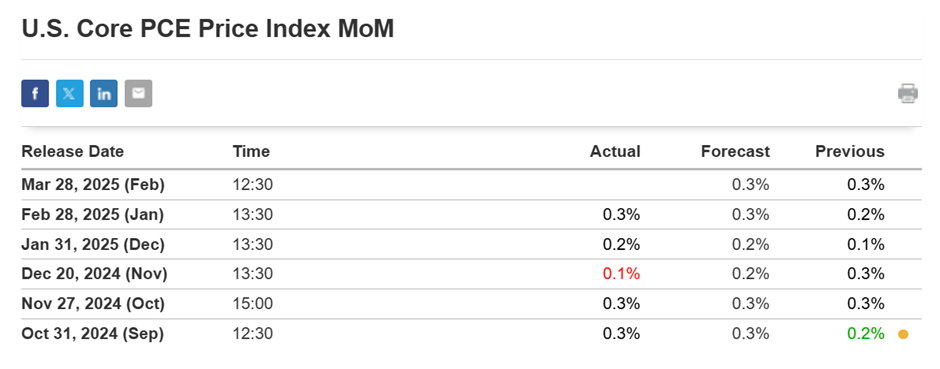

On March 28, 2025, the United States released the Core Personal Consumption Expenditures (PCE) Price Index data for February, indicating a 0.3% month-over-month increase and a 2.7% year-over-year rise, aligning with market expectations.

Today’s given signal : https://t.me/calendarsignal/17660

Implications of the Core PCE Data Release:

- Federal Reserve Policy Outlook: The Core PCE Price Index is the Federal Reserve’s preferred inflation gauge. A consistent 2.7% annual increase suggests that inflation remains above the Fed’s 2% target, potentially influencing the central bank to maintain or adjust its monetary policy stance.

- Market Anticipation: Investors closely monitor the Core PCE data to gauge inflation trends and anticipate potential interest rate movements. The reported figures may reinforce expectations of a cautious approach by the Federal Reserve regarding rate adjustments.

Impact on Gold Prices (XAU/USD):

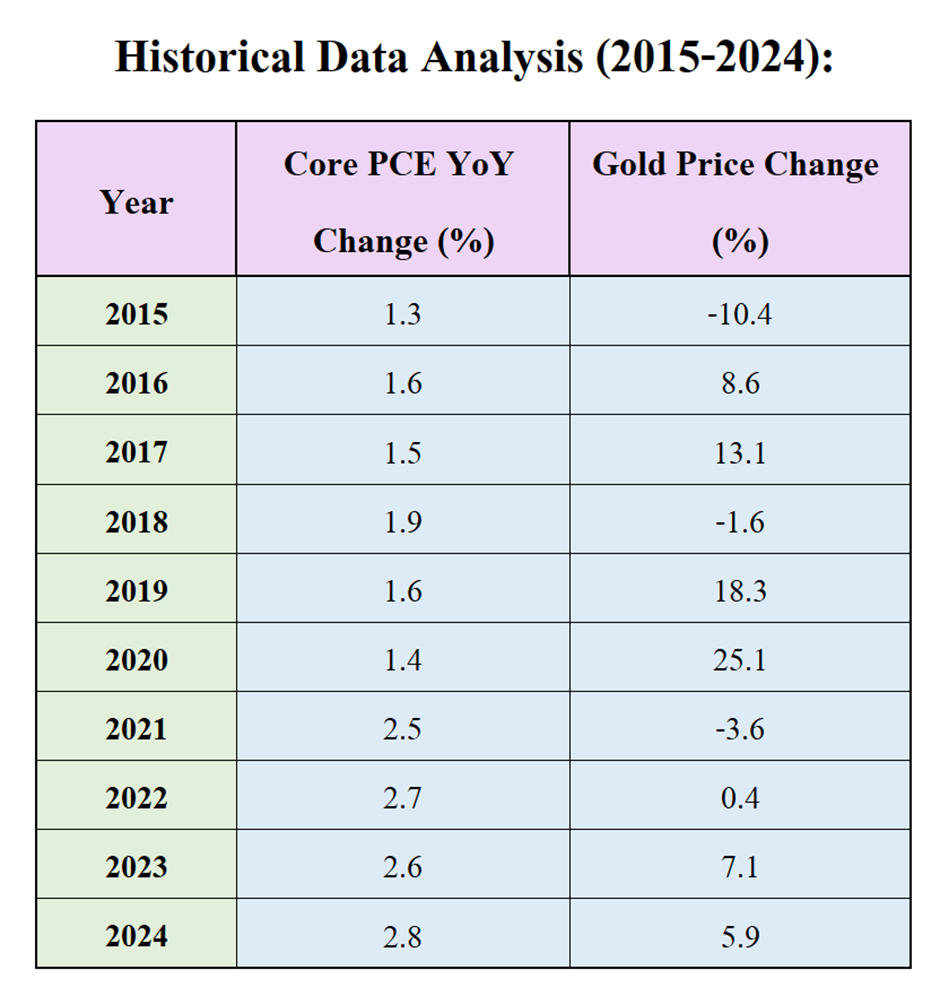

Gold prices are sensitive to inflation data and corresponding monetary policy decisions. The release of the Core PCE data can influence gold prices through:

- Inflation Hedge Appeal: Higher inflation readings can enhance gold’s attractiveness as a hedge against inflation, potentially driving prices upward.

- Interest Rate Expectations: If the Federal Reserve signals a tightening monetary policy in response to persistent inflation, higher interest rates could increase the opportunity cost of holding non-yielding assets like gold, exerting downward pressure on prices.

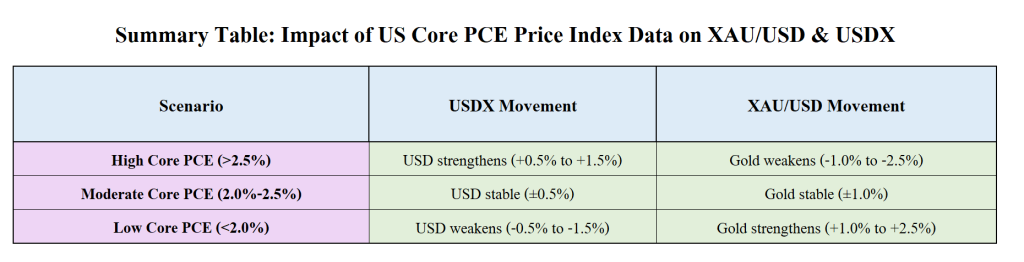

▪ Elevated Core PCE readings often lead to USD appreciation and gold depreciation due to expectations of tighter monetary policy.

▪ Moderate Core PCE figures may result in minimal market movements.

▪ Lower-than-expected Core PCE readings can weaken the USD and bolster gold prices.

Previous released data results :

The release of the Core PCE Price Index data on March 28, 2025, indicating a 2.7% annual increase, underscores persistent inflationary pressures in the U.S. economy. This scenario may influence the Federal Reserve’s policy decisions and, consequently, impact gold prices. While higher inflation can enhance gold’s appeal as a hedge, expectations of monetary tightening could exert downward pressure. Investors should monitor central bank communications and broader economic indicators to navigate the gold market effectively.

On last U.S. Core PCE Price Index data (28-2-2025) we predicted negative data, & as per that we suggest to BUY XAUUSD & as a result, we made a profit of 50 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/impact-of-us-pce-data-on-the-gold-price-28-2-2025/

Check last given signal : https://t.me/calendarsignal/17245

Performance : https://t.me/calendarsignal/17257

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11