economic Indicators

1. Durable Goods Orders

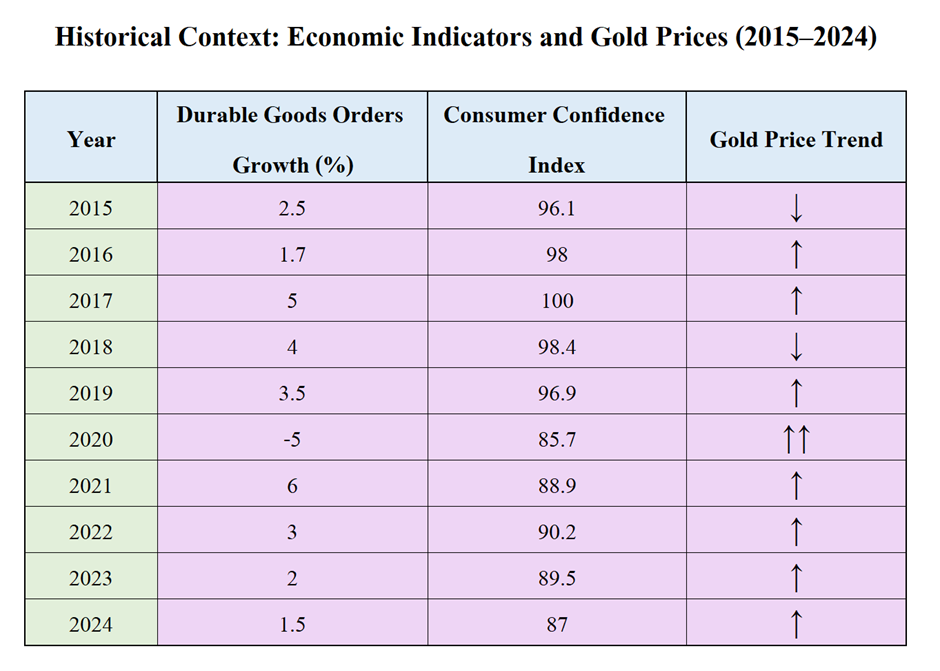

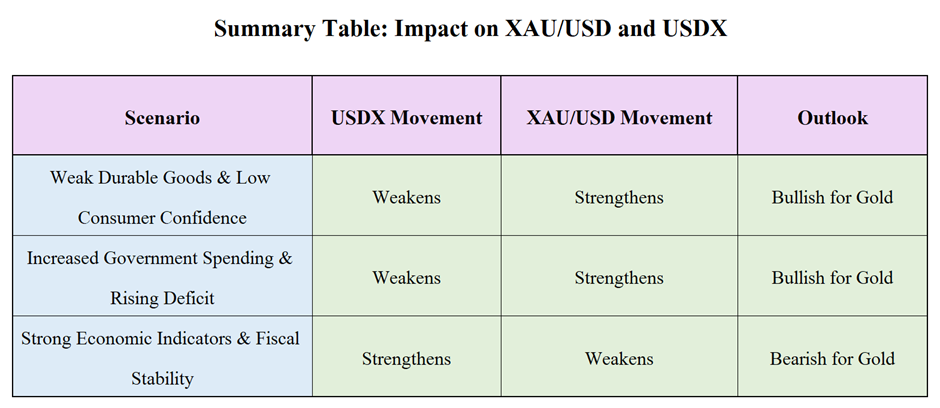

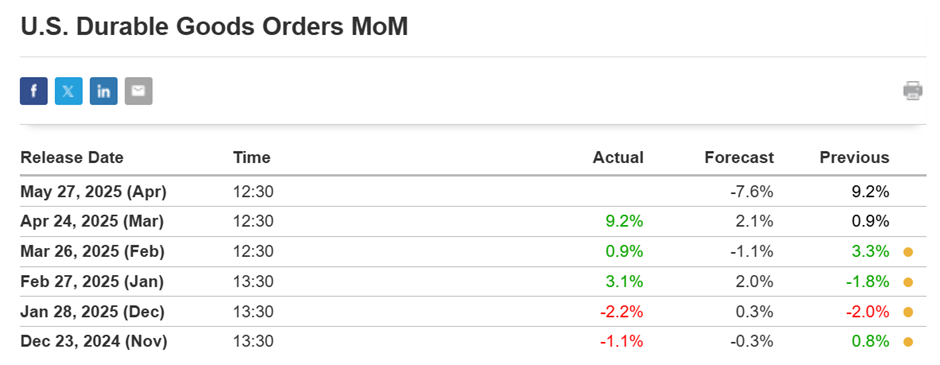

In April, durable goods orders fell by 7.6%, a sharp reversal from the 9.2% increase in March. This decline suggests a slowdown in manufacturing activity and potential caution among businesses regarding capital expenditures.

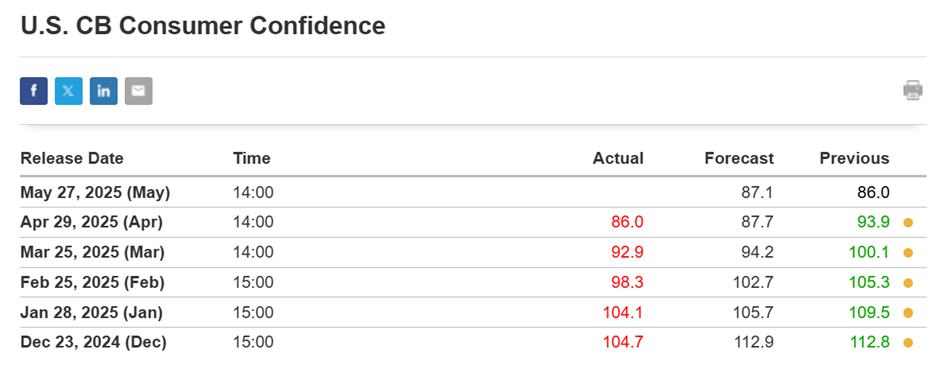

2. Consumer Confidence

The University of Michigan’s Consumer Sentiment Index dropped to 50.8 in May, down from 52.2 in April. This marks the lowest level in three years, indicating growing concerns among consumers about inflation and economic stability.

3. Federal Spending and Deficit

The House passed a $3.8 trillion tax and spending bill, projected to add significantly to the national debt over the next decade. Analysts warn that such fiscal expansion could lead to higher interest rates and inflationary pressures.

Impact on Gold (XAU/USD)

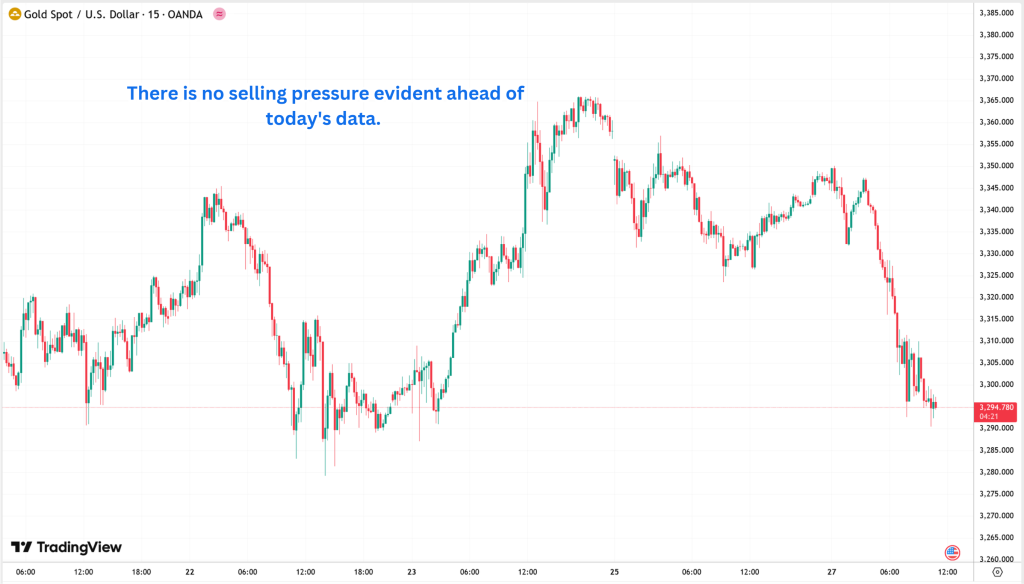

Gold prices experienced volatility in response to these economic indicators. Initially, the strengthening U.S. dollar exerted downward pressure on gold, with prices dipping by 0.5% to $3,325.99 per ounce. However, concerns over fiscal stability and potential inflationary effects from increased government spending may support gold as a safe-haven asset in the longer term.

Insights for New Traders

- Understanding Economic Indicators: Durable goods orders reflect business investment in long-term assets, while consumer confidence gauges household sentiment. Declines in both can signal economic slowdown, often leading investors to seek safe-haven assets like gold.

- Fiscal Policy Implications: Large government spending and increasing deficits can raise concerns about inflation and currency devaluation, potentially boosting gold demand.

- Market Sentiment: Gold prices are influenced by a combination of economic data, fiscal policies, and investor sentiment. Staying informed about these factors is crucial for making informed trading decisions.

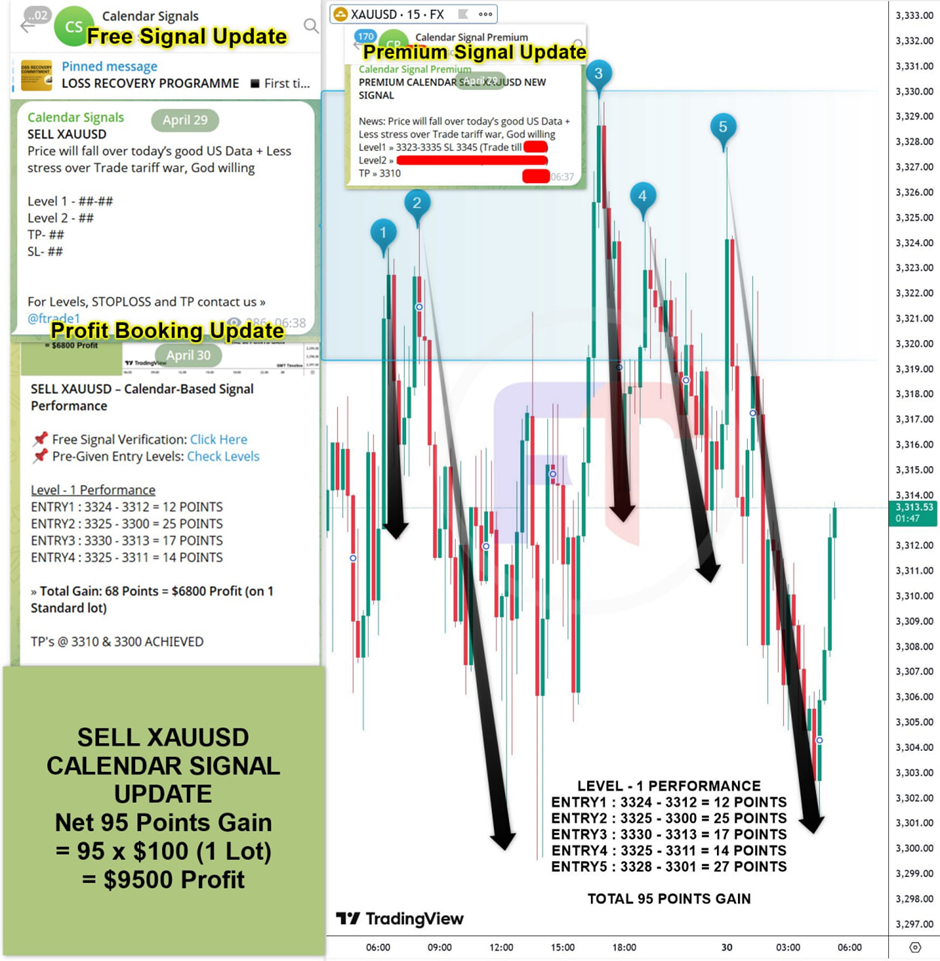

Previous released data results :

On last C.B. consumer confidence data (29-4-2025) we predicted good US Data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 95 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/18209

Performance : https://t.me/calendarsignal/18229

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11